CNA or AFG: Which P&C Insurer Should You Hold in Your Kitty?

The Zacks Property and Casualty Insurance industry did well in 2021 and is expected to retain the momentum this year as well, given favorable fundamentals. However, the new Omicron variant is raising concerns across the globe. However, increased knowledge about the COVID-19 virus variants and increased vaccination should be a silver lining.

Exposure growth, prudent underwriting, favorable reserve development and sturdy capital level should continue to support P&C insurers despite odds.

Per December Economic Projections of the Fed, GDP in 2022 is estimated to grow 4% while the unemployment rate is expected to be 3.5%, better than the September projections. As the insurance industry is an important contributor to the country’s GDP, it is well poised to grow, though a surge in infections due to the new variant is raising eyebrows.

Here we focus on two property and casualty insurers, namely American Financial Group, Inc. AFG and CNA Financial Corporation CNA to find out which stock is more suitable for retention in one’s portfolio for better returns.

American Financial with a market capitalization of $11.7 billion provides specialty property and casualty insurance products in the United States. CNA Financial with a market capitalization of $12.7 billion provides commercial property and casualty insurance products primarily in the United States. Both the companies carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Before putting them on the weighing scale, let’s discuss some key factors that will likely shape the industry’s performance.

Insurers should continue to witness improved pricing. Per Willis Towers Watson’s 2022 Insurance Marketplace Realities, 24 lines of business will witness a rate rise while eight business lines will have mixed/flat rates.

Price hikes, focus on growing niches, and a compelling and diversified suite of products and services should help improve operational efficiencies and drive premiums for insurers. Per Deloitte Insights, the non-life insurance premium is expected to increase 3.7% in 2022.

With a greater possibility of a rate increase this year, insurers are poised to benefit as they are beneficiaries of a rising rate environment.

Insurers have been investing heavily in technology to improve scale and efficiencies. Per Deloitte Insights, the technology budget is projected to increase 13.7% in 2022.

A solid capital level should continue to support insurers in pursuing strategic mergers and acquisitions as well as investing in growth initiatives. Industry players are engaging in share buybacks, increasing dividends or paying out special dividends.

The industry has rallied 17.8% year to date compared with the Zacks S&P 500 composite’s rise of 27.5% and the Finance sector’s rise of 19%.

Image Source: Zacks Investment Research

Let’s now see how American Financial and CNA Financial fare in terms of some of the key metrics.

Price Performance

American Financial has rallied 50.2% in a year’s time compared with the industry’s increase of 17.8% and CNA Financial’s gain of 13.1%.

Image Source: Zacks Investment Research

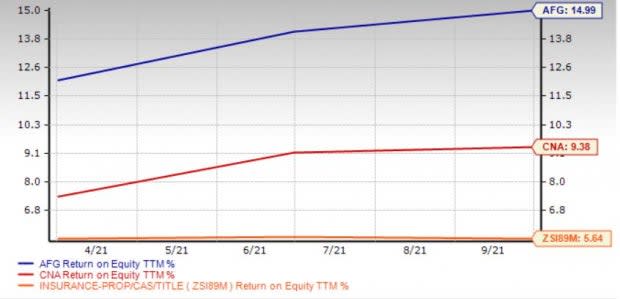

Return on Equity (ROE)

American Financial with a return on equity of nearly 15% exceeds CNA Financial’s ROE of 9.4% and the industry average of 5.6%.

Image Source: Zacks Investment Research

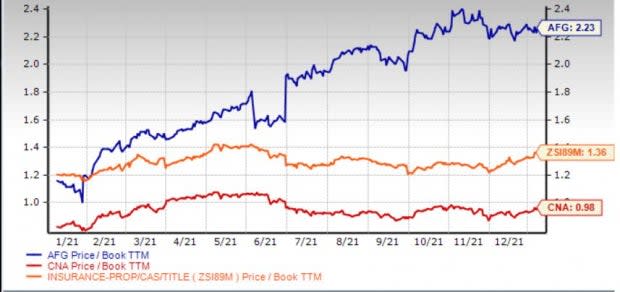

Valuation

Price-to-book value is the best multiple used for valuing insurers. Compared with American Financial’s reading of 2.23 and the industry average of 1.36, CNA Financial is cheaper with a reading of 0.98.

Image Source: Zacks Investment Research

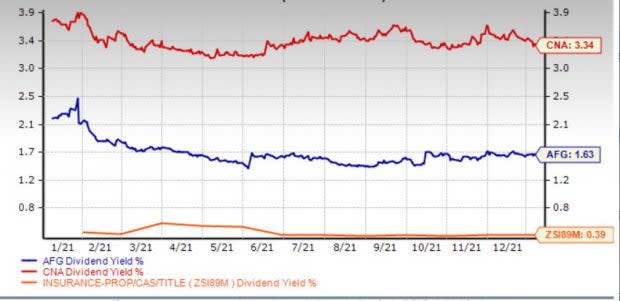

Dividend Yield

CNA Financial’s dividend yield of 3.3% betters American Financial’s reading of 1.6% and the industry average of 0.4%.

Image Source: Zacks Investment Research

Debt-to-Equity

CNA Financial’s debt-to-equity ratio of 21.9 is lower than the industry average of 24.2 as well as American Financial’s reading of 133.6.

Earnings Surprise History

CNA Financial outpaced expectations in each of the four trailing quarters, delivering an earnings surprise of 19.68%, on average. American Financial surpassed estimates in the last four reported quarters, with the average surprise being 47.70%.

Growth Projection

The Zacks Consensus Estimate for 2022 earnings indicates a 7.5% decline from the year-ago reported figure for American Financial while that for CNA Financial implies an increase of 11.3%.

Combined Ratio

The combined ratio is a profitability measure to identify how well an insurer is performing in its daily operations. A ratio below 100% indicates that the company is making an underwriting profit. American Financial’s combined ratio of 89 tops CNA Financial’s reading of 100.

VGM Score

VGM Score rates each stock on their combined weighted styles, helping to identify those with the most attractive value, best growth and most promising momentum. While CNA has an impressive VGM Score of A, American Financial has a VGM Score of C.

To Conclude

Our comparative analysis shows that CNA Financial has an edge over American Financial in terms of valuation, dividend yield, leverage, VGM Score, leverage and growth projection while American Financial scores higher with respect to price, return on equity, combined ratio and earnings surprise history.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance