Carl Icahn Cuts Back Tenneco

- By Graham Griffin

Carl Icahn (Trades, Portfolio) has revealed several cuts to his Tenneco Inc. (NYSE:TEN) holding according to GuruFocus' Real-Time Picks, a Premium feature.

Icahn is known for taking activist positions in undervalued, struggling companies and working with management in order to improve profitability as well as unlock value for shareholders. He seeks to avoid consensus thinking and believes the momentum with trends will always fall apart.

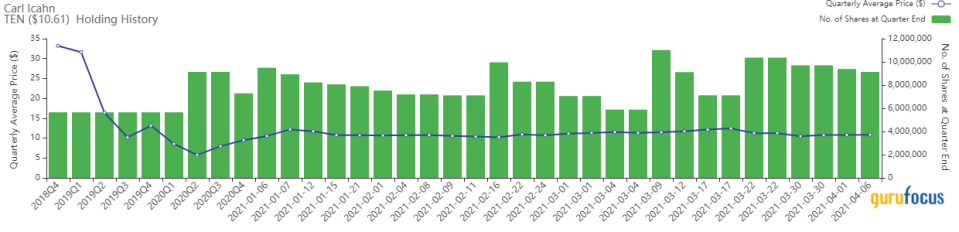

Icahn first acquired his Tenneco holding in 2018 with the purchase of 5.65 million shares. The holding flew under the radar and remained unchanged until the second quarter of 2020, when Icahn boosted it by 61.67% with the purchase of 3.48 million shares. The guru has been in a continual buy and sell pattern, regularly adding 30% to 80% to the holding as the price per share drops.

On April 6, Icahn revealed a 2.68% reduction in his Tenneco (NYSE:TEN) following two reductions the week prior. On the day of the most recent reduction, the shares traded at an average price of $10.86. The reduction had a -0.01% impact on the equity portfolio and GuruFocus estimates the total loss of the holding at 30.58%.

Tenneco's emissions-control products meet strict air-quality legislation, optimize engine performance, improve fuel economy and acoustically tune engine sound to fit a vehicle's profile. Ride-control products enhance safety by enabling improved steering, braking and acceleration as well as improving ride comfort. Champion, Fel-Pro, Moog, Monroe and Walker are some of Tenneco's well-known aftermarket brands.

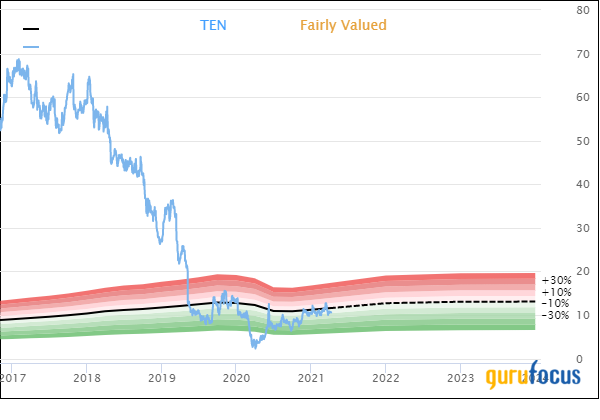

On April 8, the stock was trading at $10.61 per share with a market cap of $872.13 million. According to the GF Value Line, the shares are trading at fair value.

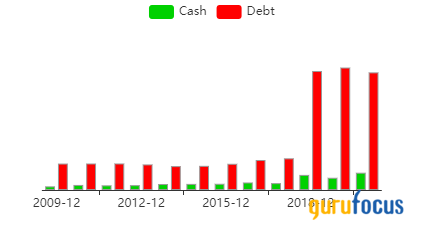

GuruFocus gives the company a financial strength rating of 3 out of 10, a profitability rank of 6 out of 10 and a valuation rank of 10 out of 10. There are currently eight severe warning signs issued for the company, including new long-term debt and assets growing faster than revenue. An Altman Z-Score of 0.9 places the company in the distress column, indicating a higher chance of bankruptcy occurring in the next two years.

Icahn is the largest shareholder with 11.14% of shares outstanding. Other top shareholders include Vanguard Group Inc. (Trades, Portfolio), BlackRock Inc. (Trades, Portfolio) and Fuller & Thaler Asset Management, Inc. (Trades, Portfolio).

Portfolio overview

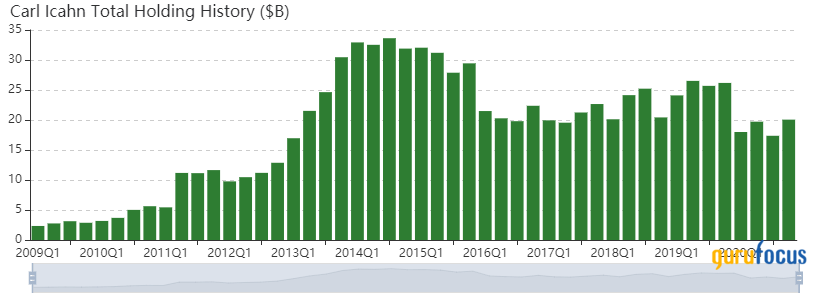

At the end of the fourth quarter of 2020, Icahn's portfolio contained 18 stocks, with two new holdings. It was valued at $20.06 billion and has seen a turnover rate of 3%. The top holdings are Icahn Enterprises LP (NASDAQ:IEP), Occidental Petroleum Corp. (NYSE:OXY), CVR Energy Inc. (NYSE:CVI), Herbalife Nutrition Ltd. (NYSE:HLF) and Cheniere Energy Inc. (LNG).

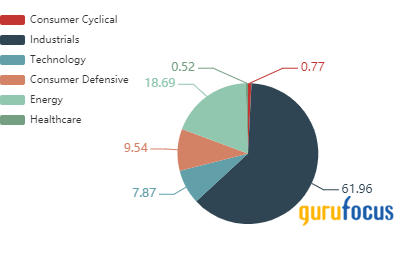

By weight, the top three sectors represented are industrials (61.96%), energy (18.69%) and consumer defensive (9.54%).

Disclosure: Author owns no stocks mentioned.

Read more here:

New Operating Data Available to Members

GM on the Rise With Hummer EV

Larry Robbins' Firm Jumps Into Longview Acquisition Corp

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance