Canadian investors could get bump after U.S. midterms

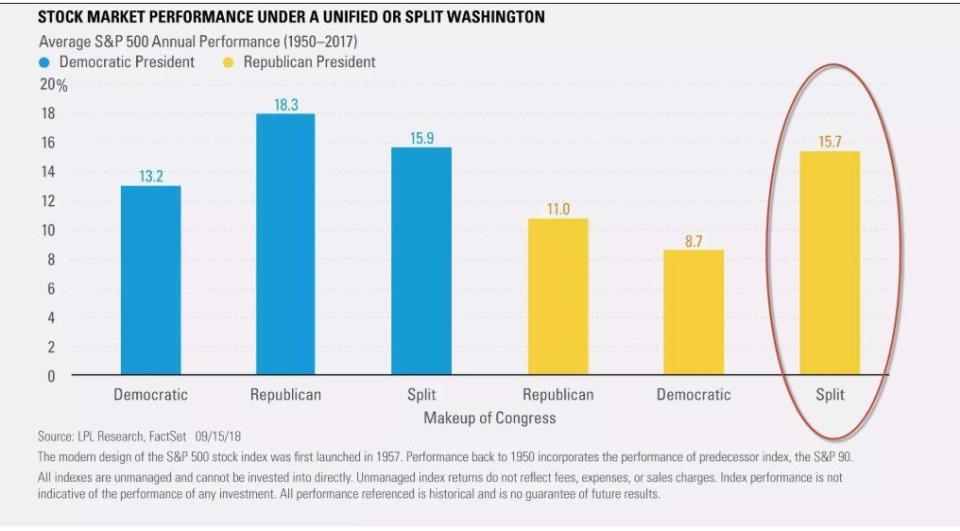

The Democrats are expected to take the house in tonight’s U.S. midterm elections. If the polls are right, investors can expect better returns on stocks. That’s because the market typically does best when there is gridlock in Washington.

A split congress with a Republican president has produced 15.7 per cent annual returns for U.S. equities since 1950. That’s good news for Canadians investing south of the border. But it could turn out well either way.

“We view this as possibly being a win/win scenario no matter the political outcome for markets,” Ryan Modesto, CEO at 5i Research, told Yahoo Finance Canada. “In general, more certainty is better as investors can go about their day without worrying about a political wrench being thrown into things.”

Pollsters were caught completely off-guard by Donald Trump’s victory, so what if they are wrong again? That could be good news too.

“If Republicans stand their ground, it could mean tax cuts which could boost markets (in the short term at least),” says Modesto. “However, the possibility of Republican’s having their hands tied (through a strong performance for Democrats) would likely help remove a lot of the risks of unexpected policies being put forward, which markets should appreciate.”

Canadian stocks shielded by the drama

Modesto says in general a strong U.S. market should be a tailwind for Canadian markets, but doesn’t think the midterms will have a whole lot of impact here at this stage.

The TSX has been underperforming compared to the U.S. market for years. Canada has its own issues with trade tensions, low oil prices, and its own politics.

“I think the election, to state the obvious, will be much more impactful south of the border,” says Brian Madden, Senior Vice President at Goodreid Investment Counsel told Yahoo Finance Canada.

“And I think more so than the 2016 Presidential elections will be a political event, more so than something with broad economic resonance.”

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance