Bull of the Day: AeroVironment (AVAV)

Headquartered in Monrovia, CA, AeroVironment Inc. (AVAV) is a company known for its Unmanned Aircraft Systems (better known as drones). It focuses primarily on the design and development of these systems, as well as tactical missile systems that provide situational awareness, multi-band communications, force protection and other mission effects. AeroVironment supplies its drones to the U.S. Department of Defense, including the U.S. Army, Marine Corps, Special Operations Command, Air Force, and Navy.

The company recently sold off its electric charger division for $32 billion to Webasto Group, a move that allows it to focus completely on its various drone applications.

AeroVironment’s recent first quarter was a strong one, with results blowing straight past estimates. Sales surged 127% year-over-year to $78 million, and gross profit margins on those sales nearly doubled, hitting 42% and up from 25% in the year-ago period.

Earnings of 85 cents per diluted share easily beat the Zacks Consensus thanks to a beneficial litigation settlement that added 26 cents to the company’s bottom line.

Additionally, AeroVironment noted that backlog, which will eventually turn into revenues as the year goes on, more than doubled by the end of Q1 to $157 million; backlog was only around $70 million a year ago.

In the earnings release, president and chief executive officer Wahid Nawabi said “With the divestiture of our Efficient Energy Systems business, we have transformed AeroVironment into a future-defining technologies solution provider serving large and growing global defense, telecommunications and commercial markets. Strength in the end markets for our small UAS and Tactical Missile Systems, combined with continued progress in our HAPSMobile, Inc. joint venture, position us well to achieve our fiscal year 2019 objectives and our long-term value creation goals.”

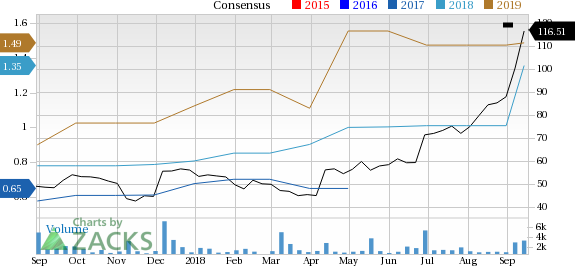

AeroVironment, Inc. Price and Consensus

AeroVironment, Inc. Price and Consensus | AeroVironment, Inc. Quote

Recently, analysts have turned optimistic on AeroVironment, and the company has seen four upwards revisions in the last 60 days, driving the stock towards a Zacks Rank #1 (Strong Buy).

Additionally, the Zacks Consensus Estimate for 2019 has increased 25 cents over the last two months, now sitting at $1.36 per share. 2020 looks pretty strong too, and earnings are expected to grow 9.5%; next year’s consensus estimate has increased from $1.47 to $1.49 in the same time period.

Despite a rough go of it last year—the stock was hit hard by short reports that mainly questioned its ability to grow its businesses—shares of AVAV have been on a great run so far in 2018, and are up about 140%. And, the stock has gained more than 100% year-to-date. In comparison, the S&P 500 is up around 15% and 7%, respectively. Its industry, Aerospace-Defense Equipment, has been a solid performer as well, sitting in the top 34% out of all industries ranked by Zacks.

With a newly refocused business, AeroVironment has the potential to become a drone industry leader. Right now, growing military use of drones is surely helping AVAV, as will any potential in commercial drones. From agriculture, oil and gas exploration, and security, commercial drones could become a huge part of AeroVironment’s future sales.

So, if you’re an investor looking for an aerospace and defense stock to add to your portfolio, make sure to keep AVAV on your shortlist.

Best Electric Car Stock? You'll Never Guess It.

Zacks Research has released a report that may shock many investors. One stock stands out as the best way to invest in the surge to electric cars. And it's not the one you may think!

Much like petroleum 150 years ago, lithium battery power is set to shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge. With battery prices plummeting and charging stations set to multiply, revenues that were already at $31 billion in 2016 are expected to blast to over $67 billion by the end of 2022.

See Zacks Best EV Stock Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AeroVironment, Inc. (AVAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance