The Case for Selling Tesla

Tesla TSLA stock has been soaring in the last few days, and investors might be wondering why. It isn’t just that it was really beaten down last year. We generally cheer when an overvalued stock loses steam because that’s when it gets within buying range.

And then there’s the question of whether you’re buying for the long term or the short term. For an investor with a relatively short investment window, there appear to be a number of concerns.

First would be the increasing competition from traditional automakers like General Motors GM and Ford F, as well as emerging players like Rivian RIVN and Lucid LCID in a market that Tesla has dominated until now. Therefore, Tesla is the only one with share to lose. All other players are gaining market share at its expense.

Second, Tesla’s own service centers are too few and far between, and certainly not keeping up with its sales. Therefore, GM dealers are getting in on this business. GM has very good reach, with most Americans living within 10 miles of a GM dealership. This is lost business for Tesla and also gives a competitor experience that could have been kept within Tesla. But there’s a positive side to this too. The fact that Teslas can be easily serviced should make them more attractive.

Third, there are concerns with respect to the China market, which is full of home grown players like NIO Inc. NIO, XPeng Inc. XPEV and Li Auto Inc. LI. Chinese players are seeing strong growth in the Chinese market and they are getting ready to expand in international markets, mainly Europe and other Asian countries. China is a big market for Tesla, so the stiff competition is likely to erode its market share. China lifting COVID restrictions is positive for not only Tesla but also the Chinese players.

When you consider the above against a valuation that’s becoming less and less attractive because of the rising share price, Tesla doesn’t look good for short term investors. Its earnings estimates have also been consistently deteriorating in the last 60 days. Therefore, analysts are also incrementally cautious about its near-term prospects. This explains the Zacks Rank #5 (Strong Sell rating) on the stock. [Note that the Zacks Rank is a reflection of near-term prospects only].

The long-term story looks as strong as ever.

Other than its solid market position and growth prospects (even with estimate cuts, analysts expect 2023 revenue and earnings growth of a respective 30.9% and 16.1% -- off a much larger base than any of its peers), Tesla also stands to benefit from recent price cuts. Not only will these cuts make its cars more competitive compared with rivals’, but the price will also make several of its models eligible for the $7,500 tax rebates (allowed on EVs under 55,000 and electric SUVs and trucks under $80,000).

It is not as easy for competitors to cut prices because unlike Tesla, they’re already making losses from EV sales. Therefore, this is a unique position that will help Tesla sell more cars.

Tesla also has two new factories coming up, one in Berlin and the other in Austin, Texas that should help it churn out higher volumes.

Let’s see how growth rates compare:

Zacks #5-ranked Tesla has 2023 revenue and earnings growth of a respective 30.9% and 16.1% (as given above)

Zacks #3 (Hold)-ranked Rivian is expected to generate revenue and earnings growth of 195.5% and 24.1%.

Zacks #3-ranked Lucid is expected to grow its revenues 185.3% and earnings -16.2% in 2023.

Analysts expect Zacks Rank #4 (Sell) Li Auto to grow revenue and earnings 135.2% and 104.2%, respectively.

Zacks #4-ranked Nio Inc will grow revenue and earnings a respective 84.4% and 42.1%.

Zacks #3-ranked Xpeng with grow its revenue and earnings 57.8% and -1.2%, respectively.

Conclusion

Government support for EV adoption is a strong positive for this group and companies with exposure to Europe, U.S. and China are well positioned. Tesla is already in all of these markets and will soon have manufacturing capacity in all of them too. Therefore, although its market share will no doubt erode this year, growth may still be quite strong.

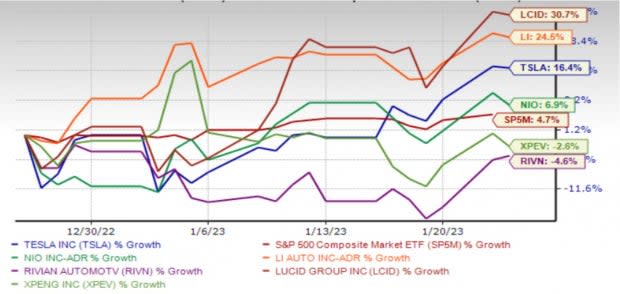

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

Lucid Group, Inc. (LCID) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance