Cleveland-Cliffs (CLF) Lands New Labor Agreement With USW

Cleveland-Cliffs Inc. CLF and the United Steelworkers (USW) have landed a tentative agreement on the new four-year labor contract for Cleveland-Cliffs’ Michigan and Minnesota mining operations. The contract is effective Oct 1, 2018.

The contract will cover around 1,800 USW-represented workers at Tilden and Empire mines in Michigan, and United Taconite and Hibbing Taconite mines in Minnesota.

The agreement offers the company a competitive cost structure. The contract also reflects Cleveland-Cliffs’ strong partnership with United Steelworkers. However, the ratification of the agreement by United Steelworkers local union members is pending.

In a year’s time, shares of Cleveland-Cliffs have outperformed the industry it belongs to. The shares have rallied around 71.4% compared with the industry’s growth of 7.6%.

During second-quarter earnings call, Cleveland-Cliffs raised the U.S. Iron Ore volume expectation to 21 million long tons. Production volume expectation was maintained at 20 million tons. The company also reduced sustaining capital expectation by $10 million to $75 million for 2018.

In the second quarter, the company’s U.S Iron Ore pellet sales volume was up year over year on increased demand and adaptation of the new revenue recognition accounting standard. Moreover, cash cost of goods sold and operating expense per long ton increased year over year, driven by higher costs related to energy rates, product mix, employee-related expenses, repairs and royalties.

Cleveland-Cliffs, in August, completed the sale of its Asia Pacific Iron Ore assets to Mineral Resources Limited. The company’s previously disclosed costs of closing the Australian operations were reduced by roughly $85 million due to this transaction.

Notably, Cleveland-Cliffs will record reversal of currency translation adjustments in the third quarter resulting from the deal. This is expected to lead to a positive contribution to net income of roughly $230 million or 75 cents per share.

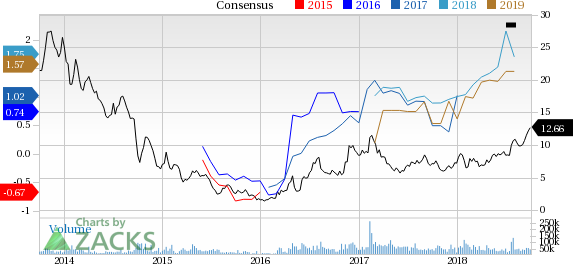

Cleveland-Cliffs Inc. Price and Consensus

Cleveland-Cliffs Inc. Price and Consensus | Cleveland-Cliffs Inc. Quote

Zacks Rank & Other Stocks to Consider

Cleveland-Cliffs is a Zacks Rank #1 (Strong Buy) stock.

A few other top-ranked companies in the basic materials space are ArcelorMittal MT, CF Industries Holdings, Inc. CF and Steel Dynamics, Inc. STLD.

ArcelorMittal has an expected long-term earnings growth rate of 4.8% and a Zacks Rank #1. The company’s shares have gained 17.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

CF Industries has an expected long-term earnings growth rate of 6% and a Zacks Rank #2 (Buy). The company’s shares have rallied 53.7% in the past year.

Steel Dynamics has an expected long-term earnings growth rate of 12% and a Zacks Rank #2. Its shares have risen 29.8% in a year’s time.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Cleveland-Cliffs Inc. (CLF) : Free Stock Analysis Report

ArcelorMittal (MT) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance