Catalyst Media Group (LON:CMX) Has Compensated Shareholders With A 19% Return On Their Investment

No-one enjoys it when they lose money on a stock. But no-one can make money on every call, especially in a declining market. The Catalyst Media Group plc (LON:CMX) is down 35% over three years, but the total shareholder return is 19% once you include the dividend. And that total return actually beats the market decline of 3.7%. And more recent buyers are having a tough time too, with a drop of 31% in the last year. Shareholders have had an even rougher run lately, with the share price down 13% in the last 90 days.

Check out our latest analysis for Catalyst Media Group

We don't think Catalyst Media Group's revenue of UK£25,000 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Catalyst Media Group will significantly advance the business plan before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

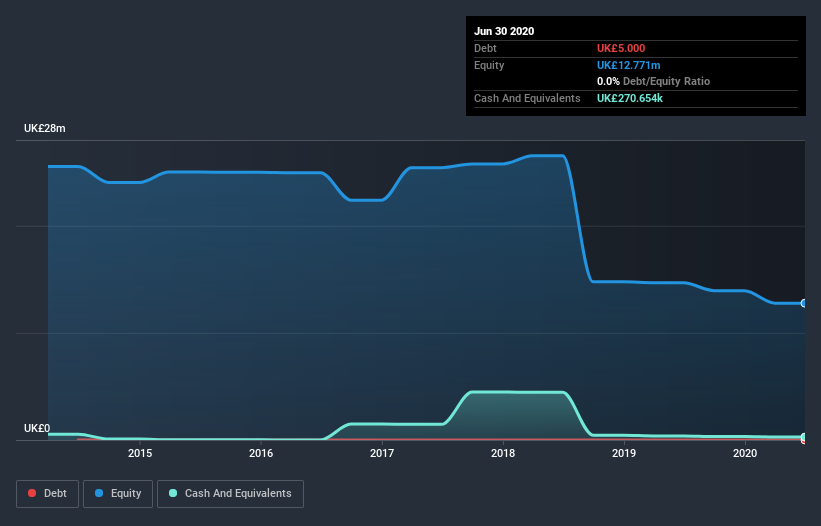

Catalyst Media Group had cash in excess of all liabilities of UK£233k when it last reported (June 2020). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. With the share price down 11% per year, over 3 years , it seems likely that the need for cash is weighing on investors' minds. You can see in the image below, how Catalyst Media Group's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Catalyst Media Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Catalyst Media Group's TSR of 19% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 4.4% in the twelve months, Catalyst Media Group shareholders did even worse, losing 31%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Catalyst Media Group you should be aware of, and 2 of them are potentially serious.

We will like Catalyst Media Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance