Cabot (CBT) Completes Acquisition of SUSN for $115 Million

Cabot Corporation CBT announced that it completed the buyout of Shenzhen Sanshun Nano New Materials (“SUSN”) for roughly $115 million. Notably, the business will be integrated into the Performance Chemicals Unit of Cabot.

The acquisition significantly bolsters the market position and formulation capabilities of Cabot in the high-growth batteries market, especially in China. Notably, with the acquisition, the company has become the only supplier of carbon additives, with commercially proven carbon black, carbon nanotube, carbon nanostructure and dispersion capabilities.

Per Cabot, the acquisition is expected to bolster its global leadership position in carbon additives. Notably, the buyout complements its already strong portfolio of conductive carbon products. Further, the acquisition creates a significant opportunity for the company to deliver innovative formulated solutions, which facilitate better battery performance for the fast-increasing energy-storage market.

The integration of Cabot’s portfolio of energy materials and SUSN is expected to create a business that generates sales of around $50 million. Revenues are projected to grow 20-25% over the next five years from sustained growth in electric vehicles and other lithium-ion battery storage applications, making this a significant part of Cabot’s specialty chemicals portfolio.

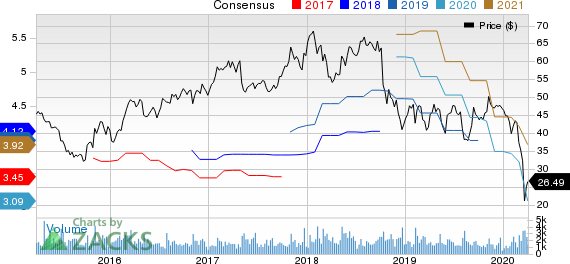

The company’s shares have dropped 39.3% in the past year compared with the industry’s decline of 43.1%.

Recently, Cabot issued an update on the impact of the coronavirus pandemic on its business.

The company stated that it will continue to serve customers globally and has contingency plans in place. It expects financial results for the fiscal second quarter to be solid. Additionally, the company expressed concerns regarding the future demand for its products and said that it is withdrawing the previous financial guidance for fiscal 2020.

Cabot continues to maintain a strong balance sheet. Regarding cash flows, the company stated that it is aggressively managing net working capital. It is also aligning capital allocation actions with the current environment. Further, the company is assessing opportunities to lower its capital spending planned earlier. Additionally, it has paused share repurchases in the near term but expects to maintain the dividend payout.

Cabot Corporation Price and Consensus

Cabot Corporation price-consensus-chart | Cabot Corporation Quote

Zacks Rank & Stocks to Consider

Cabot currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Newmont Goldcorp Corporation NEM, Franco-Nevada Corporation FNV and Barrick Gold Corporation GOLD.

Newmont has a projected earnings growth rate of 91.7% for 2020. The company’s shares have gained 29.2% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Franco-Nevada has a projected earnings growth rate of 22% for 2020. It presently carries a Zacks Rank #2 (Buy). The company’s shares have rallied 38.3% in a year.

Barrick Gold currently has a Zacks Rank #2 and a projected earnings growth rate of 43.1% for 2020. The company’s shares have gained 41.9% in a year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Goldcorp Corporation (NEM) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance