The CNH: Any Chances to Recover?

Asian currency market suffers tough times. Trade war tensions that started in January 2018 are supposed to keep going. The US and China are two major players in the tariff game. While this game seems to be positive for the US dollar, the Chinese yuan is loosing.

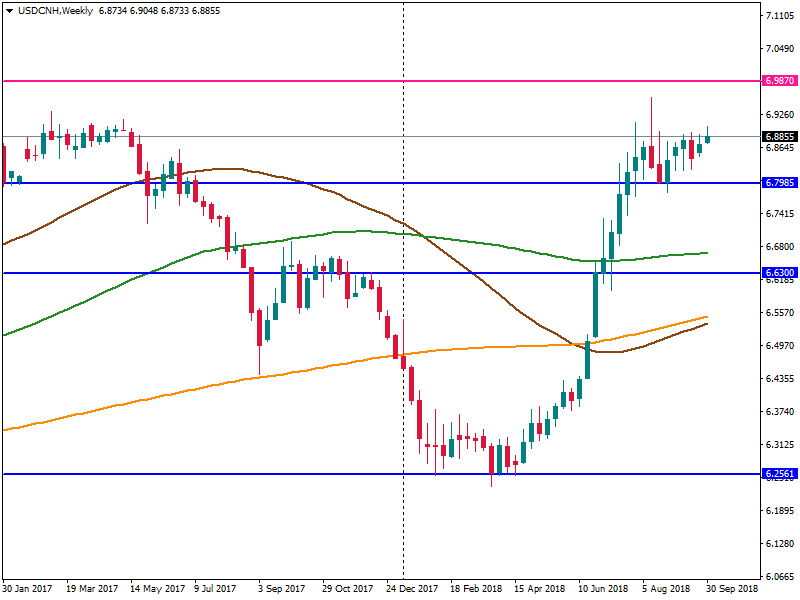

The depreciation of the CNH is enormous. Since the beginning of 2018, USD/CNH has surged from levels near 6.26 to 6.90. Is it the endpoint? Unlikely. The leading world banks came to the conclusion that the CNH traders should expect more difficult months for the currency.

The main reason that made the banks decrease their forecasts on the CNH’s rate is the trade war’s impact. According to the economic data, in the first half of 2018 China suffered the first current account deficit in 20 years. China also got the first quarterly current account deficit in 17 years. As a result, experts predict a narrowing surplus or more frequent current account deficits in the future. It’s highly possible as the US is going to keep rolling out tariffs on Chinese goods.

On September 24, the US imposed $200 billion worth tariffs (additionally to $50 billion worth tariffs imposed earlier this year). The levied duty is 10%, however, it’s anticipated to increase to 25% at the beginning of 2019. Even though China may retaliate with additional tariffs, the situation will just worsen.

Another important reason is the gap between the US interest rate and Chinese interest rate. The Federal Reserve has already raised the interest rate three times this year and is anticipated to do it once again in December. At the same time, the People’s Bank of China is expected to keep the interest rate on hold. Leading financial institutions assume that China will sacrifice the price of the Chinese yuan to support the economy.

JPMorgan was one of the first banks who cut its forecast for the Chinese yuan. They think that the People’s Bank of China may hold a looser monetary policy that is anticipated to support the economy without an intervention in the yuan’s rate. As a result, the central bank may let the currency slide further. JPMorgan sees the USD/CNH at 7.01 by the end of December. The first half of 2019 will bring the pair to 7.19 (versus the previous forecast of 7.02).

Deutsche Bank AG considers the same reasons for the yuan’s decline. Bank’s experts see the worst scenario for the yuan in the next year. USD/CNH is expected to climb to 7.4.

Bank of America Merrill Lynch agreed with others and downgraded its forecast for the Chinese currency. The new forecast for the USD/CNH is 7.05 in the first quarter of 2019 (6.90 previously) and 7.10 (versus 6.85) in the second quarter. Moreover, talking about the current situation, the bank anticipates that the yuan will plunge by 2.5% by the next quarter.

However, not all experts are so pessimistic about the Chinese currency. According to the Bloomberg survey, there are analysts that predict the strengthening of the CNH and fall of the USD/CNH pair to 6.70 by the end of next year.

Who is more correct about the future of the CNH? Let’s have a look at the current situation.

On the weekly chart, we can see that the USD/CNH pair is trading at the highs of May 2017. The crucial resistance is at 6.9875 (the highest level since the beginning of 2017). In case the pair breaks above this level, there will be no doubts that it will surge further.

Making a conclusion, we can say that the yuan is under big pressure. Most of the experts predict the significant plunge of the Chinese currency. As the trade war is anticipated to escalate further, the Chinese economy and currency will suffer a lot. If only Mr. Trump changes its policy towards China, the CNH will be able to recover.

This article was written by Daria Bobrova, a senior analyst at FBS

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance