Business Services Q3 Earnings on Nov 7: NLSN, ENV & More

This earnings season, the picture has been encouraging for the Business Services space with key players like Equifax EFX, Xerox XRX, Omnicom, Waste Management and IHS Markit delivering an earnings beat.

The business services sector was on a strong footing driven by economic strength and stability that kept service activities in good shape in the third quarter. The sector was buoyed by a strong labor market, low unemployment and inflation.

Notably, U.S. GDP grew at an annualized rate of 1.9% in third-quarter 2019 per the “advance” estimate released by the Bureau of Economic Analysis. This is above the consensus estimate of 1.6%. GDP increased 2% in the second quarter of 2019. October was the 117th month of consecutive growth in non-manufacturing activities with ISM-measured Non-Manufacturing Index touching 54.7%.

Since business services firms have lower foreign exposure compared with goods companies and incur lower foreign input costs, the industry was less affected by trade war in the third quarter.

The Zacks Business Services sector currently carries a Zacks Sector Rank in the top 32% (5 out of 16 sectors). It has gained 26.2% year to date, outperforming 23.9% rally of the Zacks S&P 500 composite.

Key Releases on Nov 7

Here we are presenting five business services companies that are scheduled to report third-quarter 2019 results on Nov 7.

According to the Zacks model, the combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — increases the odds of an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Measurement giant Nielsen Holdings plc NLSN will release its financial numbers before the bell.

The company has been strengthening its presence in advertising and diary measurement markets through strategic partnerships. During the quarter under review, its other innovative services continued to gain traction among TV and media companies. This is likely to have accelerated adoption rate and increased Global Media revenues in the quarter to be reported.

However, sluggish growth in emerging markets served might have hurt top-line growth in the to-be-reported quarter. Further, the company has been making investments in technology and infrastructure, which might hamper margin expansion and profitability. In addition, higher expenses are expected to get reflected in the bottom-line number.

The Zacks Consensus Estimate for revenues in the to-be-reported quarter is pegged at $1.6 billion, indicating growth of 0.3% from the year-ago quarter reported figure. The consensus mark for earnings stands at 42 cents, indicating 14.3% year-over-year decline.

The company has an impressive earnings surprise history, having surpassed estimates in two of the trailing four quarters, with the average beat being 7.3%.

The company has an Earnings ESP of 0.00% and a Zacks Rank #3, which makes surprise prediction difficult.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

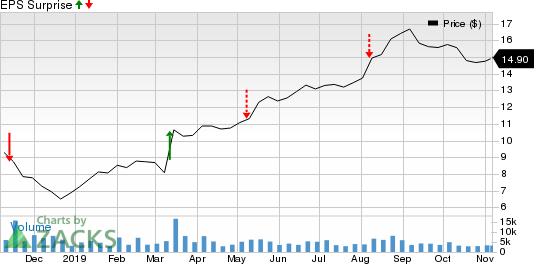

Nielsen Holdings Plc Price and EPS Surprise

Nielsen Holdings Plc price-eps-surprise | Nielsen Holdings Plc Quote

Provider of intelligent systems for wealth management and financial systems Envestnet, Inc. ENV will release its financial numbers after the bell.

Organic growth, reclassification of revenues from customers moving from an asset-based recurring revenue model to a subscription-based recurring revenue model, and contributions from PIEtech and PortfolioCenter, are likely to have benefited the top line. The consensus mark for revenues is pegged at $233.5 million, indicating year-over-year growth of 14.9%.

For earnings, the consensus mark is pegged at 58 cents, suggesting growth of 9.4% from the year-ago quarter reported figure.

Envestnet delivered average four-quarter positive earnings surprise of 4.1%. It has an Earnings ESP of 0.00% and a Zacks Rank #3.

Envestnet, Inc Price and EPS Surprise

Envestnet, Inc price-eps-surprise | Envestnet, Inc Quote

Business process outsourcing and IT services provider Genpact Limited G will release its quarterly numbers after the bell.

Large deal ramps and transformation services wins are expected to have driven the company’s revenues, the consensus estimate for which is pegged at $879.3 million, indicating year-over-year growth of 17.6%.

The consensus estimate for earnings stands at 52 cents per share, indicating growth of 8.3% from the year-ago quarter reported figure.

Genpact delivered average four-quarter positive earnings surprise of 5.5%. It has an Earnings ESP of 0.00% and a Zacks Rank #3.

Genpact Limited Price and EPS Surprise

Genpact Limited price-eps-surprise | Genpact Limited Quote

Asset management and disposition company Ritchie Bros. Auctioneers Incorporated RBA will release its quarterly numbers after the bell.

The consensus estimate for revenues is pegged at $280.1 million, indicating year-over-year growth of 14.1%. The top line is likely to have benefited from increase in inventory sales and total services revenues.

Disciplined cost management efforts are expected to have driven earnings, the consensus estimate for which stands at 22 cents per share, indicating growth of 22.2% from the year-ago quarter reported figure.

Ritchie Bros. delivered average four-quarter negative earnings surprise of 0.93%. It has an Earnings ESP of 0.00% and a Zacks Rank #3.

Ritchie Bros. Auctioneers Incorporated Price and EPS Surprise

Ritchie Bros. Auctioneers Incorporated price-eps-surprise | Ritchie Bros. Auctioneers Incorporated Quote

Provider of colocation space and related services Switch, Inc. SWCH will release its financial numbers after the bell.

The company has been strengthening its strategic relationships with hyperscale cloud vendors with a view to build highly connected multi-cloud availability zones. Sales activity across the company’s Prime Campus locations is likely to have remained strong in the quarter.

The Zacks Consensus Estimate for revenues is pegged at $113.3 million, indicating growth of 10.2% from the year-ago quarter reported figure.

The consensus mark for earnings stands at 5 cents. The company reported break-even earnings in the year-ago quarter.

Switch delivered average four-quarter negative earnings surprise of 29.2%. It has an Earnings ESP of 0.00% and a Zacks Rank #3.

Switch, Inc. Price and EPS Surprise

Switch, Inc. price-eps-surprise | Switch, Inc. Quote

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nielsen Holdings Plc (NLSN) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Xerox Corporation (XRX) : Free Stock Analysis Report

Ritchie Bros. Auctioneers Incorporated (RBA) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

Envestnet, Inc (ENV) : Free Stock Analysis Report

Switch, Inc. (SWCH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance