Chinese companies flooded into the U.S. IPO market in 2018

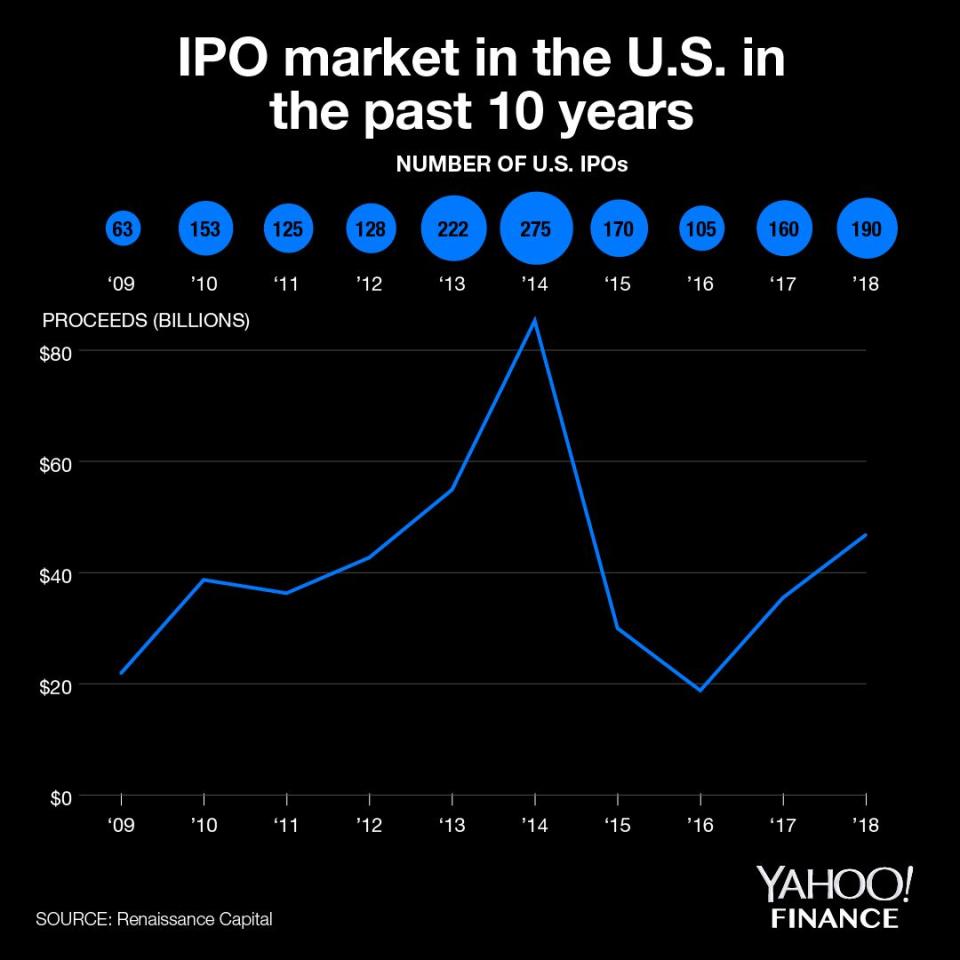

The U.S. stock market had a wild ride in 2018, but that didn’t deter foreign companies from seeking capital and investors here.

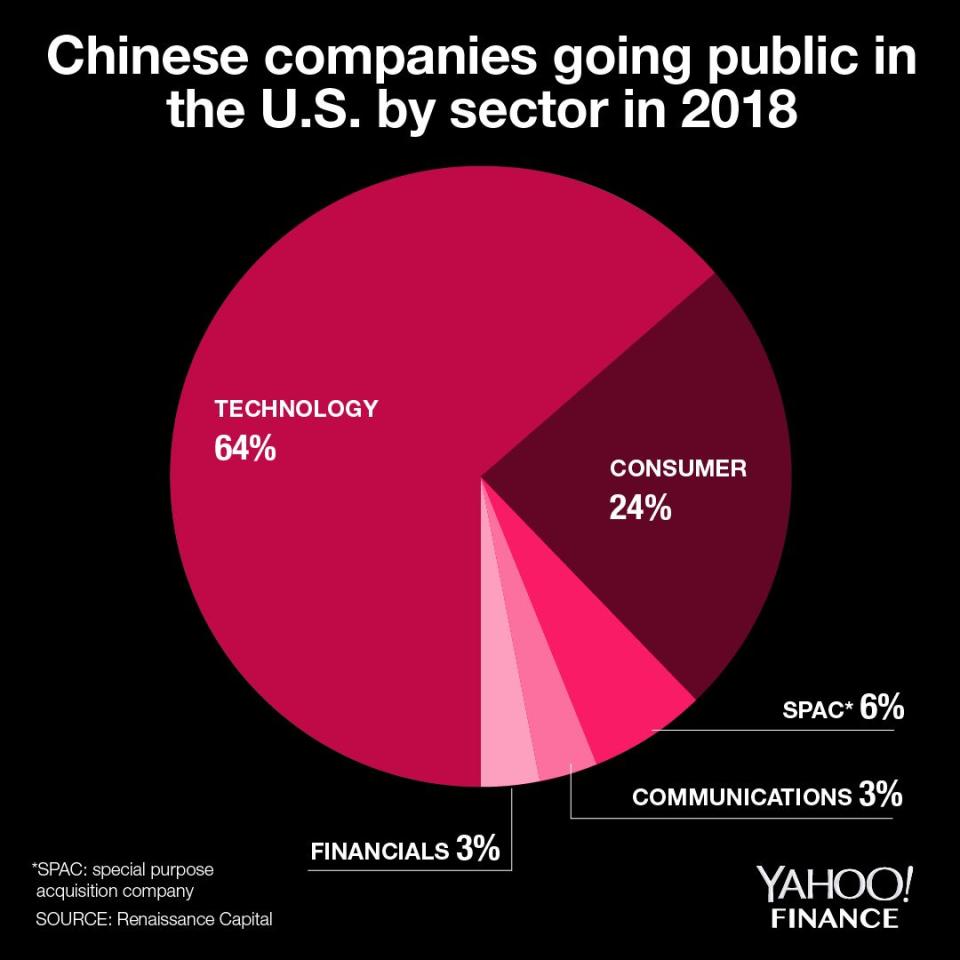

Thirty-three Chinese companies went public in the U.S. this year, double the number from last year and the most since 2010. Chinese companies accounted for 17% of all U.S. IPOs this year, with the majority in the tech sector. Chinese tech IPOs have outstripped those from Silicon Valley for the third year.

U.S. exchanges are known for their comprehensive structure and access to an international investor base. But there are no guarantees that a U.S. listing will generate returns. Two-thirds of the newly-listed Chinese company stocks are finishing the year in red, with an average loss of 13% below their issue. China-related stocks first felt the pinch of the trade dispute between Washington and Beijing, and got hit further by the recent global sell-off.

With an IPO boom based on numbers, there was no mega deal like Alibaba. The e-commerce giant raised $21.8 billion in 2014 and remains the biggest of all U.S. IPOs. Four Chinese companies raised more than $1 billion this year. Among them is a Chinese online streaming platform iQiyi, which made the biggest deal with $2.3 billion in IPO proceeds.

“A lot of the Chinese tech companies are already backed by U.S.-based VCs, which made it natural for them to think about going public in the U.S.,” Kevin Carter, founder of Emerging Markets Internet and Ecommerce ETF, told Yahoo Finance. Marketplace app Pinduoduo and electric vehicle maker NIO are both backed by Sequoia Capital China, a subsidiary of the California-based Venture Capital firm.

“We believe that companies sought out the relative stability of U.S. capital markets in response to domestic volatility and a tightening credit environment in China,” Renaissance Capital wrote in its annual review on the IPO market. China’s domestic stock market has seen a more than 20% free fall in 2018.

It’s easier to go public in the U.S.

The multiple-class structure is very popular among tech companies, which allows founders to maintain considerable voting power even when shares are diluted. Among the nine Chinese companies listed in the U.S. in the first quarter of 2018, six have a dual-class structure.

But stock exchanges in mainland China and Hong Kong had largely said no to the structure, considering it too risky for investors. Alibaba walked away from the Hong Kong exchange mainly due to this.

Losing tech giants like Alibaba has pushed some global markets to rethink the rules. Right before Chinese smartphone maker Xiaomi raised $4.7 billion in April, Hong Kong loosened requirements to allow dual-class share structures. Two months later, the Singapore Exchange followed suit.

This offers more options outside the U.S. for Chinese companies with such a structure. “There is also increasing competition to U.S. exchanges from their foreign counterparts,” Ken Fong, an analyst at Dealogic, wrote in a post in April.

Even mainland Chinese exchanges want a piece of the pie. Chinese regulators vowed earlier this year to bring foreign-listed Chinese companies home, but no major progress has been made since the domestic market crashed.

“It’s a paradox that most Chinese tech giants are listed in the U.S., where their users in China can’t even invest in their shares,” said Carter.

Investors are keeping a close eye on potential Chinese IPOs next year, including Didi Chuxing, a ride-hailing giant, and Ant Financial, the fintech platform partly owned by Alibaba. They are expected to list in either Hong Kong or New York, with a potential dual listing in Shanghai.

“The China Securities Regulatory Commission also liberalized listing rules this year to pave the way for more domestic tech sector issuance, easing regulatory obstacles such as mandatory profit requirements. Listing reforms on both the mainland and Hong Kong should open the door for even more tech IPOs,” analysts at BlackRock wrote in a note in November.

Krystal Hu covers technology and trade for Yahoo Finance. Follow her on Twitter.

Read more:

Amazon got over $42 million worth of free publicity from its HQ2 search

Shares of these U.S. suppliers are getting slammed in the wake of the Huawei arrest

Yahoo Finance

Yahoo Finance