Children's Place (PLCE) to Report Q1 Earnings: What Awaits?

The Children's Place, Inc. PLCE is scheduled to release first-quarter fiscal 2019 results on May 15, before the opening bell. In the last quarter, the company delivered a negative earnings surprise of 47.9%. In three of the trailing four quarters, this pure-play children's specialty apparel retailer has underperformed the Zacks Consensus Estimate, recording average negative earnings surprise of 10.3%. Let’s see what awaits this quarterly release.

How are Estimates Faring?

The Zacks Consensus Estimate for the first quarter is pegged at a loss of 58 cents per share, reflecting a significant decline from earnings of $1.87 reported in the year-ago quarter. Notably, the consensus mark has narrowed by 2 cents over the past 30 days. The Zacks Consensus Estimate for revenues stands at $392.2 million, down approximately 10% from the year-ago quarter’s figure.

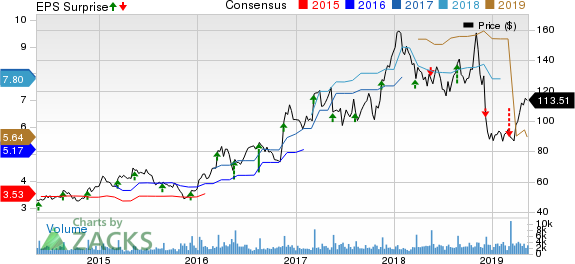

Children's Place, Inc. (The) Price, Consensus and EPS Surprise

Children's Place, Inc. (The) price-consensus-eps-surprise-chart | Children's Place, Inc. (The) Quote

Factors to Consider

Children's Place had earlier entered into an Asset Purchase Agreement with Gymboree Group, Inc. and related entities to buy intellectual property assets of Gymboree and Crazy 8 (the Gymboree Assets) for $76 million. Although this buyout is likely to be accretive to fiscal 2020 adjusted earnings per share, management informed that this may have a negative low-teens percentage impact on fiscal 2019 earnings, owing to incremental investments to harness opportunities provided by the Gymboree assets.

Also, the company expects first half of fiscal 2019 to be quite tough with performance expected to improve in the back-half on account of lower supply in the children’s apparel space. For the first quarter, the company anticipates adjusted loss of 40-70 cents a share, down from earnings of $1.87 recorded in the prior-year period. Net sales are anticipated to be in the range of $385-$395 million, down from $436.3 million reported in the first quarter of fiscal 2018. Comparable retail sales are expected to decline in the band of 10-12%.

Nevertheless, the company is focusing on digital transformation, fleet optimization and international expansion. Children’s Place liquidated its seasonal inventories and exited the fourth quarter with a much leaner inventory level. Margins are likely to gain from lower inventory levels and fall in product costs. Moreover, it remains on track to gain traction in the U.S. market and expand globally. Its e-commerce business is performing well. The company is also strengthening digital ecosystem and bolstering shipping and delivery capabilities, which are likely to cushion the top line.

What Our Model Says

Our proven model does show that Children's Place is likely to beat estimates this quarter. This is because a stock needs to have both — a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Children's Place has a Zacks Rank #2 and ESP of +9.96%, which makes us confident of a beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks With Favorable Combination

Here are some other companies you may want to consider as our model shows that these too have the right combination of elements to post earnings beat.

Boot Barn Holdings, Inc. BOOT has an Earnings ESP of +2.62% and a Zacks Rank #2.

Target Corporation TGT has an Earnings ESP of +0.42% and a Zacks Rank #2.

Dollar General DG has an Earnings ESP of +1.51% and a Zacks Rank #3.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Children's Place, Inc. (The) (PLCE) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance