Clearing the Air: The Biggest Misconception About Canopy Growth Corp.

By now, pretty much every Canadian investor has heard of Canopy Growth Corp (TSX:CGC). Based on the prospects of legalized marijuana, Canopy has rallied over 300% this year, making it the best-performing stock on the TSX. But before you jump on the bandwagon, I want to clear up the biggest misconception about the stock; namely, the fact that Canopy has not yet actually generated a positive net income.

A quick lesson in accounting

Canopy makes no net income. That?s right; the oft quoted figure of .05 per diluted share the company reported in its Q2 2017 filings is not entirely accurate. Moreover, the company also did not generate an incredible 186% in gross margins during the same quarter. The reason for this misconception is due to the fact that Canopy reported the unrealized gains in biological assets on its income statement and netted it against its cost of sales.

For those unfamiliar with International Financial Reporting Standards (IFRS), the unrealized gains in fair value of biological assets refers to the non-cash gains a company makes on their plants and animals as they mature through their life cycles. Generally, this type of reporting is common among agricultural entities. When it comes to Canopy, the unrealized gains in fair value, of course, refers to their marijuana plants as they go through their life cycle up to the pre-harvest period.

Upon harvesting, the biological assets are then moved to the inventory at fair value (the price the company would receive for the assets during an orderly transaction between market participants), which becomes the cost for the inventory. After which, upon sale of the assets, the inventory is expensed as cost of sales and netted against the fair value gains.

Sounds confusing? It is.

Although what Canopy is doing is completely within accounting guidelines, this type of reporting creates significant earnings volatility and anomalies, such as 186% gross profits, potentially throwing off investors who are unfamiliar with IFRS complexities. Unlike, say, a manufacturer whose cost of sales would be incredibly straightforward, Canopy?s cost of sales is contingent upon the strains being grown, the life cycle stage of the pre-harvest plants, and, of course, significant management judgement in determining fair value of marijuana assets.

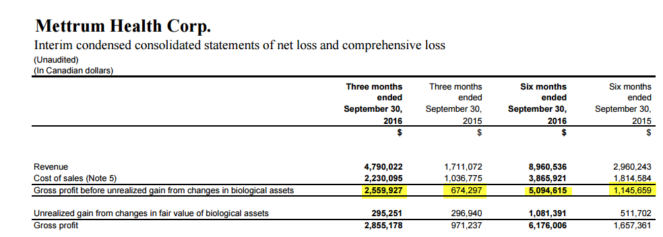

So how do we account for such anomalies during forecasting? One perfectly feasible way would be to separate gross profits before and after taking into account the unrealized fair value gains, such as in the case of Mettrum Health Corp below.

Mettrum reports both adjusted and non-adjusted cost of sales on its income statement. (Source: company filings)

Now, although Canopy does not feature same method in its reporting, you can, however, see the adjusted gross profits in the super-valuable MD&A that accompanies the 10-Q. In this case, Canopy?s adjusted cost of sales is $3,239,000, translating to a profit margin of 62% for Q2; that?s still a great margin, but it?s certainly not 186%. Taking this into account and flowing it down to the bottom line, I would estimate Canopy?s adjusted net income for Q2 to be around -.046 per diluted share.

Canopy?s MD&A shows the adjusted gross margins. (Source: company filings)

On the flip side, nothing escapes the cash flow statement, and these non-cash unrealized gains eventually get subtracted from net income. Based on this notion, Canopy would also have negative EBITDA and cash flows from operations for Q2 2017. While this is nothing out of the ordinary for a growth stock, don?t be surprise to see more equity raises and more debt taken on to fund acquisitions. If you?re comfortable with that, then Canopy might just reward your boldness.

How 1 Man Turned $10K Into Over $8 Million

Discover how one man turned a modest $10,600 investment into an $8,016,867 fortune.

Learn more about this man and how you can start down the path toward financial independence.

Simply click here to learn more

More reading

Canopy Growth Corp.: When the Going Gets Weird, the Weird Turn Pro

Canopy Growth Corp.: It?s Good But This Other Growth Story Is Better

Fool contributor Alexander John Tun has no position in any stocks mentioned.

How 1 Man Turned $10K Into Over $8 Million

Discover how one man turned a modest $10,600 investment into an $8,016,867 fortune.

Learn more about this man and how you can start down the path toward financial independence.

Simply click here to learn more

Fool contributor Alexander John Tun has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance