I Built A List Of Growing Companies And United Security Bancshares (NASDAQ:UBFO) Made The Cut

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in United Security Bancshares (NASDAQ:UBFO). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for United Security Bancshares

United Security Bancshares's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Impressively, United Security Bancshares has grown EPS by 27% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

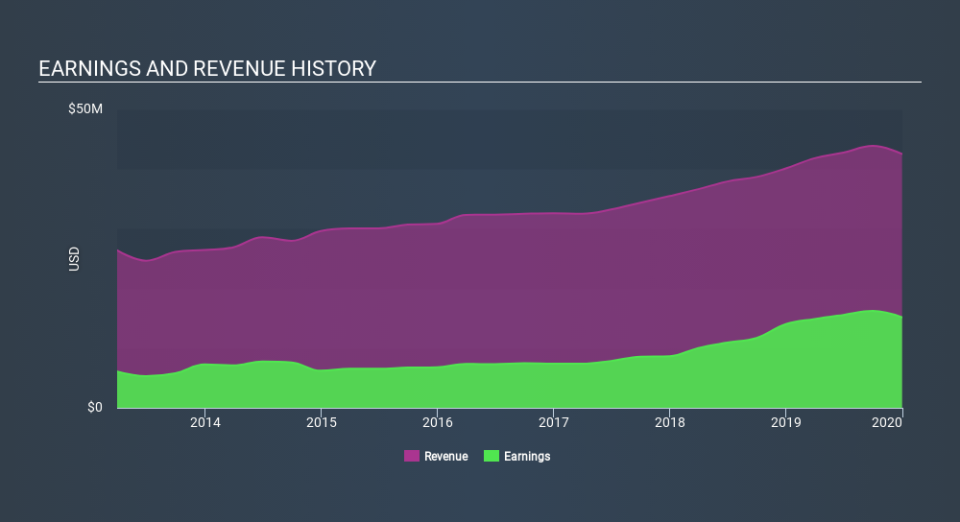

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of United Security Bancshares's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. United Security Bancshares maintained stable EBIT margins over the last year, all while growing revenue 6.1% to US$43m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since United Security Bancshares is no giant, with a market capitalization of US$171m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are United Security Bancshares Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx United Security Bancshares insiders have stood united by refusing to sell shares over the last year. But my excitement comes from the US$56k that Senior VP & COO David Eytcheson spent buying shares (at an average price of about US$10.16).

Along with the insider buying, another encouraging sign for United Security Bancshares is that insiders, as a group, have a considerable shareholding. To be specific, they have US$27m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 16% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Dennis Woods, is paid less than the median for similar sized companies. For companies with market capitalizations between US$100m and US$400m, like United Security Bancshares, the median CEO pay is around US$1.1m.

The United Security Bancshares CEO received US$767k in compensation for the year ending December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does United Security Bancshares Deserve A Spot On Your Watchlist?

For growth investors like me, United Security Bancshares's raw rate of earnings growth is a beacon in the night. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. If you think United Security Bancshares might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

As a growth investor I do like to see insider buying. But United Security Bancshares isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance