Buffett: FDIC would have made Great Depression a 'much different experience'

Warren Buffett said on Saturday the Federal Deposit Insurance Corporation is an under-appreciated part of the U.S. economy, arguing that the Great Depression would have been a “much different experience” if the FDIC had been created 10 years earlier.

“One very, very, very good thing that came out of the Depression, in my view, is the FDIC,” Buffett said in his Berkshire Hathaway annual shareholder meeting, exclusively hosted online at Yahoo Finance. “It would have been a somewhat different world, I’m sure, if the bank failures hadn’t just rolled across this country.”

During the Great Depression, fear over losing deposits spurred runs on thousands of banks across the country, draining them of cash and putting thousands of depository institutions out of business.

Buffett said the FDIC, which was created in 1933 as a response to the crisis, could have prevented the bank runs.

The FDIC continues to insure U.S. bank deposits, promising to cover up to $250,000 per depositor in the event of a bank failure. To date, no depositor has ever lost money from FDIC-insured funds. The FDIC’s deposit insurance fund is supported by payments from the banks themselves, therefore relying on no taxpayer money.

Buffett said after the 2008 and 2009 global financial crisis, he hopes banks have learned to act responsibly with depositor funds.

“Banks need regulation,” Buffett said. “They benefit from the FDIC, but part of having the government standing behind your deposits is to behave well.”

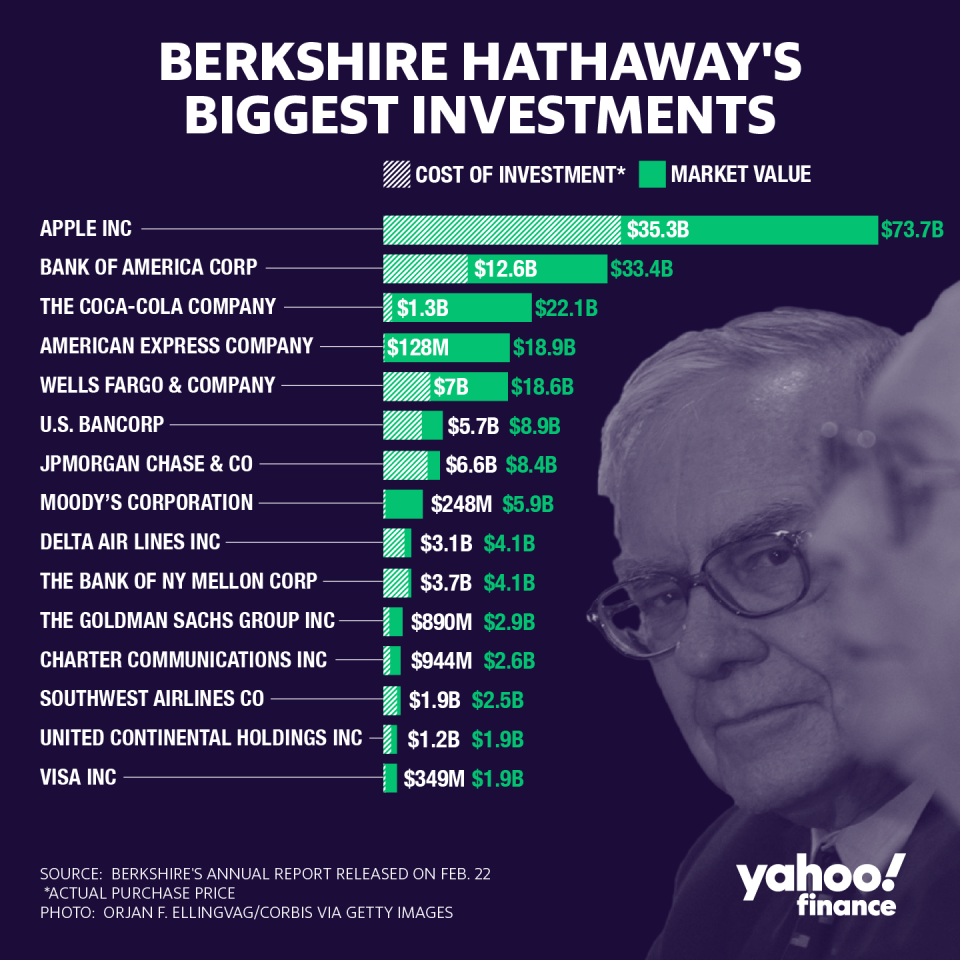

Buffett’s company Berkshire Hathaway (BRK-A, BRK-B) holds substantial stakes in major U.S. banks like Wells Fargo (WFC), JPMorgan Chase (JPM), Bank of America (BAC), and U.S. Bancorp (USB).

Broadly, Buffett said he sees no “special problems” in the banking system as a result of the COVID-19 crisis. But Buffett said energy loans and consumer credit could pose issues for banks, which reported higher loan loss provisions in anticipation of credit concerns in the near-term.

“I think overall the banking system is not going to be the problem,” Buffett said. “I wouldn’t say that with a 100% certainty because there are certain possibilities that exist in this world where banks could have problems.”

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

Buffett: Fed 'did the right thing' by unfreezing corporate debt markets

El-Erian: Fed is tangled in a 'spaghetti bowl' of credit risk

Fed commits to near-zero rates as US economy sees 'sharp declines'

A glossary of the Federal Reserve's full arsenal of 'bazookas'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance