Is Cadence Design Systems (NASDAQ:CDNS) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Cadence Design Systems, Inc. (NASDAQ:CDNS) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Cadence Design Systems

What Is Cadence Design Systems's Net Debt?

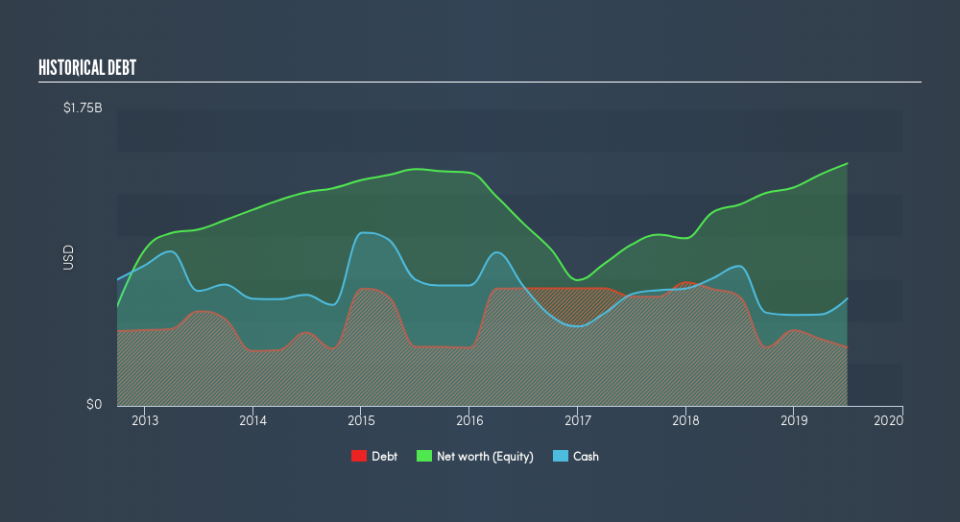

As you can see below, Cadence Design Systems had US$345.7m of debt at June 2019, down from US$644.8m a year prior. However, it does have US$633.4m in cash offsetting this, leading to net cash of US$287.8m.

How Healthy Is Cadence Design Systems's Balance Sheet?

We can see from the most recent balance sheet that Cadence Design Systems had liabilities of US$610.2m falling due within a year, and liabilities of US$571.6m due beyond that. Offsetting this, it had US$633.4m in cash and US$248.1m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$300.3m.

Having regard to Cadence Design Systems's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$19.7b company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, Cadence Design Systems boasts net cash, so it's fair to say it does not have a heavy debt load!

On top of that, Cadence Design Systems grew its EBIT by 40% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Cadence Design Systems can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Cadence Design Systems may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Cadence Design Systems actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

We could understand if investors are concerned about Cadence Design Systems's liabilities, but we can be reassured by the fact it has has net cash of US$288m. And it impressed us with free cash flow of US$613m, being 140% of its EBIT. So we don't think Cadence Design Systems's use of debt is risky. Another factor that would give us confidence in Cadence Design Systems would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance