Buy These 4 Hot Tech Stocks as Market Recovery Gains Pace

The stock market is in recovery mode for the last two months after bottoming out in late-March due to the pessimism surrounding the coronavirus crisis. Since April, the Dow Jones, the Nasdaq, and the S&P 500 indices have appreciated 18.7%, 30.6%, and 20.6%, respectively.

Year-to-date losses of Dow Jones and S&P 500 have contracted to 8.8% and 3.5%, respectively, from 23.2% and 20% as of Mar 31. The Nasdaq Composite index’s YTD return has even turned to 12.1% as of Jun 22 from -14.2% as of Mar 31.

Optimism over a potential vaccine for COVID-19 and an uptick in economic activities, with lockdown measures starting to ease, are mainly driving the U.S. stock market. Notably, economic activities were stalled from March due to the lockdown.

Earlier this month, the stock market got a further boost from an unexpected drop in U.S. unemployment rate. According to the latest data released by the U.S. Bureau of Labor Statistics, the unemployment rate fell to 13.3% in May from April’s 14.7%.

Moreover, strong retail sales data for May released last week further boosted investors’ confidence about the economic recovery. Per Census Bureau’s Jun 16 report, U.S. retail spending rose 17.7% in May, following record collapse in March and April of 16.4% and 14.7%, respectively.

Tech Sector Plays Crucial Role in Market Rebound

The technology sector has played a crucial role in the quicker-than-expected recovery of the stock market. Since April to date, the Technology Select Sector SPDR XLK, which tracks an index of the S&P 500 technology stocks, has rallied 29.3%. Moreover, the ETF has a positive year-to-date return of 13.3%, outperforming the gains of all three major U.S. indices.

While the coronavirus outbreak has had a sector-wide impact economically, the U.S. tech sector has been more resilient compared with others. The pandemic has, surprisingly, opened up newer avenues of growth for tech companies. The coronavirus-led global lockdown is fueling demand for PCs, notebooks and peripheral accessories, as more and more workers and students are now working and learning from home.

The work-and-learn-from-home necessity is also stoking demand for cloud storage. Furthermore, the lockdown has bolstered the usage of online and e-commerce services globally. Therefore, data-center operators are enhancing their capacities to accommodate the demand spike for cloud services. (Read more: 6 Remote-Working Software Stocks to Ride on Virus-Led Lockdowns)

In addition, the long-term growth prospects of tech companies look promising owing to the continuous digital transformations. The rapid adoption of cloud computing, along with the ongoing integration of AI and machine learning, has been a major growth driver.

The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to spur further growth. Moreover, blockchain, IoT, autonomous vehicles, AR/VR and wearables offer significant growth opportunities.

Considering the healthy growth prospects of tech companies, it makes sense to invest in this space for long-term gains.

Choosing the Stocks

It is difficult to pick the right stocks from a wide range of available investment opportunities.

This is where the Zacks Stock Screener comes in handy. With the help of this screener, we have filtered four tech stocks that are incredible for investment right now. These stocks carry a Zacks Rank #1 (Strong Buy) or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Also, the stocks have a VGM Score of A or B. Per Zacks’ proprietary methodology, stocks with such favorable combinations offer solid investment opportunities.

Bet on These 4 Tech Stocks

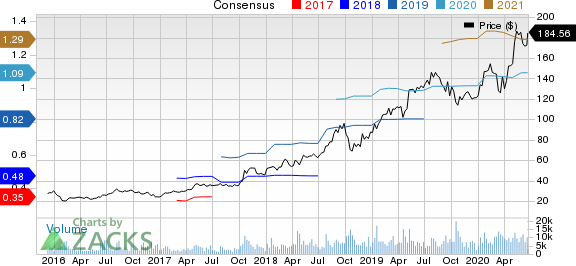

Atlassian Corporation Plc TEAM, which carries a Zacks Rank #2 at present, is poised to grow on the massive digitalization of work in organizations, big or small. Apart from this, integration with leading applications like Slack, Dropbox, and Adobe, along with partnerships with the likes of Amazon’s AWS and Microsoft, will likely expand the Atlassian paying user base.

The stock has a VGM Score of B and its earnings are likely to grow 21.8% in fiscal 2021.

Atlassian Corporation PLC Price and Consensus

Atlassian Corporation PLC price-consensus-chart | Atlassian Corporation PLC Quote

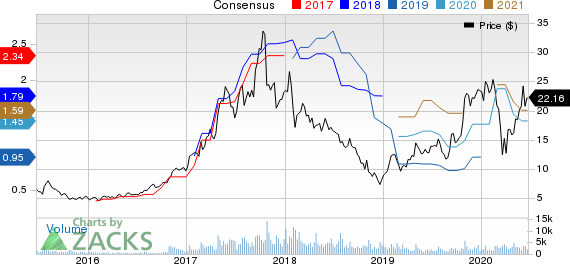

Ultra Clean Holdings, Inc. UCTT is riding on improvement in fab utilization, which is expected to bolster growth in services division. Moreover, the company is well poised to deal with the COVID-19-led supply bottlenecks on uptick in memory segment.

This Zacks Rank #2 stock has a VGM Score of A. The company’s full-year 2020 earnings are anticipated to jump nearly 59.3% year over year.

Ultra Clean Holdings, Inc. Price and Consensus

Ultra Clean Holdings, Inc. price-consensus-chart | Ultra Clean Holdings, Inc. Quote

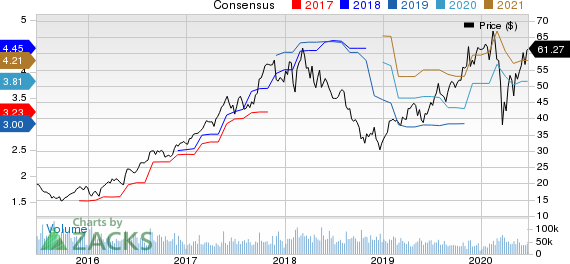

GoDaddy GDDY thrives on the growing adoption of its domain products. Higher subscriptions to Websites and Marketing, and managed WordPress offerings, international expansion, robust feature engagements and strength in GoCentral are tailwinds for this currently #2 Ranked stock’s Hosting and Presence business.

Notably, post the recently-announced acquisition of Neustar’s Registry business, which is expected to close in second-quarter 2020, GoDaddy will emerge as one of the largest players in the Internet infrastructure industry.

The company has a VGM Score of B and its earnings are likely to grow 28.1% in 2020.

GoDaddy Inc. Price and Consensus

GoDaddy Inc. price-consensus-chart | GoDaddy Inc. Quote

Applied Materials AMAT is well poised to gain from the integration of advanced machine learning capabilities across its semiconductor fabs to enhance automated defect analysis.

This Zacks Rank #2 stock has developed an automated defect-classification technology that utilizes different imaging techniques to identify and eliminate defects in chip manufacturing. Also, the company's commitment toward the development of new AI and machine learning-powered computing materials and designs holds promise.

The stock has a VGM Score of B. The company’s fiscal 2020 earnings are anticipated to soar nearly 25.3% year over year.

Applied Materials, Inc. Price and Consensus

Applied Materials, Inc. price-consensus-chart | Applied Materials, Inc. Quote

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ultra Clean Holdings, Inc. (UCTT) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

GoDaddy Inc. (GDDY) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance