Citigroup (C) Divests Analytics and Index Businesses to LSE

The Wall Street banking giant – Citigroup Inc. C – continued the strategy of divesting parts of its consumer and investment banking operations to free up capital, reduce expenses and in turn, increase profits. The firm has entered into an agreement to vend its Fixed Income Analytics and Index Businesses to London Stock Exchange Group plc (LSE). The cash deal has been signed for a consideration of $685 million, subject to certain adjustments.

Citigroup’s Yield Book and Fixed Income Indices are used by over 350 institutions internationally, in analyzing a number of fixed income instruments. Notably, Fixed Income Indices, which is the owner of the World Government Bond Index (WGBI), is known for compiling benchmarks and providing related data.

Further, Yield Book relates to books about bond data which began publishing in the 1960s by the Wall Street firm – Salomon Brothers. Yield Book was initiated in 1989 by Salomon Brothers. It is a software tool which helps customers in calculating bond yields. The unit provides various analytical tools to investors and traders in corporate, government and mortgage bonds, along with derivatives and other securities.

Terms of the Deal

The agreement includes sale of fixed income analytics platform, The Yield Book, and Citi Fixed Income Indices. LSE's FTSE Russell Information Services division will combine both the assets.

On clearance of certain regulatory conditions, the transaction is likely to close in the second half of 2017.

To focus on core operations and following a strategic review process, Citigroup has planned to divest the businesses. Per the bank, LSE will prove beneficial for the Fixed Income Analytics and Index Businesses providing optimum output to main stakeholders, including employees, clients and shareholders.

Conclusion

Regulatory pressure over Citigroup’s global operations and the concerns of weak returns were the primary reasons behind the restructuring. Aimed at enhancing the efficiency of the company’s overall business, the initiatives include streamlining operations and optimizing its presence globally.

Amid the troubled financial currents, Citigroup is likely to gain some financial flexibility from such moves. We believe that the company is poised well to address its internal inefficiencies and setbacks. Further, we believe that the company’s streamlining initiatives will boost its capital position, reduce expenses and drive operational efficiency.

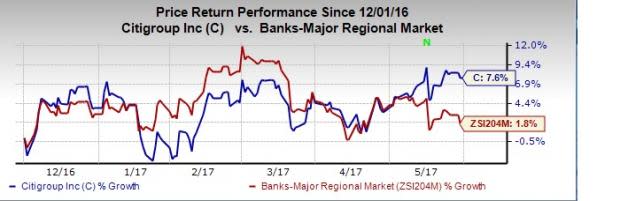

Citigroup currently carries a Zacks Rank #3 (Hold). The bank has recorded growth of 7.6% compared with 1.8% growth recorded by the Zacks categorized Regional Banks-Major industry, over the past six months.

Stocks to Consider

M&T Bank Corporation MTB has been witnessing upward estimate revisions for the last 60 days. Over the last six months, the company’s share price has been up more than 7.4%. It carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comerica Incorporated CMA has been witnessing upward estimate revisions for the last 60 days. Additionally, the stock jumped over 5.2% over the past six months. It currently holds a Zacks Rank #2.

The PNC Financial Services Group, Inc. PNC has been witnessing upward estimate revisions for the last 60 days. Also, the company’s shares have risen nearly 5.6% over the last six months. It presently holds a Zacks Rank #2.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple's 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Click for Free PNC Financial Services Group, Inc. (The) (PNC) Stock Analysis Report >>

Click for Free Comerica Incorporated (CMA) Stock Analysis Report >>

Click for Free M&T Bank Corporation (MTB) Stock Analysis Report >>

Click for Free Citigroup Inc. (C) Stock Analysis Report >>

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance