Canadian National (CNI) Q4 Earnings Beat, 2022 Outlook Upbeat

Canadian National Railway Company’s CNI fourth-quarter 2021 earnings (excluding 2 cents from non-recurring items) of $1.36 per share (C$1.71) surpassed the Zacks Consensus Estimate of $1.21. The bottom line increased in double digits year over year due to lower costs.

Quarterly revenues of $2,977.4 million (C$3,753 million) topped the Zacks Consensus Estimate of $2,917.4 million. The top line improved year over year, driven by higher freight rates and fuel surcharges.

Freight revenues (C$3,586 million), which contributed 95.6% to the top line, increased 2% year over year as economic activities gathered pace. Freight revenues at the Grain and fertilizers segment declined 13%, while the same at the automotive unit decreased 4% year over year. Freight revenues at the petroleum and chemicals; metals and minerals; and coal and intermodal units climbed 14%, 11%, 31% and 1%, respectively. Freight revenues at the Forest products sub group were flat year over year.

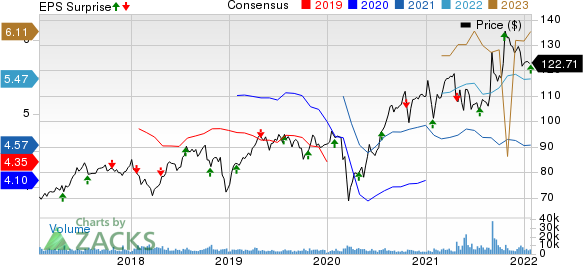

Canadian National Railway Company Price, Consensus and EPS Surprise

Canadian National Railway Company price-consensus-eps-surprise-chart | Canadian National Railway Company Quote

While overall carloads (volumes) fell 10% year over year, revenue ton miles (RTMs) slipped 11%. Segment-wise, carloads in both petroleum and chemicals, and metals and minerals dipped 1% each. Carloads in forest products, grain and fertilizers, intermodal, and automotive units declined 7%, 16%, 19%, and 8%, respectively. Carloads for coal augmented 38% year over year in the reported quarter. Freight revenues per carload and freight revenues per RTM improved 14% each in the reported quarter.

Operating expenses (on a reported basis) for the fourth quarter dipped 1% to C$2,187 million due to a reduction in workforce as part of CNI’s cost-cutting measures and lower volumes. Due to high fuel prices, expenses on fuel climbed 43% year over year. Adjusted operating income increased 12% year over year to C$1,579 million. Adjusted operating ratio (defined as operating expenses as a percentage of revenues) improved to 57.9% from the year-ago quarter’s 61.4%. Lower value of the metric is desirable.

Liquidity

Canadian National, carrying a Zacks Rank #3 (Hold), generated free cash flow of C$1,262 million during the December quarter compared with the year-ago quarter’s C$1,140 million. Cash and cash equivalents amounted to C$838 million as of Dec 31, 2021 compared with C$569 million at December-2020 end.

2022 Outlook

Canadian National expects adjusted earnings to increase approximately 20% year over year in 2022. It estimates RTMs to rise in the low-single-digit range in 2022 from that in 2021. The company predicts its capital expenditures to be around 17% of its revenues in 2022. CNI continues to expect an operating ratio of approximately 57% for 2022. It is forecasting free cash flow of approximately C$4 billion in 2022 compared with C$3.3 billion in 2021.

Dividend Hike & New Share Buyback Program

Canadian National’s board approved a dividend hike of 19%. The new dividend of C$0.7325 cents per share will be paid to shareholders on Mar 31, 2022 of record as of Mar 10. This marks the company’s 26th annual dividend increase.

The company also announced a normal course issuer bid in the range of C$5 billion for cancellation, over a 12-month period up to 42 million common shares. The bid will run from Feb 1, 2022 through Jan 31, 2023.

Appointment of New CEO

Canadian National announced the appointment of Tracy Robinson as its new president and chief executive officer, as well as a board member. Robinson will assume this new role Feb 28, 2022 onward. Last October, CNI announced the retirement of its current chief executive officer Jean-Jacques Ruest. Although Ruest will depart CNI’s board on Feb 28, he will remain associated with the company as an advisor until Mar 31, 2022, to ensure a smooth transition.

Sectorial Snapshot

Within the broader Transportation sector, J.B. Hunt Transport Services JBHT, United Airlines UAL and Delta Air Lines DAL recently reported fourth-quarter 2021 results.

J.B. Hunt Transport Services, carrying a Zacks Rank #1 (Strong Buy), reported fourth-quarter 2021 earnings of $2.28 per share, surpassing the Zacks Consensus Estimate of $1.99. The bottom line surged 58.3% year over year on the back of higher revenues across all segments. You can see the complete list of today’s Zacks #1 Rank stocks here.

J.B. Hunt’s operating revenues of $3,497 million also outperformed the Zacks Consensus Estimate of $3,287.8 million. The top line jumped 27.7% year over year. Total operating revenues, excluding fuel surcharges, rose 21.7% year over year.

United Airlines, carrying a Zacks Rank #4 (Sell), incurred a loss (excluding 39 cents from non-recurring items) of $1.60 per share in the fourth quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of $2.23. The amount of loss narrowed by 77.1% year over year.

United Airlines’ operating revenues of $8,192 million also outperformed the Zacks Consensus Estimate of $7,930.9 million. The top line surged more than 100% year over year, with passenger revenues, which accounted for 84% of the top line, soaring 185.4% to $6,878 million.

Delta, carrying a Zacks Rank #5 (Strong Sell), reported fourth-quarter 2021 earnings (excluding 86 cents from non-recurring items) of 22 cents per share, outpacing the Zacks Consensus Estimate of 15 cents. Results came against the year-ago quarter’s loss of $2.53 per share. Strong holiday travel demand and favorable pricing aided the December quarter’s results.

Delta’s revenues came in at $9,470 million, which not only beat the Zacks Consensus Estimate of $9,232.1 million, but also soared in excess of 100% from the year-ago figure as people resorted to air travel during the holidays.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Canadian National Railway Company (CNI) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance