CDW Reports Q1 Preliminary Results and Updates US IT Outlook

CDW Corporation CDW has released its selected preliminary financial results for the first quarter that ended Mar 31, 2023, and updated its outlook for the U.S. IT industry. The company is slated to report first-quarter results on May 3.

The company saw a decline in its first-quarter performance due to economic uncertainty, which caused customers to prioritize mission-critical initiatives and spend more cautiously. The contraction in demand was most prominent with the company's largest commercial customers and across transactional products, while solutions were relatively resilient but still came below the company’s expectations.

Following the announcement, shares are down 10.6% in the pre-market trading on Apr 19, 2023.

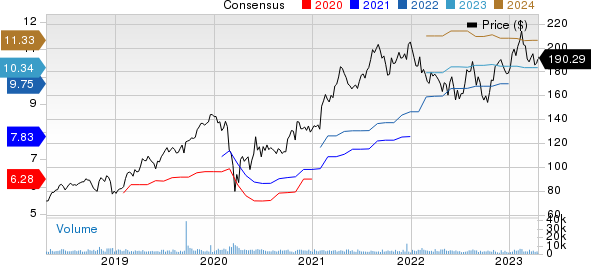

CDW Corporation Price and Consensus

CDW Corporation price-consensus-chart | CDW Corporation Quote

CDW's first-quarter net sales were $5.1 billion. The first-quarter gross margin was aided by a stronger mix of high-value products and services. However, the impact of more conservative purchases by customers weighed on the first quarter's non-GAAP operating income margin, which came in at the low end of the company’s full-year range. CDW aims to align its fixed cost base with the anticipated demand in response to the above-mentioned factors.

The company also reported strong first-quarter cash flow performance due to disciplined working capital management. This provided strategic flexibility, which helped the company to return $280 million of cash to shareholders via dividends and share repurchases.

The company now expects the U.S. IT market to decline by a high-single-digit rate in 2023 compared with the previous guidance of remaining flat due to the first-quarter market performance and near-term unfavorable conditions. Despite headwinds in the IT space, CDW is targeting net sales outperformance of 200 to 300 basis points in constant currency.

CDW expects 2023 non-GAAP earnings per share on a diluted basis to be “modestly” below 2022.

CDW offers discrete hardware and software products to integrated IT solutions businesses, such as mobility, security, data center optimization, cloud computing, virtualization and collaboration.

CDW currently holds a Zacks Rank #4 (Sell). Shares of the company have gained 6.3% against the sub-industry’s decline of 10.7% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Arista Networks ANET, Asure Software ASUR and Salesforce CRM. Asure Software and Salesforce currently sport a Zacks Rank #1 (Strong Buy), whereas Arista Networks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2023 earnings has increased 1.2% in the past 60 days to $5.83 per share. The long-term earnings growth rate is anticipated to be 14.2%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 14.2%. Shares of ANET have increased 26.9% in the past year.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings has increased 25% in the past 60 days to 35 cents per share. The long-term earnings growth rate is anticipated to be 25%.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 445.8%. Shares of ASUR have increased 187.8% in the past year.

The Zacks Consensus Estimate for Salesforce’s 2023 earnings has increased 21.5% in the past 60 days to $7.11 per share. The long-term earnings growth rate is anticipated to be 16.8%.

Salesforce’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 15.6%. Shares of the company have increased 3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance