Clarks looking for reboot under new Chinese leadership

After British founding family was forced to cede control, focus of attention turns to Asia

It began with a sheepskin slipper in 1825, but Clarks is moving out of its comfort zone in a battle for survival under new Chinese leadership.

The British footwear institution, founded by Quaker brothers Cyrus and James Clark, shifted from comfort to fashion after the desert boot inspired by James’ great grandson Nathan Clark’s time in Burma in the 1940s, became the footwear of choice for The Beatles, Oasis and generations of reggae artists.

Now the boot is on the other foot as the founding family were forced to this year cede control to Chinese Olympian Li Ning and private equity group LionRock after slumping into the red and struggling to refinance debts after years of malaise.

Li Ning, the billionaire former gymnast who now heads a sports footwear colossus with sales of 14.4bn RMB (£1.7bn), teamed up with LionRock shortly before it pumped £100m into Clarks to take a 51% controlling stake.

The Chinese investors want to follow the lead of Dr Martens and Birkenstock, turning Clarks from a historic brand and the pride of Somerset, into an international powerhouse led by expansion in Asia.

Industry insiders say they will use the Li Ning brand’s contacts to help secure expansion for Clarks in China and beyond. “The UK will now be not that important,” one said.

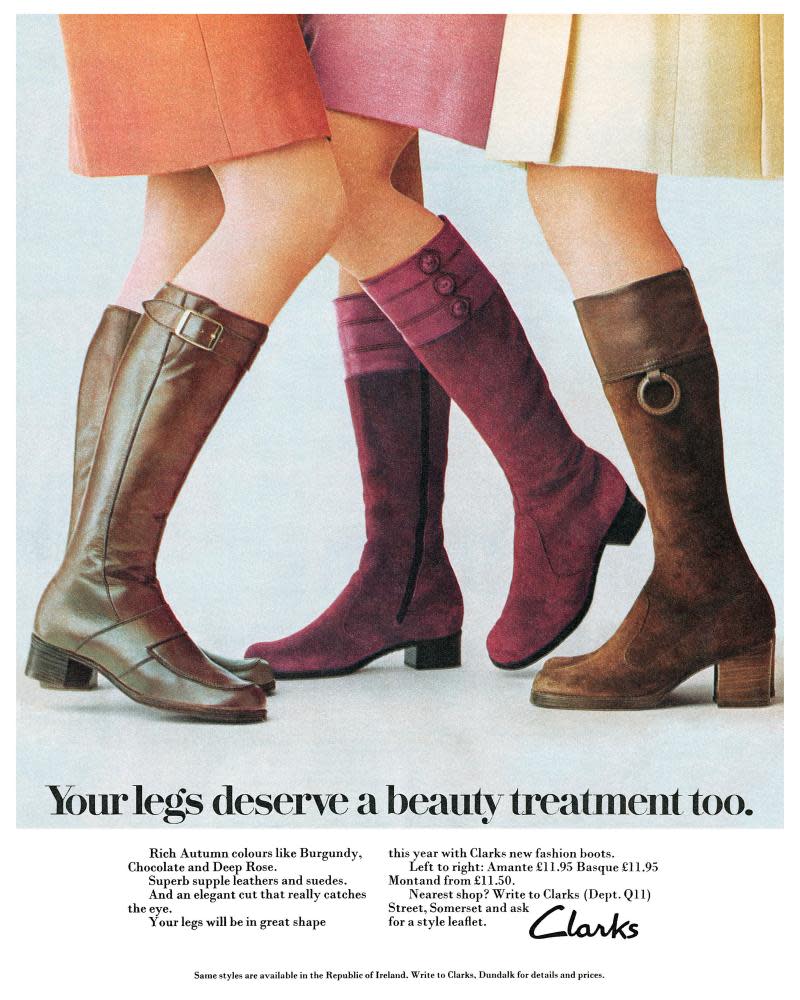

Photograph: Neil Baylis/Alamy

At home, a potential signal for the future comes via a tie-up with Marks & Spencer, through which Clarks now sells its children’s shoes.

But Li Ning will have to pull off a flip of incredible proportions to turn around the troubled brand, where sales have fallen steadily for at least four years and profits have crumbled away since 2014.

Clarks has found itself pincered between both discount and upmarket rivals after being kicked aside by trendier trainer purveyors.

“You get born in Clarks and you die in Clarks but from 10 to 70 you don’t want them,” says one industry insider.

“Taste moved quicker than they did and the market disappeared rapidly at the mid to more expensive price point,” a rival says.

As the pandemic compounded years of poor trading, Clarks cancelled its dividend to shareholders including the founding family in January for the second consecutive year. That came after it reported a 43% slump in sales to £775m in the year to 30 January as the group sank £172m into the red from a £21.5m profit a year before. Net debt rose to £98m from £32m a year before and the pension surplus dived from nearly £128m to just £9.9m last year.

Clarks’ board warned in May that there was “material uncertainty” about its ability to meet targets given the on-going pandemic.

While Clarks was trading ahead of budget when it filed its annual report in May, the company said changes in consumer behaviour “may cast significant doubt on [the company’s] ability to continue as a going concern” and it may have to consider an “equity cure” or debt-for-equity swap to raise more cash.

Such questions are likely to be top of the minutes at the annual shareholder meeting, set for 23 December when the Clarks family may have to consider losing their grip on the brand entirely.

Also on the agenda is likely to be Clarks’ search for a new boss after going through six chief executives in as many years. Johnny Chen, Clarks’ chair, is currently acting as interim chief executive taking over from Victor Herrero, a former executive at US fashion label Guess, who stepped down earlier this month after just nine months in the role.

Amid Clark’s revolving door, the company has spent more than £2m on pay-offs or legal fees relating to the departure of its top-level team including a very public legal spat with former Zara and Karen Millen boss Mike Shearwood.

Clarks is currently in mediation with representatives for workers at its warehouse in Street, Somerset, who say the business is seeking to cut their wages by almost 15% by using controversial fire and rehire tactics.

A year ago, Clarks left its landlords outraged after pushing through a controversial restructure that cut rent on 60 stores to nil.

While Clarks was not alone in suffering during the pandemic its troubles date back well before Covid-19 appeared.

The company has gone from being the UK’s biggest footwear retailer six years ago to a poor third behind Sports Direct and JD Sports. Its share of the market has halved to 4% during that time as JD’s has grown by more than a third to almost 11%, according to analysts at GlobalData.

Problems at home have been compounded by Clarks’ disparate image around the world. In the UK, eight out of 10 of its bestsellers are children’s shoes while in Asia it is known for trainers and in North America it has a cut-price image.

One industry insider says Clarks has suffered from a string of leaders who wanted to sell something different to what their core customer wanted. “For the last five years they have wanted a different consumer and have put the ones they have got on the back burner.”

Clarks employed more than 11,000 people in 2014 and had cut 2,500 jobs around the world by January after closing more than 250 shops in the UK alone. Major writedowns on outdated IT systems and millions of pounds worth of unwanted stock have also held back the business.

Patrick O’Brien at GlobalData says Clarks was too slow to reduce its store count and move with the times, leaving it in a “real predicament”.

“It is very difficult for a retailer like that to remain relevant. They are stuck in a place in people’s psyche that is contrary to where the market is going.”

An industry insider puts it more bluntly: “It is still a major brand but they have lost their way completely.”

Yahoo Finance

Yahoo Finance