Citi earnings cast spotlight on consumer lending amid economic headwinds

Concerns over an economic slowdown may weigh on banks in this week’s wave of second-quarter earnings reports, but Citigroup (C) — the first big bank to report — is showing that consumer lending could be the key to growth amid tightening financial conditions.

Thanks in part to a strong credit card portfolio, Citi reported adjusted earnings per share of $1.83 on revenue of $18.8 billion. Citi also benefited from a $350 million gain on its investment in Tradeweb, an electronic trading platform that went public earlier this year and also counts JPMorgan Chase, Goldman Sachs, and Morgan Stanley among its shareholders.

Citi’s earnings numbers topped the street’s expectations of $1.80 for adjusted earnings per share on $18.5 billion of revenue, according to Bloomberg estimates. Cost-cutting was also a big theme for the company, as it reduced operating expenses by 1% due to efficiency initiatives.

But amid an inverting yield curve and slowing global growth, Citi reported a 9% year-over-year drop in equity revenues and a 4% drop in fixed income revenues (when controlling for the Tradeweb gain).

“There remains uncertainty with respect to the economic market and rate environment, but I think we’ve shown that our franchise can manage through these by focusing on the things that we can control,” Citi CEO Michael Corbat said on an earnings call Monday morning.

The street is wondering if other banks reporting this week will rely on other pillars — like strong consumer spending — to support earnings growth amid that uncertainty.

“Today’s results were good enough, they were satisfactory, they were fine, they were acceptable, they were okay,” Wells Fargo analyst Mike Mayo told Yahoo Finance’s On the Move.

Mayo said he expects macro factors to weigh on the other big banks scheduled to report this week, in the form of downward revisions in earnings forecasts.

Strong consumer

Citi’s earnings were supported by growth in its branded credit cards, where revenues from its North American businesses increased by 7% year-over-year to $2.2 billion.

Citi CEO Mark Mason said consumer businesses had “solid momentum,” showing no signs of wear-and-tear from worries over the U.S. economy. The company said customers who signed on to Citi credit cards due to promotions have been steadily transitioning to average interest-earning balances, which would provide more revenue growth for the rest of the year.

Mason said that pipeline will be a “meaningful contributor” through 2020, particularly in North America.

Economists have been pleased by U.S. consumer data in the face of global uncertainty. Federal Reserve Chairman Jerome Powell told Congress July 10 that the “most reliable drivers” of economic momentum are consumer spending and business investment. Describing business investment as slow, Powell said consumer spending is looking good.

“While growth in consumer spending was weak in the first quarter, incoming data shows it bounced back, and is now running at a solid pace,” Powell said.

A robust consumer banking landscape could be a running theme as JPMorgan Chase (JPM) and Wells Fargo (WFC) prep their presentations for Tuesday and Bank of America (BAC) gets set to report on Wednesday.

Weak markets

But can credit cards and consumer credit support tough times at the trading desks?

Citi executives acknowledged that the financial markets had created a “challenging” operating environment, mostly due to uncertainty over rates.

Since the end of 2018, financials have been decelerating as the Federal Reserve shifted from a stance of steadily hiking interest rates, to signaling “patience” on future rate hikes, to leaving the door open for a rate cut.

Lower rates do not independently mean smaller margins for the banks; in some cases lowering rates can steepen the yield curve and give banks more room for profits.

But the reality is more of a chicken-or-the-egg question: lowering rates may be the result of concerns underlying the economy that present negative macro headwinds to the banking industry, which is the beating heart of the economy.

This was the thesis of Morgan Stanley’s industry-wide downgrade ahead of earnings. In a July 8 note, Morgan Stanley’s research team wrote that large cap bank stocks should be a less attractive play in the face of a gloomier economic outlook.

“We’ve stood firm in our attractive industry view many times before when the bond market has pushed yields lower (2016, 2018), but this time the risks of a more material slowdown are higher and staring us in the face,” they wrote.

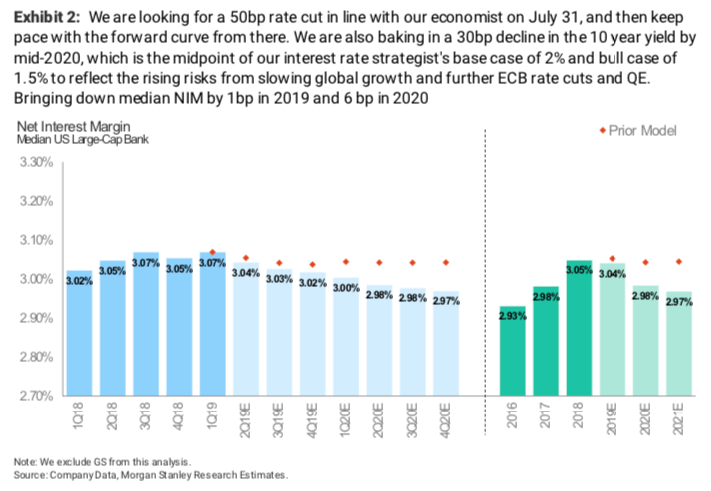

Predicting that rate cuts would be followed by further declines in long-term yields, Morgan Stanley said banks should expect net interest margin (a measure of the difference between interest earned and interest paid) to slowly decline.

Citi reported a net interest margin of 2.67% for the second quarter of 2019, down 5 basis points quarter-over-quarter, and 3 basis points year-over-year.

Those macro trends could weigh on Citi as it stands by its lofty goals on return in the next year and a half. Executives stood by their projections of 12% return on tangible common equity for the fiscal year 2019 and then 13.5% for the fiscal year 2020.

Mayo said this is the tenth time that Citigroup has stood by its target despite acknowledging economic headwinds.

“I will hold this against Citigroup if they miss their target,” Mayo told Yahoo Finance. “And the purpose here is to make sure they have enough intensity to meet their targets and make sure they’re laser-focused on achieving that.”

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Powell: 'Just so important' to keep economic expansion going

Maxine Waters pushes against Trump's Fed criticism to 'get rid of any uncertainties'

Federal agencies kill big banks’ hopes of escaping Volcker rule

Powell to Congress: 'Uncertainties' continue to weigh on the economy

Jobs report takes steam out of expectations for 50 basis point Fed cut

Congress may have accidentally freed nearly all banks from the Volcker Rule

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance onTwitter,Facebook,Instagram,Flipboard,SmartNews,LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance