Cabot (CBT) to Unveil Battey Application Center in Europe

Cabot Corporation CBT intends to open a new state-of-the-art battery application technology center in Munster, Germany. This center will primarily focus on accelerating the application of Cabot’s battery materials product lines within Europe through technical collaboration with its customers. The new center will boost Cabot’s global presence in the battery materials market and play a key role in the company’s delivery of innovative materials to customers in the Europe, Middle East, and Africa (EMEA) region and globally. The EMEA technology center is expected to start its operations by April 2023.

The new technology center will allow the company to enhance its battery materials development capabilities by broadening partnerships and innovation with other participants in the battery industry, such as battery manufacturers, Electric Vehicle (EV) customers and partners across Europe. The technology center will also enable Cabot to provide superior technical application capabilities to its customers globally, as the center will also feature its advanced testing equipment. The EMEA center will provide strong support to the global transition toward EVs.

The company stated that through the establishment of its conductive carbon additive (CCA) manufacturing and commercial capabilities in Europe, its EMEA center will be able to work more closely with its customers and offer faster development times and extensive testing and trialing in Europe. The company also stated that this center will enable it to work closely with battery producers and automakers and expand its R&D capabilities, which will support the accelerating growth taking place in battery and EV production throughout Europe. This center will also enable Cabot to serve the significant growth in battery production, which is expected to rise by roughly 50% over the next four years annually.

Along with enhancing battery materials development capabilities, this center also supports the company’s full range of CCA products, such as conductive carbons, carbon nanotubes (CNTs), and carbon nanostructures (CNS), as well as blends and dispersions. The center will also aid other Cabot product lines that support the battery market, including fumed alumina for separator and cathode coatings, and aerogel for thermal management.

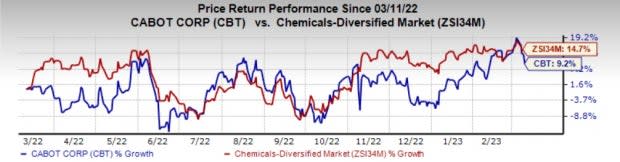

Shares of Cabot have gained 9.2% compared with a 14.7% rise recorded by its industry.

Image Source: Zacks Investment Research

Cabot expects its Reinforcement Materials segment to benefit from customer agreements that took effect in January 2023. The company’s Performance Chemicals segment is also projected to benefit from the increasing demand for battery materials and inkjet applications and rising volumes across major product lines. It sees adjusted earnings for fiscal 2023 in the range of $6.25-$6.75 per share.

Cabot Corporation Price and Consensus

Cabot Corporation price-consensus-chart | Cabot Corporation Quote

Zacks Rank & Key Picks

Cabot currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Olympic Steel, Inc. ZEUS, ATI Inc. ATI, and Cal-Maine Foods, Inc. CALM. ATI currently carries a Zacks Rank #2 (Buy), while ZEUS and CALM sport a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel’s shares have gained 83.9% in the past year. The Zacks Consensus Estimate for ZEUS’s current-year earnings has been revised 61% upward in the past 60 days. ZEUS topped Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 26.2% on average.

ATI’s shares have gained 52.5% in the past year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 1.9% upward in the past 60 days. The company has an earnings growth rate of 9% for the current year.

ATI topped Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 32.4% on average.

Cal-Maine’s shares have gained 28.6% in the past year. The company has an earnings growth rate of 515.8% for the current year. The Zacks Consensus Estimate for CALM’s current-year earnings has been revised 19% upward in the past 60 days.

CALM topped Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 15.3% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance