Bull of the Day: C.H. Robinson Worldwide (CHRW)

C.H. Robinson Worldwide CHRW is one of the largest logistics platforms on the planet. CHRW stock is bucking the downward trend of 2022 and its recent surge sent C.H. Robinson to new all-time highs.

With C.H. Robinson, investors would add solid long-term growth potential inside an integral industry, alongside dividends, solid value, and much more.

The Logistics Giant’s Growth Pitch

C.H. Robinson is one of the world's largest logistics platforms, with nearly $30 billion in freight under management. The company provides freight transportation and logistics, as well as outsource solutions, information services, and beyond to roughly 100,000 global customers.

C.H. Robinson provides access to 85,000 transportation providers worldwide, including contract motor carriers, railroads, air freight carriers, and ocean carriers. The company is also bullish that its low single-digit market share provides it a “great opportunity” to continue to grow across all services. C.H. Robinson’s expansion efforts include a big push to boost its office network outside of North America.

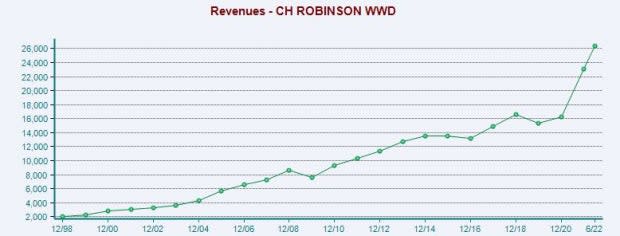

In general, the third-party logistics industry presents room for continued expansion in a globally-interconnected world, where streamlined shipping and transportation services are paramount. C.H. Robinson’s revenue climbed 6% in 2020 and a whopping 43% in 2021 to surge from $16 billion in total fiscal 2020 sales to $23 billion last year.

Image Source: Zacks Investment Research

C.H. Robinson topped our Q2 earnings and revenue estimates on July 27 and it provided upbeat guidance in the face of economic slowdown fears. Higher pricing across most of its services and higher truckload and ocean volume helped drive its strong top and bottom line showing in Q2 and across the entire first half.

C.H. Robinson’s consensus Zacks EPS estimates for Q3 is now up over 20% since its second quarter release, with its fiscal 2022 earnings estimate around 14% higher and FY23 up 5%. CHRW’s bottom-line positivity helps it land a Zacks Rank #1 (Strong Buy) at the moment.

Zacks estimates call for C.H. Robinson’s revenue to climb another 15% in 2022 to hit $26.5 billion to help lift its adjusted earnings by 35%. The company is expected to see its earnings and revenue fall in 2023 as it faces a string of very difficult to compete against years of growth.

That said, C.H. Robison could easily post far-stronger-than-projected earnings results going forward, having topped our quarterly EPS estimates by over 31% in three out of the last four quarters—including a 38% Q2 beat.

Image Source: Zacks Investment Research

Other Fundamentals

C.H. Robison’s executive team acknowledged the lingering questions regarding global economic growth, inflation, and consumer discretionary spending when it reported its financial results on July 27. The company noted that its “flexible non-asset-based business model” helps it deal with some of the inflationary pressures. CHRW remains focused heavily on finding ways to thrive at all times and “maximize long-term shareholder returns through all phases of the business cycle and various economic scenarios.”

For instance, C.H. Robison’s been returning tons of value to shareholders, including nearly $340 million worth of share repurchases last quarter. When factoring in its quarterly dividend payment, the company returned 100% more cash to shareholders YoY in Q2. And despite economic headwinds, the firm upped its capital expenditures outlook for 2022, as it invests in a “higher level of internally developed software.”

C.H. Robison’s 2% dividend yield tops the S&P 500’s 1.5% and many other firms in its highly-ranked Transportation – Services industry. The space currently sits in the top 17% of over 250 Zacks industries right now. CHRW’s dividend yield looks even stronger considering the stock is up nearly 5% in 2022 vs. its industry’s 9% drop and the market’s 14% fall.

Image Source: Zacks Investment Research

Long-Term Outperformance & Valuation

Investors should know that the stock has ripped above both its 200-day and 50-day moving averages recently. C.H. Robinson shares are up 25% in the last year, and they closed regular trading Tuesday near fresh records at $111.96 per share.

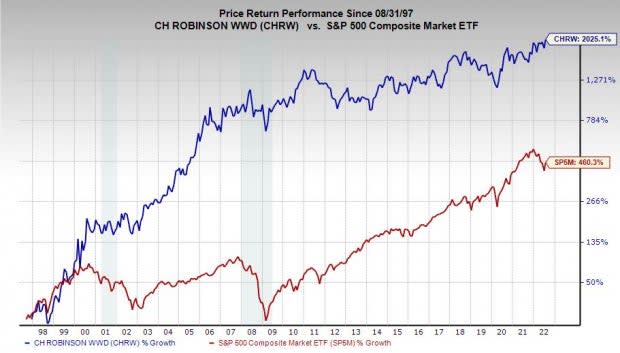

Stretching our view back, C.H. Robinson stock is up 110% in the last 10 years and 72% in the past five to nearly match the benchmark—with it up over 2,000% in the last 25 vs. the S&P 500’s 460%.

Even with the impressive run and the outperformance, C.H. Robinson is trading at close to a 50% discount to its own 5-year highs in terms of forward earnings at 15.2X. Better still, CHRW stock is trading right near its lowest levels in the last 15 years. This also represents a discount to the S&P 500 and comes not too far above its Zacks Econ sector, even though it has crushed the space when it comes to price performance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance