Caterpillar's Q3 beat expectations, shares tumble

Global construction equipment giant Caterpillar (CAT) announced quarterly results that were a bit better than expected. However, management kept its full-year earnings guidance unchanged. Shares sold off following all the news.

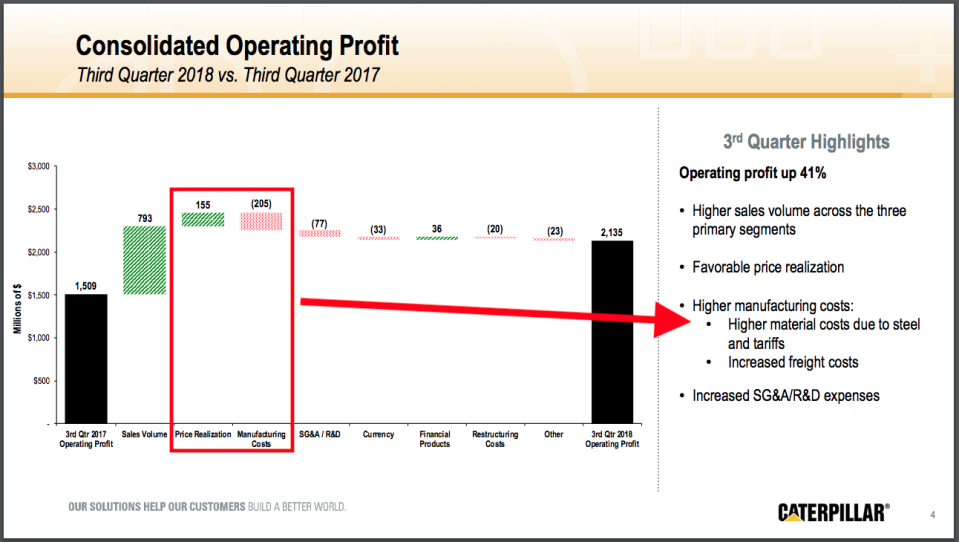

Q3 revenue climbed 18% to $13.5 billion, which was slightly better than the $13.3 billion expected by analysts. Earnings came in at $2.86 per share, up from $1.95 a year ago and a penny better than expected.

Shares were down 6% following the announcement.

“Most end markets continue to improve,” management said in a press release.

Caterpillar’s construction industries business segment sales grew 16% to $5.7 billion. Among other things, management cited “higher demand for oil and gas, including pipelines, and non-residential construction activities” in North America. Strong onshore drilling activity in North America helped the energy and transportation business segment sales grow 15% to $5.6 billion.

Management also cited “positive global economic growth” for helping fuel demand for heavy construction equipment sales. This helped drive resource industries segment sales to $2.6 billion, up 35% from the same period a year ago.

Notably, Caterpillar was able to offset the impact of higher material costs due to tariffs by raising prices.

Despite the positive tone of the earnings announcement, the company kept full-year earnings guidance at a range of $11.00-$12.00 per share.

Analysts had forecast full-year earnings of $11.65 per share, which is a bit higher than the midpoint of management’s guidance.

“Order rates and backlog remain healthy,” management said. “In the fourth quarter, price realization, operational excellence and cost discipline are expected to more than offset higher material and freight costs, including tariffs.”

–

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @SamRo

Read more:

Robert Shiller: The stock market today is similar to the stock market in 1928

Janet Yellen nails how investors should think about valuations

The stock market has been in a new price regime for 20 years

Warren Buffett: One metric tells me the most about the future

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn

Yahoo Finance

Yahoo Finance