Canadian Imperial (CM) Stock Dips as Q4 Earnings Decline Y/Y

Shares of Canadian Imperial Bank of Commerce CM lost 7.6% following the release of its fourth-quarter (ended Oct 31) and fiscal 2022 results. Quarterly adjusted earnings per share of C$1.39 were down 17% from the prior-year quarter.

Results were adversely impacted by higher expenses and a significant rise in provisions. However, a rise in revenues, an improvement in loan demand and a strong balance sheet position were tailwinds.

After considering several non-recurring items, net income was C$1.19 billion ($0.89 billion), reflecting a year-over-year decline of 18%.

Revenues Improve, Costs Rise

Total revenues for the quarter under review were C$5.39 billion ($4.05 billion), up 6% year over year. The improvement was driven by higher net interest income and non-interest income.

Net interest income was C$3.19 billion ($2.40 billion), growing 7% year over year. Non-interest income increased 6% to C$2.20 billion ($1.65 billion).

Non-interest expenses totaled C$3.48 billion ($2.62 billion), up 11% year over year.

The adjusted efficiency ratio was 60.9% at the end of the reported quarter, rising from 57.8% as of Oct 31, 2021. An increase in the efficiency ratio indicates a deterioration in profitability.

Provision for credit losses was C$436 million ($327.7 million), up significantly from the prior-year quarter.

Balance Sheet Strong

As of Oct 31, 2022, total assets were C$943.6 billion ($692 billion), up 5% from the prior quarter. Net loans and acceptances increased 2% sequentially to C$528.7 billion ($387.8 billion), while deposits grew 3% to C$697.6 billion ($511.6 billion).

As of Oct 31, 2022, the Common Equity Tier 1 ratio was 11.7% compared with 12.4% in the prior-year quarter. The Tier 1 capital ratio was 13.3% compared with 14.1% in the prior-year period. The total capital ratio was 15.3%, down from 16.2%.

Adjusted return on common shareholders’ equity was 11.2% at the end of the fiscal fourth quarter, down from the prior year’s 14.7%.

Our Take

Given the improving economy, rising rates and loan growth, Canadian Imperial is likely to witness steady improvement in revenues. However, a challenging operating backdrop, steadily increasing provisions and rising expenses remain near-term concerns.

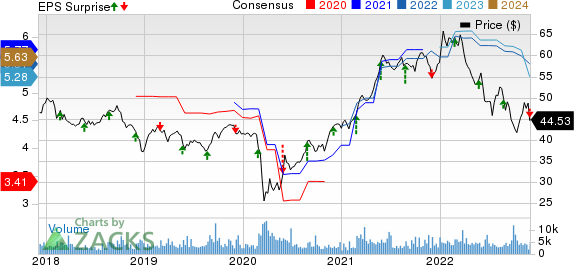

Canadian Imperial Bank of Commerce Price, Consensus and EPS Surprise

Canadian Imperial Bank of Commerce price-consensus-eps-surprise-chart | Canadian Imperial Bank of Commerce Quote

CM currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

HSBC Holdings HSBC reported a third-quarter 2022 (ended Sep 30) pre-tax profit of $3.1 billion, down 41.8% from the prior-year quarter.

Results reflected a rise in adjusted revenues. However, adjusted expenses increased from the year-ago quarter, which was a headwind for HSBC. Expected credit losses and other credit impairment charges were a net charge in the quarter under review against a release in the prior-year quarter.

UBS Group AG UBS reported a third-quarter 2022 (ended Sep 30) net profit attributable to shareholders of $1.73 billion, down 37.6% from the prior-year quarter.

UBS’ performance was affected by a fall in revenues and a decline in total net credit loss releases. Nonetheless, operating expenses decreased from the prior-year quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UBS Group AG (UBS) : Free Stock Analysis Report

Canadian Imperial Bank of Commerce (CM) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance