China's slowdown casts light on understated exposure at largest US banks

On paper, the largest U.S. banks have low exposure to China. But a slowing Chinese economy could pose indirect risks.

China said Friday that its pace of economic growth had fallen to 6.5%, the slowest since early 2009. The downturn is raising questions about how China’s lagging economy will affect into U.S. growth.

But the U.S. banking industry does not have a lot of direct business dealings in China. According to data released by the Federal Financial Institutions Examinations Council in October, U.S. banks’ risk claims in China totaled $102.6 billion as of June 30, 2018, which is only 0.6% of total domestic and foreign exposures. Goldman Sachs says firms in the technology sector appear to be most exposed to China; for comparison, Skyworks Solutions (SWKS) ranks among the most exposed companies with 83% of its revenue linked to China.

Mayra Rodríguez Valladares, a managing principal at financial consultancy MRV Associates, acknowledged that none of the large banks are “excessively exposed China in a direct way.” But she warned of the “secondary” impacts of a slowing Chinese economy. At issue: China is so large a player in the global economy that the U.S. banks are still exposed to slowing activity through its relationships abroad and at home.

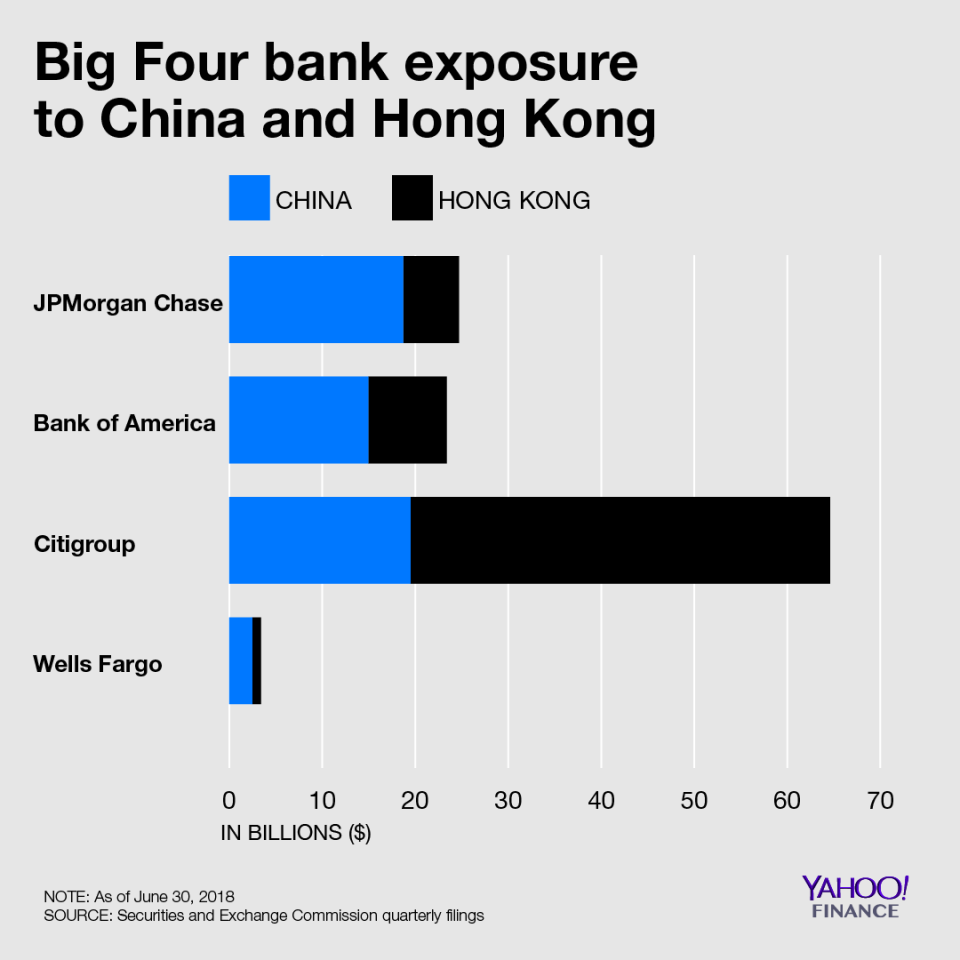

For example, although activity in China is only a sliver of the U.S. banks’ international exposure, Hong Kong — a special administrative region under China — is a huge market for them.

Filings with the Securities and Exchange Commission show that Citigroup (C) had only 1.2% of its assets, or about $19.5 billion, in direct exposure to China as of June 30, 2018. Most of their activity is driven by their division that deals with corporate and investment banking, although they also have a sizable retail business in the country.

But Hong Kong, which is a special administrative region in China and widely considered to be the financial access point to the mainland, accounted for $45.1 billion of Citi’s foreign exposures. Combined, Citi’s $64.6 billion exposure to Hong Kong and China is closer to 4% of the company’s total assets.

In comparison, JPMorgan Chase (JPM) has $24.7 billion in total exposure to both countries, Bank of America (BAC) has $23.4 billion in total exposure and Wells Fargo (WFC) has only $3.4 billion in total exposure.

Rodríguez Valladares added that the U.S. banks are exposed to more indirect risks through its equity trading and foreign exchange businesses, adding that Chinese risks are prevalent in their U.S. business loans too. Domestic businesses that work with China through their supply chains may be harmed by the economic slowdown.

“These interconnections shouldn’t be understated, and its hard to get a number because these interconnections are not so visible,” Rodríguez Valladares said.

Citi CEO Michael Corbat has made note of the deep ties between the U.S. and China. In an interview with CNBC, Corbat said that while the escalating trade war remains an issue, a slowdown in the “two book ends of the global economy of growth” would have huge weigh on markets.

“We’ve seen a lot of currency volatility and we’ve seen fears of the slow down,” Corbat said.

Read more:

Fed Vice Chair Quarles prefers ‘more gradual’ rate hikes

Prudential Financial to shed its post-crisis ‘too big to fail’ label

Yahoo Finance

Yahoo Finance