Cambium (CMBM) Q4 Earning Top Estimates, Top Line Surges Y/Y

Cambium Networks Corporation CMBM reported healthy fourth-quarter 2022 results, with the bottom line and the top line beating the respective Zacks Consensus Estimate. The leading wireless solutions provider recorded higher revenues year over year on growth in Point-to-Point and Enterprise product categories and continuous improvement in the supply chain environment.

Net Income

On a GAAP basis, net income in the December quarter was $10 million or 35 cents per share compared with $1.4 million or 5 cents per share in the prior-year quarter. Top-line expansion, low-interest expenses and significant income tax benefits are key drivers of improvement during the quarter.

Non-GAAP net income came in at $10.3 million or 36 cents per share compared with $4.4 million or 16 cents per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 11 cents.

For the full year 2022, GAAP net income amounted to $20.2 million or 72 cents per share compared with a net income of $37.4 million or $1.31 per share in the previous year. On a non-GAAP basis, net income in 2022 declined to $26.9 million or 94 cents per share from respective tallies of $35.6 million or $1.26 per share in 2021.

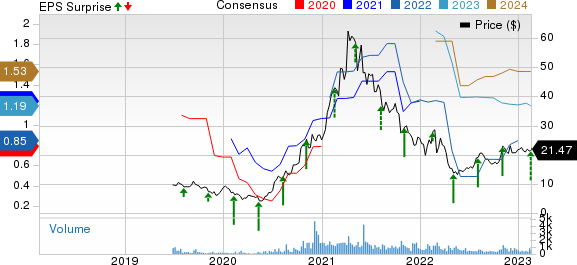

Cambium Networks Corporation Price, Consensus and EPS Surprise

Cambium Networks Corporation price-consensus-eps-surprise-chart | Cambium Networks Corporation Quote

Revenues

Quarterly revenues increased to $84.5 million from $78.7 million in the year-ago quarter. The upside can be attributed to healthy demand for Enterprise products and higher Point-to-Point revenues. However, declining Point-to-Multi-Point revenues partially offset this positive trend. The top line beat the consensus estimate of $82.1 million.

By product category, quarterly revenues at Point-to-Multi-Point (PMP) came in at $29.7 million compared with $37 million a year ago. The decline is primarily due to service providers continuing to move on from legacy PMP 450 to new gigabit technologies.

Revenues from Point-To-Point (PTP) business rose to $21.3 million in the fourth quarter from $15.3 million in the prior-year quarter. Robust growth of the company’s federal defense business in North America, as well as growth in EMEA (Europe, Middle East and Africa) and CALA (Caribbean and Latin America), using Cambium's PTP 700 mission-critical technology for fixed wireless broadband communications, is principle drivers for the 39% growth year over year.

During the fourth quarter, revenues at Enterprises surged to $32 million from $25.8 million in the year-ago quarter. 24% year over year top line expansion is primarily driven by rising demand of the company’s Wi-Fi 6 and 6E solutions, switching revenues and healthy growth in SaaS solutions.

Region wise, revenues from North America rose to $44.4 million from $33.4 million in the year-ago quarter. Revenues from Europe, the Middle East and Africa (EMEA) declined to $20 million from $26 million in the prior-year quarter. The company witnessed a top-line decline from the Caribbean and Latin America (CALA) as revenues fell from $10.3 million in the year-ago quarter to $9.2 million in the fourth quarter. However, revenues from Asia-Pacific cushioned the top-line performance as revenues rose to $10.9 million from $9 million in the prior-year quarter.

In 2022, total revenues declined by 12% to $296.9 million compared with $335.9 million in 2021.

Other Details

Non-GAAP gross profit increased to $41.9 million from $34.8 million for respective margins of 49.6% and 44.2%. The improvement is a result of higher volume and a greater mix of enterprise and PTP products combined with lower freight costs. However, higher component costs owing to inflation partially offset this trend. Total operating expenses were $31.9 million compared with $31.6 million in the prior-year quarter. Non-GAAP operating income rose to $13.2 million from $5.8 million. Non-GAAP adjusted EBITDA totaled $14.3 million compared with $6.7 million a year ago, for respective margins of 16.9% and 8.6%.

Cash Flow & Liquidity

During the quarter, Cambium generated $4 million from operating activities compared with $5.6 million in the prior-year period. As of Dec 31, 2022, the company had a $48.2 million cash balance with $24.5 million of long-term debt compared with respective tallies of $59.3 million and $27 million in the prior-year period. The decline is due to high inventory levels and debt payments.

Outlook

For the first quarter of 2023, revenues are expected in the range of $74-$80 million, indicating growth of approximately 20-29% year over year and suggesting a fall of 5-12% sequentially. Management expects seasonality in PMP business, the slowdown of world economies might hamper the company’s top-line performance. However, the defense business in PTP is likely to remain strong. Non-GAAP earnings are anticipated to be in the band of $4.1-$6.8 million or 14-23 cents per share. Non-GAAP operating income is projected between $5.8 million and $9 million, while adjusted EBITDA is likely to be in the range of $6.8-$10 million, with a corresponding margin between 9.2% and 12.5%. Non-GAAP income tax rate is expected between the ranges of 17% to 21%.

Zacks Rank & Stocks to Consider

Cambium currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Viavi Solutions Inc. VIAV, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 9.10%, on average, in the trailing four quarters. In the last reported quarter, it delivered an earnings surprise of 27.27%.

Viavi Solutions Inc. is a leading provider of network test, monitoring and service enablement solutions to diverse sectors across the globe. The product portfolio of the company offers end-to-end network visibility and analytics that help build, test, certify, maintain and optimize complex physical and virtual networks.

Jabil Inc. JBL, carrying a Zacks Rank #2, delivered an earnings surprise of 8.8%, on average, in the trailing four quarters. Earnings estimates for JBL for the current year have remained unchanged in the past 30 days at $8.37 per share.

Jabil is one of the largest global suppliers of electronic manufacturing services. The company offers electronics design, production, product management and after-market services to customers catering to aerospace, automotive, computing, consumer, defense, industrial, instrumentation, medical, networking, peripherals, storage and telecommunications industries.

Splunk Inc. SPLK, carrying a Zacks Rank #2, delivered an earnings surprise of 222%, on average, in the trailing four quarters. It has an Earnings ESP of +0.39%.

Splunk Inc. provides software solutions that enable enterprises to gain real-time operational intelligence by harnessing the value of their data. The company’s offerings enable users to investigate, monitor, analyze and act on machine data and big data, irrespective of format or source and help in operational decision-making.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Viavi Solutions Inc. (VIAV) : Free Stock Analysis Report

Cambium Networks Corporation (CMBM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance