Cisco's (CSCO) Q4 Earnings Miss Estimates, Revenues Flat Y/Y

Cisco Systems CSCO reported fourth-quarter fiscal 2022 non-GAAP earnings of 83 cents per share, which lagged the Zacks Consensus Estimate by 27.38%. The bottom line decreased 1.2% year over year.

Revenues were almost unchanged year over year at $13.10 billion. Revenues beat the consensus mark by 2.75%.

Quarter in Detail

Region-wise, the Americas revenues decreased 3% year over year to $7.47 billion. EMEA revenues increased 8% from the year-ago quarter to $3.58 billion. APJC revenues decreased 2% year over year to $2.06 billion.

Service revenues (26.1% of total revenues) were unchanged year over year at $3.41 billion.

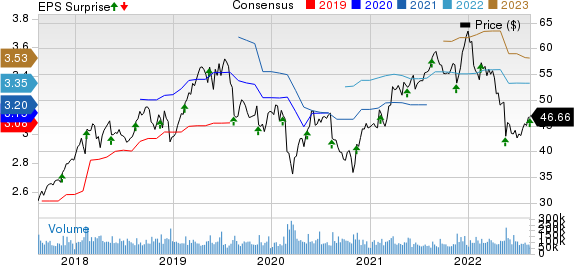

Cisco Systems, Inc. Price, Consensus and EPS Surprise

Cisco Systems, Inc. price-consensus-eps-surprise-chart | Cisco Systems, Inc. Quote

Annualized recurring revenues (“ARR”) came in at $22.9 billion, up 8% year over year.

Product revenues (73.6% of total revenues) decreased 0.3% on a year-over-year basis to $9.69 billion.

Break Down of Product Revenues

Secure, Agile Networks (62.9% of total Product revenues) revenues decreased 1% year over year to $6.09 billion.

Collaboration (12% of Product revenues) revenues increased 2% on a year-over-year basis to $1.16 billion.

End-to-End Security (10.2% of Product revenues) revenues were up 20% to $984 million.

Internet for the Future (13% of Product revenues) revenues decreased 10% to $1.26 billion.

Optimized Application Experiences (1.9% of Product revenues) revenues were up 8% to $185 million.

Revenues from Other Products decreased 22% to $3 million.

Operating Details

Non-GAAP gross margin contracted 270 basis points (bps) from the year-ago quarter’s level to 62.9%.

On a non-GAAP basis, product gross margin contracted 370 bps to 61.3%. Service gross margin remained unchanged at 61.3%.

Non-GAAP operating expenses were $4.59 billion, up 8.9% year over year. As a percentage of revenues, operating expenses expanded 290 bps to 35%.

Non-GAAP operating margin expanded 20 bps year over year to 32.4%.

Balance Sheet and Cash Flow

As of Jul 30, 2022, Cisco’s cash & cash equivalents and investments balance were $19.3 billion compared with $20.1 billion as of Apr 30, 2022.

Total debt (short-term plus long-term) as of Jul 30, 2022, was $9.52 billion compared with $9.42 billion as of Apr 30, 2022.

Cash flow from operating activities was $3.7 billion, unchanged from the previous quarter.

Cisco paid a quarterly dividend of 38 cents per share and returned $2.4 billion to shareholders through buybacks.

Remaining performance obligations (“RPO”) at the end of the fiscal fourth quarter were $31.5 billion, up 2%, with 54% of this amount to be recognized as revenues over the next 12 months. Product RPO was up 6% and service RPO was down 1%.

Guidance

For first-quarter fiscal 2023, revenues are expected to grow between 2% and 4% on a year-over-year basis.

Non-GAAP gross margin is anticipated between 63% and 64% for the quarter.

Non-GAAP operating margin is anticipated between 31.5% and 32.5% for the quarter. Non-GAAP earnings are anticipated between 82 cents and 84 cents per share.

For fiscal 2023, revenues are expected to rise by 4-6% on a year-over-year basis. Non-GAAP earnings are anticipated between $3.49 and $3.56 per share.

Zacks Rank & Upcoming Earnings to Watch

Cisco currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Computer & Technology sector scheduled to report their earnings soon are Intuit INTU, Palo Alto Networks PANW and Hewlett Packard HPE. While both Intuit and Palo Alto Network have a Zacks Rank #2 (Buy), Hewlett Packard sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Intuit’s shares have underperformed the sector year to date, declining 25.7%.

INTU is scheduled to release fourth-quarter fiscal 2022 results on Aug 23.

Palo Alto Networks shares have outperformed the sector year to date, declining 7.6%.

PANW is scheduled to release fourth-quarter fiscal 2022 results on Aug 22.

Hewlett Packard shares have outperformed the sector year to date, declining 5.4%.

HPE is set to report third-quarter fiscal 2022 results on Aug 30.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance