Would You Buy a 10%-Off Cruise Right Now?

(Bloomberg Opinion) -- In the wake of the coronavirus, enticing people to set a course for adventure on a floating mega-palace will be a difficult proposition.

The public image of cruises, which for many older people are still associated with the 1970s American TV series “The Love Boat,” has been tarnished by the pandemic. On Thursday, Carnival Corp. said it would suspend all voyages by its Princess Cruises division, which suffered the only known outbreaks of coronavirus at sea, for 60 days.

Cruising divides opinion at the best of times. Fans see it as a fun, hassle-free and cost-effective way to explore several often sun-drenched destinations in one go, particularly when food, drinks and entertainment are thrown in. For others, it conjures up a horror of claustrophobia, seasickness and way too much proximity to other holiday makers. Headlines about passengers stuck on ships turned away from ports for fear there may be a deadly virus on board will only serve to reinforce their aversion.

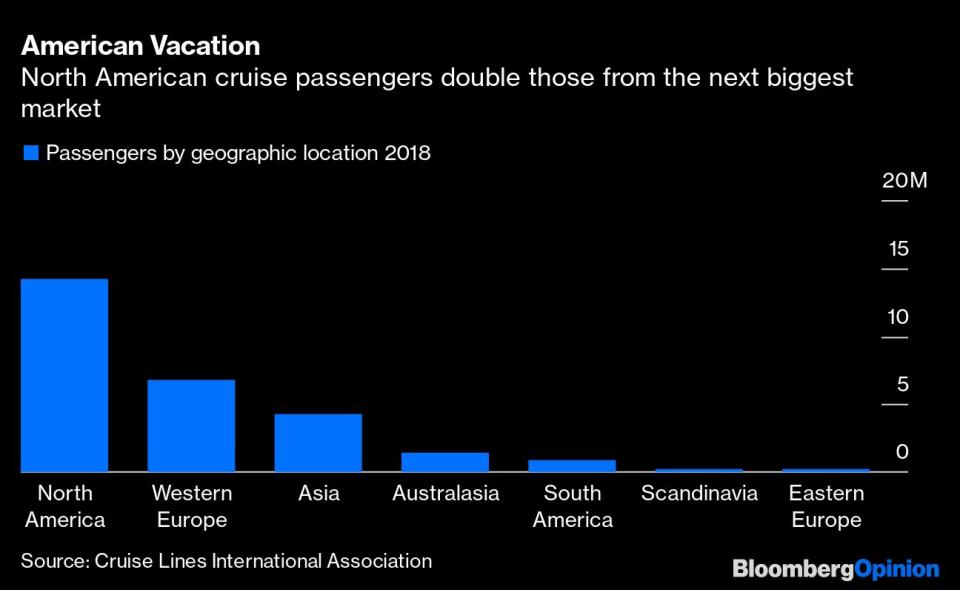

The images of Carnival’s majestic Grand Princess, a behemoth that spent days circling the waters around San Francisco because 21 passengers tested positive for the virus, will be particularly damaging. As will an unprecedented warning from the U.S. State Department not to take cruises because they hold an elevated risk of Covid-19 infection and potentially landing in quarantine on a foreign shore. After all, North America is the world’s biggest cruise market by some distance.

It’s hard to see how a $60 billion industry that’s already made such an effort to remake its image as more than a retirement pastime can easily overcome this hit. It still depends in large part on passengers over 50 who may be more likely to think twice getting on board. And before embarking, those over 70 may even be required to present a doctor’s note that they have a clean bill of health, not exactly reassuring for a carefree getaway.

But first for the immediate pain. The global pandemic could hurt the cruise industry worse than both the 9/11 terrorist attacks in 2001 and the financial crisis of 2008-2009, according to Brian Egger, an analyst at Bloomberg Intelligence. Even before Carnival’s decision to suspend its 18 Princess vessels, he was estimating that revenue yields, a measure that reflects both pricing and occupancy leverls, could fall by as much as 20% this year.

Richard Clarke, an analyst at Bernstein, estimates that most bookings for travel packages are down around 40% across the market. The drop off in cruise demand may be even worse.

That’s a worry for the big U.S. operators — Carnival, Royal Caribbean Cruises Ltd. and Norwegian Cruise Line Holdings Ltd. — as well as TUI AG, the German tour operator that’s been developing its ocean-vacation arm to give it an edge against rivals. Carnival’s response is a dramatic one. But more lines could take this option, both to stem losses from operating half-empty vessels and to give them a very deep clean as a way to reassure holidaymakers that they are safe once the pandemic has subsided. On Friday, travel-to-insurance group Saga Plc said it was spending its cruise operations, cutting profit by up to 15 million pounds ($18.9 million).

Alternatively, cruise operators could look to continue filling vessels with deep discounts. Analysts at Nomura have estimated that pricing could drop by at least 10% this year. That may encourage enthusiasts to take to the high seas, but at a lower profit. Yet as the pandemic spreads, and people around the world question how far from home they’re willing to travel, it’s unclear just how many takers there will be. And that’s before any official travel restrictions, such as President Donald Trump’s decision to temporarily curtail European travel to the U.S. It’s understandable that shares have tumbled since the coronavirus took hold.

To weather the shock, Royal Caribbean and Norwegian have boosted liquidity in recent days. Even so, Royal Caribbean looks to face the most difficult challenges ahead, with net debt reaching 3.7 times Ebitda at the end of this year, according to the Bloomberg consensus of analysts’ estimates. That’s compared to Norwegian at 3.3 times and Carnival at 2.5 times.

The industry may recover from the latest shock. After all, demand returned after the Costa Concordia disaster in 2012, when 32 people died after the cruise ship ran aground off the Italian coast. But it may never be the same again.

Previous contagious outbreaks had prompted the industry to tighten hygiene standards. It will have to elevate them further given the spotlight on the dangers of thousands of people living in close quarters. Additional steps, such as more stringent screening of guests and staff, could raise expenses. Cruise lines will likely look methodically to ensure they have agreements with all ports on every itinerary so ships with sick passengers can dock. Putting such arrangements in place would take time and involve more cost.

With the focus on the heightened risks faced by older travelers, especially those with underlying health conditions, cruise operators will need to intensify efforts to capture younger consumers, with all the associated marketing expense and investment in amenities to attract them. TUI Cruises is already focused on family vacations, while Walt Disney Co. has plans to almost double its fleet to seven ships by 2023. Virgin Voyages, Richard Branson’s over-18s luxury cruise offering, recently took delivery of its first liner, boasting Instagrammable spots, yoga classes and a festival-like lineup of shows, although it has postponed the Scarlet Lady’s maiden voyage.

Winning over young adults won’t necessarily be easy. Cruise liners are associated with a list of environmental problems. So while “cruise shaming” hasn’t yet caught on, expect more focus on the industry’s impact on the planet, as well as its role in over-tourism in cities from Barcelona to Venice and Copenhagen.

For the time being though, cruise operators’ main focus will be keeping passengers healthy and making sure that any ships that do sail are as full as possible. With ever more alarming headlines, that means more struggles for the Love Boat.

To contact the author of this story: Andrea Felsted at afelsted@bloomberg.net

To contact the editor responsible for this story: Melissa Pozsgay at mpozsgay@bloomberg.net

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Andrea Felsted is a Bloomberg Opinion columnist covering the consumer and retail industries. She previously worked at the Financial Times.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Yahoo Finance

Yahoo Finance