Cadence (CDNS) Earnings and Revenues Top Estimates in Q1

Cadence Design Systems Inc CDNS posted first-quarter 2021 non-GAAP earnings of 83 cents per share, which topped the Zacks Consensus Estimate by 12.2%. Also, the bottom line increased 38.33% year over year.

Revenues of $736 million surpassed the Zacks Consensus Estimate by 2.4% and increased 19% on a year-over-year basis.

Revenue growth was benefitted by continued strength across all segments as well as some earlier-than-expected hardware sales.

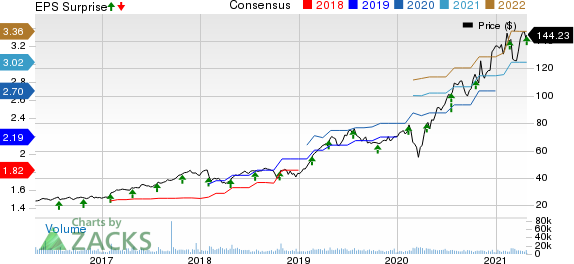

Cadence Design Systems, Inc. Price, Consensus and EPS Surprise

Cadence Design Systems, Inc. price-consensus-eps-surprise-chart | Cadence Design Systems, Inc. Quote

Despite better-than-expected first-quarter results, shares are down 4.5% in the pre-market trading on Apr 27. In the past year, the company’s stock has returned 83.8% compared with the industry’s surge of 52.3%.

Performance in Details

Product & Maintenance revenues (95% of total revenues) of $699 million increased 20% year over year.

Services revenues (5%) of $37 million increased 2.8% from the year-ago quarter’s figure.

Geographically, Americas, China, Other Asia, Europe, Middle East and Africa (EMEA) and Japan contributed 46%, 12%, 18%, 18% and 6%, respectively, to total revenues.

Product-wise, Custom IC Design & Simulation, Digital IC Design & Signoff, Functional Verification, IP and Systems Design & Analysis contributed 23%, 27%, 26%, 14% and 10% to total revenues, respectively.

Cadence Digital Full Flow saw robust traction in the first quarter along with Palladium Z1 and Protium X1.

In the first quarter, the company unveiled that Cadence Palladium Z2 Enterprise Emulation and Protium X2 Enterprise Prototyping systems. provide two times more capacity and offer 1.5 times improved performance than the prior generation — Palladium Z1 and Protium X1. These solutions are embedded with next-generation emulation processors and Xilinx UltraScale+ VU19P FPGAs.

In April 2021, Cadence acquired Pointwise, which specializes in mesh generation for computational fluid dynamics (CFD). The company’s solutions are being leveraged by firms in the aerospace sector. Pointwise complements Cadence’s earlier buyout of NUMECA International.

Cadence also rolled out Sigrity-X solutions in the quarter under review. Sigrity-X is the company’s next-generation signal and power integrity solution that deploys simulation engines and an enormous parallel architecture. Consequently, these solutions offer up to 10 times improved performance for system level simulations for applications across hyperscale, 5G, automotive and aerospace domains.

Synergies from Integrand and AWR acquisition are boosting adoption of Cadence’s System Analysis portfolio offerings. In the first quarter conference call, the company added that Qualcomm expanded usage of Virtuoso and AWR products for advanced RFIC design as well as Clarity solutions for systems analysis in the quarter under review.

Meanwhile, total non-GAAP costs and expenses increased 8.8% year over year to $456 million.

Non-GAAP gross margin expanded 50 basis points (bps) to 90.4%, while non-GAAP operating margin was 38.1%, up 590 bps on a year-over-year basis.

Balance Sheet & Cash Flow

As of Apr 3, 2021, the company had cash and cash equivalents of approximately $743 million compared with $928 million as of Jan 2, 2021.

Moreover, the company’s long-term debt came in at $347 million as of Apr 3, 2021 compared with $346.8 million as of Jan 2, 2021.

The company generated operating cash flow of $208 million in the reported quarter compared with prior-quarter’s figure of $136 million. Free cash flow for the quarter under review was $191 million compared with $105 million reported in fourth-quarter 2020.

The company repurchased shares worth approximately $172 million in the first quarter. The company had $566 million worth of shares under its buyback authorization as of Apr 3, 2021.

Guidance

Driven by better-than-expected first-quarter results, management raised revenue outlook for 2021. However, it anticipates chip supply constraint along with alarming COVID-19 situation in India to negatively impact revenues in the IP segment in 2021. Also, Cadence projects increase in expenses in second half 2021 due to headcount additions. The guidance also includes impact of the Pointwise acquisition.

For 2021, revenues are now projected in the range of $2.88-$2.93 billion compared with the previous guidance of $2.86-$2.92 billion. The Zacks Consensus Estimate for 2021 revenues is currently pegged at $2.89 billion, which indicates year-over-year growth of 7.7%.

Non-GAAP earnings are now expected in the range of $2.99-$3.07 per share compared with $2.95-$3.05 per share guided previously. The Zacks Consensus Estimate for 2021 earnings is pegged at $3.02 per share, which suggests year-over-year growth of 7.9%.

For 2021, non-GAAP operating margin is now forecast in the range of 35-36% compared with 34.5-36% anticipated previously.

Operating cash flow is anticipated in the range of $900-$950 million for 2021. Management expects to utilize of 50% of free cash flow generated to buy back shares for the year.

For the second quarter of 2021, revenues are projected in the range of $705-$725 million. The Zacks Consensus Estimate for second-quarter revenues is currently pegged at $718.3 million, which suggests year-over-year growth of 12.5%.

Non-GAAP earnings are expected in the range of 74-78 cents per share. The Zacks Consensus Estimate for second-quarter earnings is pegged at 74 cents per share, which suggests year-over-year growth of 12.1%.

Further, non-GAAP operating margin is forecast to be around 36% for the second quarter.

Zacks Rank & Stocks to Consider

Cadence currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks worth considering in the broader technology sector are Avnet AVT, Sirius XM Holdings SIRI and Citrix Systems CTXS. All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 (Strong Buy) Rank stocks here.

Avnet and Sirius XM Holdings are scheduled to release earnings on Apr 28, while Citrix is slated to announce results on Apr 29.

Long-term earnings growth rate for Avnet, Sirius and Citrix are currently pegged at 19.9%, 13.3%, and 13.0%, respectively.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avnet, Inc. (AVT) : Free Stock Analysis Report

Citrix Systems, Inc. (CTXS) : Free Stock Analysis Report

Sirius XM Holdings Inc. (SIRI) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance