Celanese Increases Prices of Acetyl Intermediates Products

Celanese Corporation CE is raising list and off-list selling prices of acetyl intermediates products. The price hike is applicable for orders shipped and is immediately effective or as contracts permit.

The company stated that the latest price increases are incremental to any earlier announced increases.

Prices of Vinyl Acetate Monomer will increase €100/MT in Europe, Middle-East & Africa, and it will rise 5 cents/lb in the United States and Canada.

Notably, prices of Vinyl Acetate Monomer are expected to increase $125/MT in Mexico and South America, and by $100/MT in Asia outside China.

In the third quarter, the company witnessed a decline in net sales of the Acetyl Chain segment on a year-over-year basis on lower pricing for most products, mainly resulting from lower Asia demand and an overall deflationary environment for raw materials.

Its shares have gained 20.3% in the past year compared with the industry’s 12.6% growth.

In October 2019, Celanese lowered its adjusted earnings per share guidance for 2019 on expectations of weak market conditions. The company anticipates adjusted earnings of $9.60-$9.80 per share for the year compared with $10.50 mentioned earlier. The revised earnings guidance incorporates the fourth-quarter impact of an earlier announced unplanned outage at Celanese’s Clear Lake facility in Texas

Nevertheless, the company’s measures, including price increase initiatives, cost savings through productivity actions and efficiency engagement, are expected to support earnings. Notably, Celanese plans to remain focused on executing productivity programs, enhancing the business model and investing in high-return projects. It anticipates the same to deliver double-digit growth in adjusted earnings per share in 2020.

The company expects 2020 adjusted earnings of $11-$12 per share. It expects to achieve the same at the top end if the demand condition improves next year.

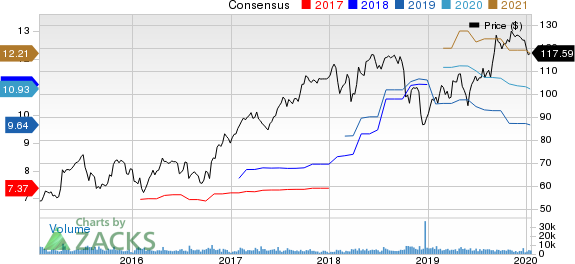

Celanese Corporation Price and Consensus

Celanese Corporation price-consensus-chart | Celanese Corporation Quote

Zacks Rank & Stocks to Consider

Celanese currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Daqo New Energy Corp. DQ, Pan American Silver Corp. PAAS and Sibanye Gold Limited SBGL.

Daqo New Energy has a projected earnings growth rate of 326.3% for 2020. The company’s shares have rallied 82.8% in a year. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Pan American Silver has an estimated earnings growth rate of 26.1% for 2020. It currently carries a Zacks Rank #2 (Buy). The company’s shares have gained 50.4% in a year.

Sibanye Gold has a Zacks Rank #2 and a projected earnings growth rate of 587.5% for 2020. The company’s shares have soared 287.1% in a year.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Celanese Corporation (CE) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Sibanye Gold Limited (SBGL) : Free Stock Analysis Report

Pan American Silver Corp. (PAAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance