Chemours Provides Update in Response to Coronavirus Outbreak

The Chemours Company CC announced measures that it is taking to address the macroeconomic uncertainties fuelled by the coronavirus pandemic.

The company’s management emphasized on workers’ wellbeing and safety in the wake of the outbreak. Moreover, it continues to concentrate on executing its business continuity strategies that will ensure a reliable supply to its customers as well as provide results to its shareholders.

Per management, the company is taking precautionary steps to navigate the prevailing uncertainties and, out of a great deal of caution, it has decided to borrow $300 million from its revolving credit facility of $800 million. Notably, the step helps to balance the company’s access to domestic and non-domestic cash as well as strengthens financial flexibility in the short term.

Chemours said that it may use the $300-million proceeds from the borrowing in the future for working capital needs or other general corporate purposes. Reportedly, repayment of the borrowing is likely to arise when the uncertainties in the global markets subside.

As earlier reported, Chemours had overall liquidity of around $1.6 billion as of Dec 31, 2019. Notably, the company’s debt maturities are well-spaced and balanced, with no senior debt slated to mature until 2023.

Chemours’ shares have lost 81.1% in the past year compared with the 47.4% decline recorded by its industry.

On the fourth-quarter earnings call, the company had projected an adjusted EBITDA of $1.05-$1.25 billion for 2020.

Capital expenditure for the year is anticipated to be approximately $400 million, while free cash flow is projected to be more than $350 million.

Moreover, adjusted earnings per share are forecast at $2.60-$3.55 for 2020.

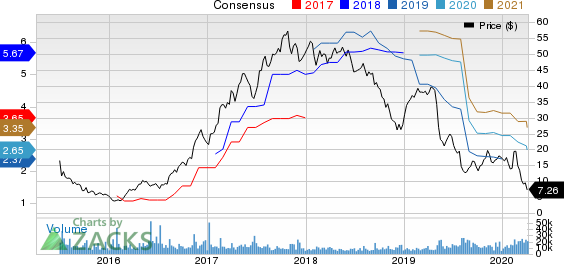

The Chemours Company Price and Consensus

The Chemours Company price-consensus-chart | The Chemours Company Quote

Zacks Rank & Stocks to Consider

Chemours currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Harmony Gold Mining Company Limited HMY, Franco-Nevada Corporation FNV and Barrick Gold Corporation GOLD.

Harmony Gold has a projected earnings growth rate of 185.7% for 2020. The company’s shares have gained 3.9% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Franco-Nevada has a projected earnings growth rate of 22% for 2020. It currently carries a Zacks Rank #2 (Buy). The company’s shares have rallied 42.8% in a year.

Barrick Gold currently has a Zacks Rank #2 and a projected earnings growth rate of 41.2% for 2020. The company’s shares have surged 47.5% in a year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance