Chesapeake (CHK) Q1 Loss Widens Y/Y on Gas Prices, Stock Down

Chesapeake Energy Corporation CHK reported first-quarter 2020 loss per share (adjusted for 1:200 reverse stock split) of $852.97, which was significantly wider than the year-ago loss of $6.37. Low oil and gas prices, along with overall production decline affected its bottom line. Also, increased operating costs hurt its profit levels.

Total revenues amounted to $2,525 million, up from $2,162 million in the year-ago quarter. The top line also beat the Zacks Consensus Estimate of $1,060 million. The upside was supported by gains on undesignated hydrocarbon derivatives.

The company is not being able to access financing. It is currently considering a bankruptcy court restructuring of its massive $9,163-million debt, if crude prices don’t improve significantly and stay in the bearish territory. Coronavirus-induced lockdowns that destroyed energy demand is responsible for the current crude pricing scenario. The stock declined 12.2% yesterday, following the news. Its balance sheet details are discussed below.

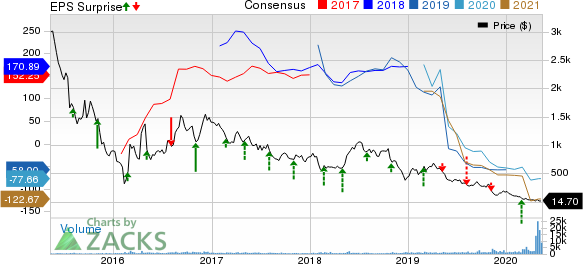

Chesapeake Energy Corporation Price, Consensus and EPS Surprise

Chesapeake Energy Corporation price-consensus-eps-surprise-chart | Chesapeake Energy Corporation Quote

Operational Performance

Total Production Decreases

Chesapeake’s production in the reported quarter was approximately 479 thousand barrels of oil equivalent per day (MBoe/d), down from 484 MBoe/d a year ago, primarily due to lower production from Haynesville assets.

Total production comprised 126 thousand barrels of oil per day (Mbbls/d), up from the year-ago level of 109 Mbbls/d on the back of Brazos Valley output. Total natural gas production in the quarter was 1,898 million cubic feet per day (MMcf/d), lower than 2,023 MMcf/d in the year-ago period. Natural gas liquids (NGLs) production came in at 37 Mbbls/d in the first quarter, declining from 39 Mbbls/d in the year-ago period.

Price Realizations Plunge

Oil equivalent average sales price was $20.53 per barrel, down from $28.22 a year ago.

Oil price was $46.93 per barrel, down from $57.80 in the year-ago quarter. Moreover, natural gas prices declined to $1.86 per thousand cubic feet from the year-ago level of $3.27. Average sales price of NGLs was recorded at $10.71 per barrel in the quarter compared with $20.03 a year ago.

Marketing Operations

On the marketing front, the company recorded revenues of $724 million, lower than the year-ago figure of $1,233 million. Marketing expenses in the first quarter were $746 million, lower than the year-ago level of $1,230 million. The year-over-year decline stemmed from lower oil, natural gas and NGL prices from marketing operations.

Operating Expenses

Total operating costs in the first quarter surged to $10,768 million from $2,378 million in the prior-year period, primarily due to higher impairment charges. Rising exploration costs also resulted in higher expenses.

Cash Flow

Net cash provided by operating activities in the first quarter was recorded at $397 million, down from the year-ago level of $456 million.

Balance Sheet

At the end of the quarter under review, Chesapeake had a cash balance of $82 million. Net long-term debt was $9,163 million. Net current maturities of long-term debt were $420 million, much higher than its cash balance. Notably, $250 million of senior notes are due in 2020 and $294 million in 2021. Moreover, the company’s ability to clear debt is questionable since the upstream energy player’s times interest earned ratio of 0.02 is significantly lower than the industry’s 0.8.

Importantly, it had $1.9 billion outstanding borrowings under the $3-billion credit revolving facility at quarter-end.

Guidance

The company decreased 2020 capital expenditure expectation to the band of $1-$1.2 billion, which indicates a decrease from the 2019 level of $2.2 billion. For the remainder of the year, its capital expenditures will likely be in the range of $500-$700 million. This will be primarily focused on the company’s gas assets.

Due to current market uncertainty, it has withdrawn financial outlook, which was provided last February.

Zacks Rank & Stocks to Consider

Currently, Chesapeake has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space include RGC Resources Inc. RGCO, CNX Resources Corporation CNX, and Comstock Resources, Inc. CRK, each holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

RGC Resources’ 2020 earnings per share are expected to rise 14.8% year over year.

CNX Resources beat earnings estimates thrice and met once in the last four quarters, with average positive surprise of 111.5%.

Comstock Resources’ 2020 sales are expected to gain 30.8% year over year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chesapeake Energy Corporation (CHK) : Free Stock Analysis Report

Comstock Resources Inc (CRK) : Free Stock Analysis Report

CNX Resources Corporation (CNX) : Free Stock Analysis Report

RGC Resources Inc (RGCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance