Can Cigna's (CI) Q1 Earnings Beat on Medical Customers Growth?

The Cigna Group CI is set to sustain its earnings beat streak for the first quarter of 2023, the results for which are scheduled to be released on May 5, before the opening bell.

What Do Estimates Say?

The Zacks Consensus Estimate for first-quarter earnings per share of $5.23 has witnessed no movement in the past week. However, the estimate is indicative of a 13% decline from the year-ago quarter’s reported earnings of $6.01 per share. Our estimate for earnings per share is pegged at $5.43, indicating a 9.6% year-over-year decline.

The Zacks Consensus Estimate for revenues is pegged at $45.5 billion, suggesting a rise of 3.2% from the year-ago quarter’s reported figure, whereas our estimate indicates 2.4% growth.

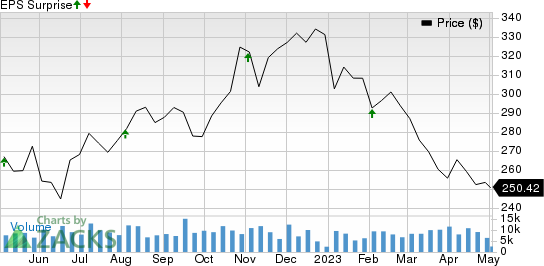

Cigna’s earnings beat estimates in all the trailing four quarters, the average being 10%. This is depicted in the graph below.

Cigna Group Price and EPS Surprise

Cigna Group price-eps-surprise | Cigna Group Quote

What the Quantitative Model Suggests

Our proven model predicts an earnings beat for Cigna this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is precisely the case here.

Earnings ESP: Cigna has an Earnings ESP of +0.73%. This is because the Most Accurate Estimate is pegged at $5.27 per share, higher than the Zacks Consensus Estimate of $5.23. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Cigna currently has a Zacks Rank #3.

Before we get into what to expect in the to-be-reported quarter in detail, let’s see how the company performed in the last quarter.

Q4 Earnings Rewind

In the last reported quarter, the global health company’s adjusted earnings per share of $4.96 beat the Zacks Consensus Estimate by 2.5% primarily on the solid performance of the Evernorth business, strong membership growth and a decline in the expense level.

Now, let us see how things have shaped up prior to the first-quarter earnings announcement.

Factors Driving Q1 Performance

Improved performances across CI’s Evernorth and Cigna Healthcare businesses are likely to have contributed to the to-be-reported quarter’s performance. The company is expected to have gained from an expanding customer base and growth in specialty pharmacy services in the first quarter.

The Zacks Consensus Estimate for pharmacy revenues implies a 5.1% rise from the year-ago quarter’s actuals, whereas our estimate suggests a 4% jump. Also, the consensus mark for fees and other revenues indicates 15.9% year-over-year growth, whereas our estimate suggests a 9.2% increase.

The consensus mark for Evernorth’s revenues predicts a 5.2% year-over-year jump, whereas our estimate suggests 4.5% growth. The factors stated above are likely to have positioned the company for year-over-year growth in the top line.

The Zacks Consensus Estimate for total medical customers signals a 6.3% increase from the year-ago period’s reported number, whereas our estimate suggests 5.7% growth. Our estimate for the first quarter medical care ratio predicts a 120-basis-point year-over-year improvement. These are likely to have positioned the company for an earnings beat in the first quarter.

However, Cigna’s net investment income is expected to have taken a hit in the first quarter. The consensus mark for net investment income suggests a 45.9% decrease from the prior-year quarter, whereas our estimate predicts a 22.5% decline. The decline in the metric is expected to have partially offset the positives in the quarter under review.

Also, the Zacks Consensus Estimate for premiums signals a 1.4% year-over-year decline for the first quarter, whereas our estimate suggests a 2% fall from the year-ago period’s reported figure. The consensus mark for pre-tax adjusted income from Evernorth indicates a 4.4% decline from that reported a year ago. This is likely to have affected the bottom line in the first quarter.

Other Stocks That Warrant a Look

Here are some other companies worth considering from the broader medical space, as our model shows that these too have the right combination of elements to beat on earnings this time around:

BellRing Brands, Inc. BRBR has an Earnings ESP of +2.40% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BellRing Brands’ bottom line for the to-be-reported quarter is pegged at 21 cents per share, which witnessed one upward estimate revision in the past week against none in the opposite direction. BRBR beat earnings estimates in all the past four quarters, the average surprise being 19.1%.

Bio-Rad Laboratories, Inc. BIO has an Earnings ESP of +0.16% and is a Zacks #3 Ranked player.

The Zacks Consensus Estimate for Bio-Rad’s earnings per share for the to-be-reported quarter is pegged at $3.24, which has been unchanged over the past week. BIO beat earnings estimates thrice in the past four quarters and missed once, the average surprise being 27.5%.

Sana Biotechnology, Inc. SANA has an Earnings ESP of +2.50% and is a Zacks #2 Ranked player.

The Zacks Consensus Estimate for Sana Biotechnology’s bottom line for the to-be-reported quarter indicates a 14.9% year-over-year improvement. SANA beat the earnings estimate in the last quarter comfortably by 2.4%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cigna Group (CI) : Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO) : Free Stock Analysis Report

BellRing Brands Inc. (BRBR) : Free Stock Analysis Report

Sana Biotechnology, Inc. (SANA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance