China $131 Billion Singles’ Day Faces Stagnation After Scandals

(Bloomberg) -- A year ago, one of China’s most famous internet celebrities sold about $1 billion of products -- from shampoo to scarves -- in a 14-hour livestream as part of Singles’ Day, the country’s annual e-commerce extravaganza.

Most Read from Bloomberg

Biden, Xi Chart Path to Warmer Ties With Blinken China Visit

FTX Latest: Binance CEO Plans Recovery Fund, Laments Bad Actors

Fall of the World’s Hottest Stock Cost Sea Founders $32 Billion

Stocks Fluctuate as Traders Mull Latest Fedspeak: Markets Wrap

This year, the 37-year-old super saleswoman known as Viya won’t take part in the world’s biggest shopping event at all after disappearing from the internet since being fined for tax evasion. A slew of other popular livestream stars who have found themselves caught up in President Xi Jinping’s crackdown on celebrity are also likely to be missing this year, dulling the glamor and likely hurting the takings of the marathon event that ends Nov. 11.

A slump in consumer confidence from recurring Covid lockdowns and heightened scrutiny on internet firms was already casting a chill over an annual event that’s shattered sales records since its inception in 2009. Alibaba Group Holding Ltd., the tech giant that dominates Singles’ Day, is expected to post flat to meager growth in takings from this year’s event -- Bloomberg Intelligence has even projected an unprecedented fall in the value of its transactions.

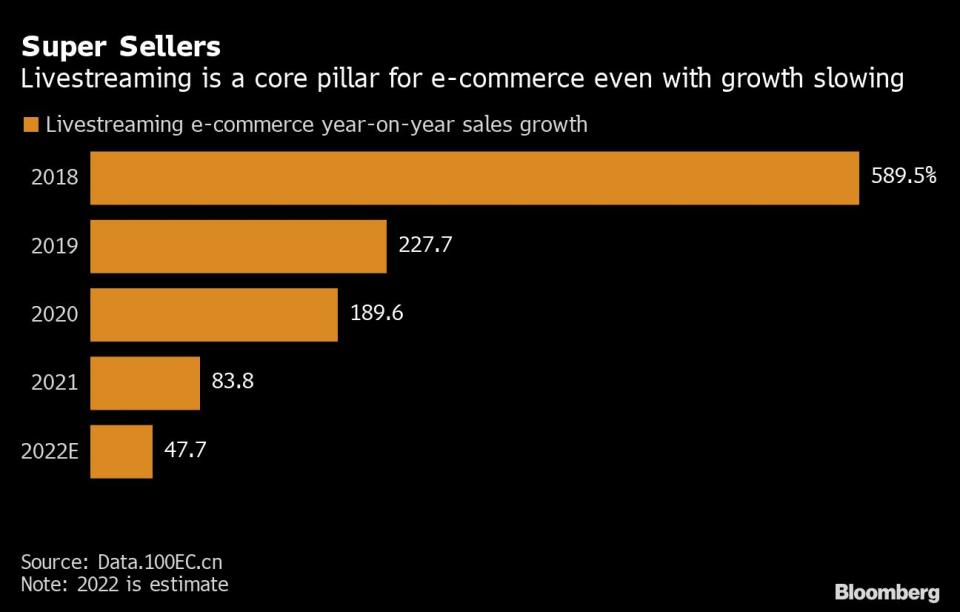

But it’s the loss of the celebrity sellers, which quickly became integral to how clothing to food was retailed in China, that will be felt the most. Livestream shopping -- where people buy products through social media platforms and interact directly with broadcast hosts -- had become a part of regular life for millions of consumers. But its growth has collided with a government push to shape Chinese culture and rein in celebrity influence. Scandals like Viya’s are already prompting brands to shift away from big-name stars, bring broadcasting in-house or use digital avatars to sell goods.

Customers are wary too. About three-quarters of consumers say they would watch a livestream or buy items through the sales channel this year, down from 97% a year ago, consulting firm AlixPartners reported from a survey of about 2,000 people in China. Some shoppers said that negative news relating to broadcast hosts had made them less engaged.

“In recent years, livestreaming seems to have created a quick way for brands to get famous and sales boomed,” said Dave Xie, a Shanghai-based principal of consultancy Oliver Wyman. “Amid the recent falls of the superstar livestreamers, brands are now actively speeding up the development of their own livestreaming studios” in order to cut ties with the top influencers, while retailers are also shifting to smaller platforms, he said.

The roughly two-week Singles’ Day bonanza dwarfs similar events around the world. Last year, millions of shoppers bought what Bain & Co. estimates was about 952 billion yuan ($131 billion) of goods during the event -- more than the US buying spree that spans Thanksgiving through Cyber Monday.

But prominence comes with scrutiny. Xi’s ‘common prosperity’ drive, aimed at reining in excess wealth, and the government’s efforts to curb the private sector’s influence have hit some of the biggest names across media and technology. E-commerce firms were caught up in a regulatory assault on China’s top internet companies that kicked off in late 2020, when authorities halted the planned initial public offering of Ant Group Co. -- the financial affiliate of Alibaba -- after Jack Ma criticized regulators.

Celebrity Scandals

Viya, once seen as the future of shopping, has been the highest-profile casualty in the livestream sector. During her career she’d partnered with Kim Kardashian to host a livestream that sold 15,000 of bottles of the US celebrity’s perfume within minutes. And she held a special event in Wuhan to showcase the city’s revitalization after a tough Covid lockdown, underscoring how influencers can wield their fame to align with the government’s values.

Her empire came crashing down in December though, when Chinese tax authorities ordered her to pay 1.34 billion yuan in back taxes, late fees and fines. She apologized but hasn’t returned online since.

Another top livestream influencer, Li Jiaqi, was caught up in a scandal mid-year when a tank-shaped cake appeared in one of his broadcasts on the eve of the anniversary of the 1989 Tiananmen Square massacre. That saw the man called ‘Lipstick King’ for his ability to sell the cosmetics vanish from the internet for about three months.

Others have also been done for tax evasion, impacting the valuations of companies that have capitalized on their rise. Viya’s tax fine sparked a drop in shares across the sector, including TVZone Media Co. and Shanghai Fengyuzhu Culture and Technology Co., amid concerns the crackdown could target more influencers.

The controversies are helping transform how brands, fearful of being collateral damage if an influencer falls afoul of the government, sell their products in the world’s biggest consumer market.

Firms are now avoiding the kind of long-term contracts that were typical for Viya and Li, and putting far more emphasis on short-term deals, according to people who’ve worked on such strategies, who asked not to be identified because the discussions are private. Companies are also setting up their own studios for livestream broadcasts and grooming in-house influencers, who are more easily controlled, according to the people.

Representatives at Meione and Qianxun, the agencies behind Li and Viya respectively, didn’t respond to requests for comment.

Global retail giants are among those going in-house. Nike Inc., L’Oreal SA and Fast Retailing Co.’s Uniqlo, as well as local labels including Anta Sports Products, have all accrued more than 20 million fans on their company-run livestreaming pages on Taobao, Alibaba’s mammoth online shopping platform that’s similar to Amazon.

Some companies are even doing away with humans entirely. Digitally created influencers are emerging, including Ayayi, who debuted on social platform Xiaohongshu last year and has worked with Tiffany & Co. Forrester Research Inc. estimates that 20% of business-to-consumer brands in China will use virtual idols in 2023.

While its brightest stars may have been dimmed, the livestream sector remains core to Chinese consumption -- if in an altered form.

And at least one celebrity host has managed to redeem himself. On the first day of Singles’ Day presales, Li -- the ‘Lipstick King’ -- generated 460 million views and gross merchandise value of 21.5 billion yuan, about double his own record from last year’s promotions, according to Forrester.

But the sector’s loss of popular names is likely to ripple beyond just this year’s Singles’ Day.

“I watched Viya and Li Jiaqi every day last year to buy everything: snacks, cosmetics, dresses and shampoos. I just trust their tastes and quality control,” said Jelly Li, a civil servant in Guangzhou. But now, “my interest in livestreaming has been much lowered,” she said.

--With assistance from Jane Zhang, Jinshan Hong and Lucille Liu.

Most Read from Bloomberg Businessweek

How Apple Stores Went From Geek Paradise to Union Front Line

Americans Have $5 Trillion in Cash, Thanks to Federal Stimulus

One of Gaming’s Most Hated Execs Is Jumping Into the Metaverse

Meta Investors Are in No Mood for Zuckerberg’s Metaverse Moonshot

©2022 Bloomberg L.P.

Yahoo Finance

Yahoo Finance