The Capstone Turbine (NASDAQ:CPST) Share Price Is Down 97% So Some Shareholders Are Very Salty

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Capstone Turbine Corporation (NASDAQ:CPST) during the five years that saw its share price drop a whopping 97%. We also note that the stock has performed poorly over the last year, with the share price down 48%. Unhappily, the share price slid 4.9% in the last week.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Capstone Turbine

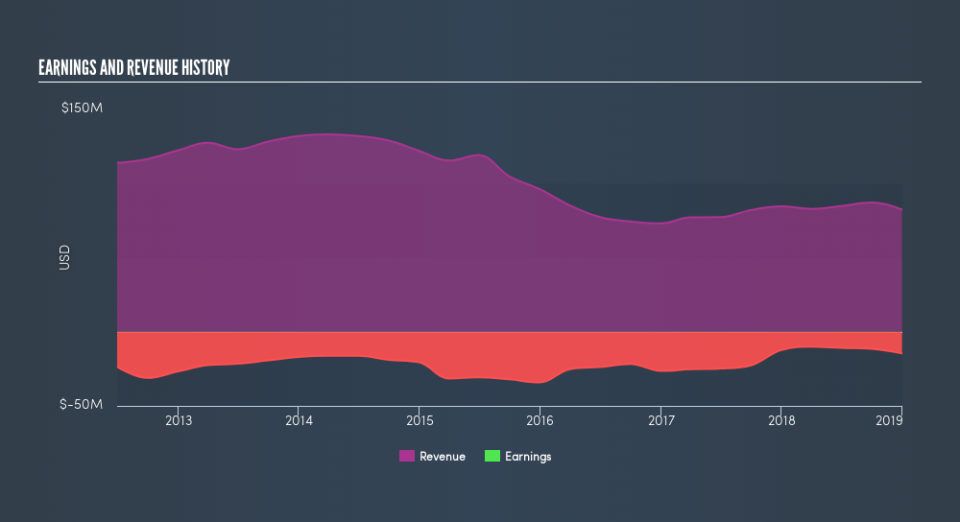

Capstone Turbine isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Capstone Turbine saw its revenue shrink by 12% per year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 52% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Capstone Turbine in this interactive graph of future profit estimates.

A Different Perspective

Capstone Turbine shareholders are down 48% for the year, but the market itself is up 1.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 52% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Capstone Turbine is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance