Chesapeake Down 57% Since Q3 Earnings, Hits 25-Year Low

Chesapeake Energy Corporation’s CHK shares have plunged 57.1%, hitting 25-year low, since its earnings announcement on Nov 5.

The reasons for the decline were weak third-quarter earnings and concerns expressed by the company in its SEC 10-Q filing regarding the impact of a tepid commodity price environment. The company stated, “If continued depressed prices persist, combined with the scheduled reductions in the leverage ratio covenant, our ability to comply with the leverage ratio covenant during the next 12 months will be adversely affected which raises substantial doubt about our ability to continue as a going concern.”

Chesapeake Energy Corporation Price

Chesapeake Energy Corporation price | Chesapeake Energy Corporation Quote

Overall Earnings Picture

Chesapeake reported third-quarter 2019 loss per share (excluding special items) of 11 cents, wider than the Zacks Consensus Estimate of a loss of 10 cents. The bottom line was also wider than the year-ago loss of a penny per share.

Operating revenues amounted to $1,170 million, down from $1,199 million in the year-ago quarter. However, the top line beat the Zacks Consensus Estimate of $1,162 million.

The weak earnings stemmed from lower natural gas production volumes, decline in realized commodity prices and higher average production expenses. The negatives were partially offset by higher quarterly oil volumes and lower gathering, processing, and transportation expenses.

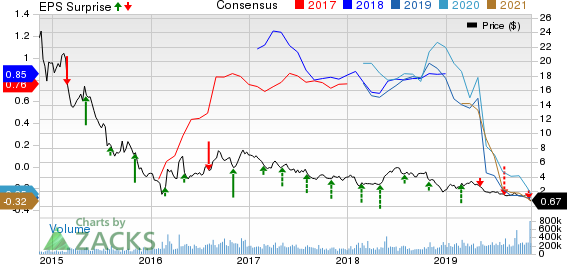

Chesapeake Energy Corporation Price, Consensus and EPS Surprise

Chesapeake Energy Corporation price-consensus-eps-surprise-chart | Chesapeake Energy Corporation Quote

Operational Performance

Total Production Declines

Chesapeake’s production in the reported quarter was approximately 44 million barrels of oil equivalent (MMBoe), down from 49.4 MMBoe a year ago. The total production comprised 10 million barrels (MMbbls) of oil (up 11.1% year over year), 183 billion cubic feet of natural gas (down 14.9%) and 3 MMbbls of natural gas liquids or NGLs (down 40%).

Importantly, daily oil production of 115 MBbl during the September quarter was higher than the year-ago level of 89 MBbl, supported by rising output from the Brazos Valley.

Price Realizations Plunge

Oil equivalent realized price — exclusive of gains (losses) on derivatives — was $22.79 per barrel, decreasing from $26.92 in the year-ago quarter. Oil price was $58.18 per barrel, decreasing from $72.39 in the year-ago quarter. Moreover, natural gas prices declined to $1.93 per thousand cubic feet from the year-ago level of $2.69. Average sales price of NGLs was recorded at $12.44 per barrel in the quarter compared with $29.09 a year ago.

Operating Expenses

Total operating costs in the third quarter declined to $2,041 million from $2,342 million in the prior-year period. However, quarterly production expenses per Boe increased to $3.54 from $2.68 in the year-ago period.

Capital Expenditure

Total capital expenditure increased to $640 million in the third quarter from $551 million in the year-ago period, primarily due to a rise in initial drilling and completion capital spending.

Balance Sheet

At the end of the quarter under review, Chesapeake had a cash balance of $14 million. Net long-term debt was $9,133 million, leading to a debt-to-capitalization ratio of 65.9%.

Guidance

The company reiterated its production guidance for 2019 in the range of 484,000-505,000 Boe per day. It expects production expense for 2019 in the range of $3.20-$3.40 per Boe.

Notably, the company maintained its total capital budget for 2019 at $2,105-$2,305 million.

For 2020, the company expects oil production to remain flat with 2019. It also plans to slash 2020 capital expenditure by 30%.

Zacks Rank and Stocks to Consider

Currently, Chesapeake has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are Lonestar Resources US Inc. LONE, CNX Resources Corporation CNX and Contango Oil & Gas Company MCF. All these companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Lonestar’s 2020 earnings per share are expected to rise 77% year over year.

CNX Resources’ 2019 earnings per share have witnessed two upward movements and no downward revision in the past 30 days.

Contango Oil & Gas’ bottom line for the current year is expected to rise around 87% year over year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNX Resources Corporation. (CNX) : Free Stock Analysis Report

Lonestar Resources US Inc. (LONE) : Free Stock Analysis Report

Contango Oil & Gas Company (MCF) : Free Stock Analysis Report

Chesapeake Energy Corporation (CHK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance