Buying Opportunities in the Auto Sector as Volatility Surges

Volatility has become the byword for the stock market this year. After enduring a tough first half, the U.S. markets breathed a sigh of relief from the big summer rally that started in mid-June and continued till mid-August. But the rally petered out in the second half of August. Fed Chairman Jerome Powell’s resolute stance at the Jackson Hole conference that he won’t back off in the fight against inflation even if it results in economic pain didn’t go down too well with investors.

The stock market slump accelerated last week when Powell raised interest rates by another 75 bps. This marked the third consecutive rate hike of 0.75% and pushed the benchmark interest rate to 3.0-3.25%, the highest level since 2008. The central bank also signaled that additional large rate hikes were likely at upcoming meetings as it combats inflation that remains near a 40-year high.

Fed officials now expect the federal funds rate at a range of 4.25% to 4.5%, a full percentage point above the 3.25% to 3.5% projected in June to end 2022. This means that the central bank could approve another 75-bps hike in November and then a 50-bps hike in December. Economists have warned that the rapid monetary tightening policy could push the economy into recession.

Not surprisingly, stocks continue to tumble as Wall Street ramps up selling in response to heightened fears about slowing economic growth. On Monday, S&P 500 carved out a new 2022 low as investors wrestle with aggressive rate hikes, stubborn inflation, the ongoing Russia-Ukraine war, exacerbated supply chains and a possibility of a recession. The index sank deeper into the bear market yesterday, touching a two-year low.

In such turbulent times, cyclical sectors suffer more. One such sector is the Auto-Tires-Trucks sector. The sector currently carries a Zacks Rank #13, which places it in the bottom 19% of the 16 Zacks sectors. Over the past month, the auto sector has declined around 8%. Amid economic uncertainty, the auto sector’s prospects look muted. So, should investors completely avoid auto stocks? No, instead they should take the opportunity of the current dip and start accumulating stocks that are trading at a discount. Rush Enterprises, Inc. RUSHA, BorgWarner, Inc. BWA and LKQ Corp LKQ are a few such beaten-down auto stocks.

Auto Market Stares at a Bumpy Road Ahead

The demand for vehicles has held strong so far but the auto market is highly sensitive to economic cycles. Consumers spend more on big-ticket items when they have higher disposable income. When income is tight, discretionary expenses are the first to be slashed. Considering the current economic slowdown, the demand for vehicles might just start cooling off.

We know that the auto industry is currently struggling with chip shortage, which has put a lid on supply. Amid the demand and supply mismatch, currently, the inventory is low and average prices of vehicles are on the rise. While consumers have been willing to pay a premium for their preferred vehicles till now, but for how long? The rising interest rates are increasing the financing costs of vehicles. With borrowing getting expensive and threats of a recession looming large, consumers might be unwilling to pay a heavy premium for cars and demand may gradually soften. As demand abates, auto retailers may choose to slash prices to compete for customers, which could dent their bottom line. As all the major U.S. indices are in a bear market, auto stocks are being severely hit.

Now is the Time to Buy for Long-Term Gains

Instead of mourning over the market’s bloodbath, savvy investors should see this as a buying opportunity. An extended downturn may unnerve some investors prompting them to stay away from the buy-the-dip strategy. Indeed, there’s no guarantee that you will get the stocks at rock-bottom prices, but you shouldn’t back off from this popular investing approach.

Just keep a long-term investment horizon. You will surely fetch profits when the cycle changes. Even if you think that it’s too early to resort to a buy-on-the-dip approach, don’t wait for a better entry point now. Don’t try to predict the bottom of the stock market. Even, the brightest minds on Wall Street couldn’t. Instead, take advantage of dollar-cost averaging. Just keep buying the dips amid the correction if you are ready to keep your money in the markets for at least three to five years.

3 Auto Bets

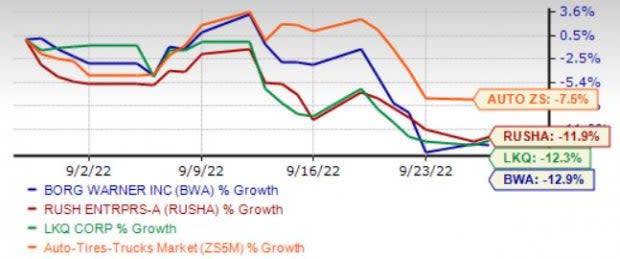

We have narrowed our search to three stocks currently trading at a deep discount to their 52-week highs. All three stocks are down around 12% over the past month. They also carry a favorable Zacks Rank and have a VGM Score of A or B.

One Month Performance

Image Source: Zacks Investment Research

Rush: Rush operates a regional network of commercial vehicle dealerships and sells new and used heavy-duty and medium-duty trucks and buses. The purchase of certain assets of Summit Truck Group in December 2021 has strengthened its dealership network. The acquisition of an additional 30% interest in Rush Truck Centers of Canada Limited in May 2022 also expanded business. RUSHA’s current dividend yield is 1.93%, with a five-year dividend growth rate of 35.6%.

Rush carries a Zacks Rank #2 (Buy) and has a VGM Score of A. The expected long-term earnings growth rate for the stock is 15%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BorgWarner: Michigan-based BorgWarner is a global leader in clean and efficient technology solutions required for combustion, hybrid and electric vehicles. Strategic buyouts like Delphi Technologies, AKASOL, Santroll's light vehicle eMotor business have bolstered BWA’s portfolio. BorgWarner’s Charging Forward project to accelerate its electrification strategy bodes well. The company’s current dividend yield is 2.04%.

BorgWarner carries a Zacks Rank #2 and has a VGM Score of A. The expected long-term earnings growth rate for the stock is 26.8%. Over the trailing four quarters, BWA has surpassed earnings estimates on all occasions, the average being 29.5%.

LKQ: LKQ is one of the leading providers of replacement parts, components, and systems that are required to repair and maintain vehicles.The buyouts of Bumblebee Batteries, Elite Electronics, Green Bean Battery, Greenlight, SeaWide Marine Distribution and others have enhanced LKQ’s portfolio. The company’s current dividend yield is 2.12%.

LKQ carries a Zacks Rank #2 and has a VGM Score of B. Estimates for LKQ’s for 2022 and 2023 earnings per share have moved north by 2 cents and 3 cents, respectively, over the past 30 days. Over the trailing four quarters, LKQ surpassed earnings estimates on all occasions, the average being 12.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Rush Enterprises, Inc. (RUSHA) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance