C-Com Satellite Systems Inc. (CVE:CMI) Not Flying Under The Radar

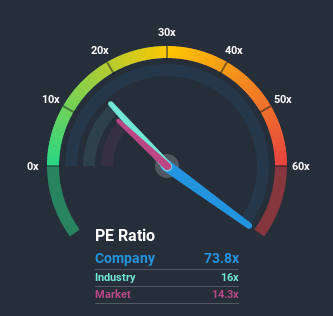

C-Com Satellite Systems Inc.'s (CVE:CMI) price-to-earnings (or "P/E") ratio of 73.8x might make it look like a strong sell right now compared to the market in Canada, where around half of the companies have P/E ratios below 14x and even P/E's below 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For example, consider that C-Com Satellite Systems' financial performance has been poor lately as it's earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for C-Com Satellite Systems

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on C-Com Satellite Systems' earnings, revenue and cash flow.

How Is C-Com Satellite Systems' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as C-Com Satellite Systems' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 45% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 71% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 6.8% shows it's a great look while it lasts.

With this information, we can see why C-Com Satellite Systems is trading at a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of C-Com Satellite Systems revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its earnings performance persists.

It is also worth noting that we have found 4 warning signs for C-Com Satellite Systems (1 is significant!) that you need to take into consideration.

Of course, you might also be able to find a better stock than C-Com Satellite Systems. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance