CF Industries (CF) Partners CHS to Produce Low-Carbon Nitrogen

CF Industries Holdings, Inc. CF has collaborated with CHS Inc. to accelerate quantifiable and certifiable greenhouse gas (GHG) emission reductions in the agriculture and food systems by manufacturing and distributing low-carbon nitrogen fertilizer. This initiative was created as part of the United States-United Arab Emirates Agriculture Innovation Mission for Climate program, which aims to drive global innovation in climate-smart agriculture.

Fertilizer production, which is critical to crop yields, contributes significantly to the global food production lifecycle GHG footprint. To address food production's GHG footprint, both firms will capitalize on CF Industries' investments to manufacture ammonia, the building component of nitrogen-based fertilizer products, with lower Scope 1 carbon dioxide (CO2) emissions. They will also use CHS' vast distribution network to connect producers with low- and zero-carbon fertilizers. The companies are keen on working together to promote the use of low-GHG nitrogen fertilizer to assist farmers and crop end users, such as consumer product goods companies and ethanol manufacturers, in reducing agriculture's overall carbon footprint.

A major advantage of incorporating decarbonized fertilizer is that it can quantify the reduction in greenhouse gas emissions related to its production and communicate this attribute to the farmer, who can then provide products with a quantifiably lower GHG footprint to their customers. This will enable the company to establish a certifiable decarbonized agricultural value chain, CF noted.

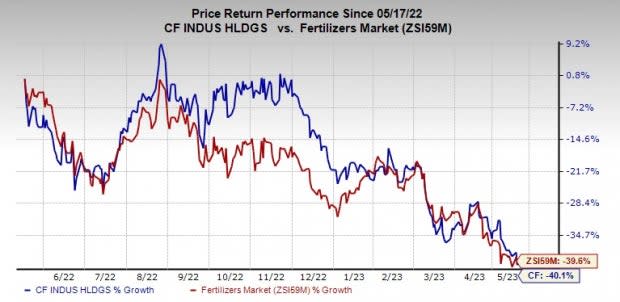

Price Performance

Shares of CF have plunged 40.1% over the past year compared with the decline of 39.6% of its industry.

Image Source: Zacks Investment Research

CF Industries noted on its first-quarter earnings call that it expects production economics in Europe to remain difficult. Full ammonia capacity production rates are not likely to restart in the region until 2023, with some plants still preferring to import ammonia in order to generate enhanced products.

CF forecasts urea exports from China to be 2-3 million metric tons for 2023 under current measures, with annual exports returning to 3-5 million metric tons if government export restrictions are lifted.

Energy inequalities between North America and marginal producers in Europe and Asia are projected to be much greater than in the past. According to the company, the global nitrogen cost curve will continue to favor low-cost North American producers with significant margin potential.

CF Industries Holdings, Inc. Price and Consensus

CF Industries Holdings, Inc. price-consensus-chart | CF Industries Holdings, Inc. Quote

Zacks Rank & Key Picks

CF Industries currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks to consider in the basic materials space include Steel Dynamics Inc. STLD, Nucor Corporation NUE and PPG Industries Inc. PPG. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Steel Dynamics currently has a Zacks Rank #2 (Buy). STLD’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 10.7% on average. STLD has rallied around 21.7% in a year.

Nucor currently sports a Zacks Rank #1. NUE’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 10.8% on average. NUE has rallied around 9.4% in a year.

PPG currently carries a Zacks Rank #2. PPG’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 6.8% on average. PPG has rallied around 12.1% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance