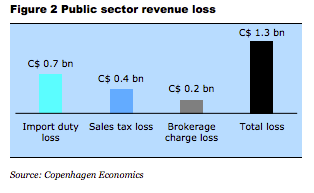

Canada missing out on $1.3B a year in taxes and duties on e-commerce shipments

Canada is missing out on more than $1.3 billion a year in tax and duties on e-commerce shipments, according to new research.

The study by consultancy Copenhagen Economics found that there is a significant discrepancy in how packages sent to Canada are treated by customs, depending on if they are shipped via postal carriers or express services, such UPS or FedEx.

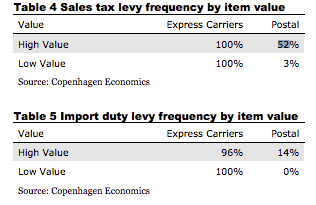

The research, which was prepared on behalf of UPS, found that sales tax is collected on only 25 per cent of shipments sent through postal carriers, compared to 100 per cent on those done through express operators.

It also found that customs are only collecting import duties on six per cent of packages sent by postal carriers, which pales in comparison to the 98 per cent taken on those that arrive by express operator shipment.

“We find that these shipments are treated differently at customs clearance, where sales tax (HST/PST) and import duty should be applied, depending on the type of delivery operator,” said the report.

“We conclude that sales tax and import duty are significantly less likely to be collected when shipments are sent via postal versus express operators.”

E-commerce imports into Canada are subject to federal and provincial sales if the total value of the content of a shipment is more than $20. The same goes for import duties.

To see if these charges were being universally applied, researchers shipped more than 200 online purchases to Canada from China, France, Japan, the United Kingdom and the United States, half using the national postal operator in the country of origin to Canada post and the other half using FedEx and UPS.

All of the shipments contained “general consumers goods,” purchased from independent e-retailers that were subject to duty and sales tax. Some of the packages were valued at between $30 and $60, and some were worth $185 to $235.

The research found that postal carriers were significantly more likely to collect duty and sales tax on the latter.

In response to its findings, officials from Canada Post told The Financial Post that it “collects and remits all duties and taxes” that it is required to by the Canadian Border Services Agency.

“As part of the global postal network, we’re proud to deliver mail and parcels to Canadians from the around the world,” a representative said.

The report said the research is particularly important given the fact that it has been estimated that the total value of goods sold through e-commerce in Canada last year was $30 billion.

Furthermore, 70 per cent of online purchases made in Canada are from foreign merchants.

“We conclude that the missed collection of sales tax and import duty on e-commerce inbound postal shipments results in a significant loss of public revenue to Canada,” said the report.

The authors added that this “failure” to collect sales tax and import duty also helps foreign online retailers.

“The lack of application of sales tax makes goods coming from outside Canada cheaper than comparable items purchased by Canadian consumers from Canadian sellers (both online and offline),” said the report.

“This gives an advantage to manufacturers and sellers located outside Canada, relative to their Canadian competitors, when a postal operator is used to deliver the goods.”

Karl Littler vice-president of the Retail Council of Canada, told The Financial Post that the study’s methodology is sound and confirms widespread anecdotal reports.

“Even if the number is hundreds of millions a year in lost revenue rather than $1.3 billion, that would be significant for the provinces and the federal government and for Canada Post,” said Littler.

He echoed the report’s conclusion that the failure to collect sales tax and import duty could create a competitive advantage for foreign retailers, as Canadian consumers will simply buy cheaper products.

“There is a vulnerability for Canadian merchants generally if a bunch of stuff is coming in tax and duty free, and for online merchants in particular,” said Littler.

“From our merchants’ perspective, that is an unlevel playing field.”

Yahoo Finance

Yahoo Finance