Broadcom (AVGO) Q4 Earnings & Revenues Surpass Estimates

Broadcom AVGO reported fourth-quarter fiscal 2019 non-GAAP earnings of $5.39 per share outpacing the Zacks Consensus Estimate by 0.56%. However, the figure declined 7.9% from the year-ago reported quarter.

Non-GAAP revenues from continuing operations were $5.776 billion, up 6.1% from the year-ago quarter. The figure surpassed the Zacks Consensus Estimate of $5.755 billion.

On Nov 4, 2019, Broadcom concluded the acquisition of Symantec’s enterprise security business. The buyout is expected to aid the company in expanding presence in infrastructure software space.

Management notes that there has been no contribution from Symantec’s enterprise security business in the fiscal fourth quarter, which ended on Nov 3, 2019.

Segmental Revenues

Semiconductor solutions’ revenues (79% of total net revenues) totaled $4.553 billion, down 7% from the year-ago quarter owing to soft demand in broadband vertical on shift to Wi-Fi 6 platforms. Nonetheless, robust demand for high capacity drives, and seasonal uptick in wireless vertical, limited the decline.

Infrastructure software revenues (21%) soared 134% year over year to $1.20 billion. The company is benefiting from synergies from CA acquisition. However, the company noted soft demand in SAN switching vertical.

Revenues for Intellectual property licensing were $23 million during the reported quarter, down 60% from the year-ago period.

Operating Details

Non-GAAP gross margin expanded 150 bps on a year-over-year basis to 69.9%. The increase can be attributed to improving mix of semiconductor sales and synergies from CA acquisition in infrastructure software vertical.

Non-GAAP operating expenses increased 17.8% year over year to $1.017 billion. As a percentage of net revenues on a non-GAAP basis, the figure expanded 180 bps to 17.6%.

Consequently, non-GAAP operating margin contracted 20 bps from the year-ago quarter to 52.3%.

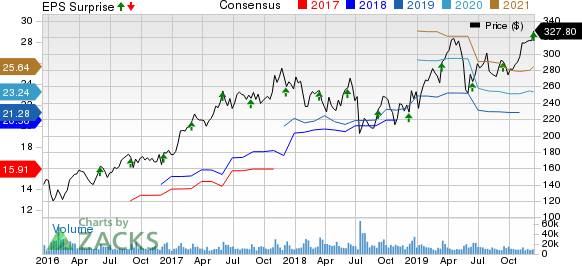

Broadcom Inc. Price, Consensus and EPS Surprise

Broadcom Inc. price-consensus-eps-surprise-chart | Broadcom Inc. Quote

Balance Sheet & Cash Flow

As of Nov 3, 2019, cash & cash equivalents were $5.055 billion, compared with $5.462 billion reported at the end of the previous quarter.

Long-term debt (including current portion) was $32.798 billion at the end of the fiscal fourth quarter compared with $37.565 billion in the prior quarter. Excess cash flow and contribution from preferred stock offering aided in debt reduction.

Broadcom generated cash flow from operations of $2.479 billion compared with $2.419 billion in the previous quarter. Capital expenditure totaled $96 million, down from the last reported quarter’s $112 million. Free cash flow during the quarter was $2.383 billion, up from $2.307 billion reported in fiscal third quarter.

During the reported quarter, the company repurchased approximately 1.5 million shares for $433 million. Additionally, Broadcom returned $1.054 billion in form of dividends to shareholders during the fiscal fourth quarter.

The company declared a quarterly dividend of $3.25 per share, up 22.6% from the prior dividend payment of $2.65. The quarterly dividend is payable on Dec 31, 2019, to shareholders as on Dec 23, 2019.

Fiscal 2019 Highlights

Broadcom reported revenues of $22.597 billion in fiscal 2019, up 8% over fiscal 2018 tally. The Zacks Consensus Estimate was pegged at $22.56 billion.

The company paid aggregate cash dividends of $4.2 billion in fiscal 2019.

Guidance

Broadcom provided encouraging outlook for fiscal 2020. The company anticipates non-GAAP revenues of $25 billion (+/- $500 million). The Zacks Consensus Estimate is currently pegged at $24.05 billion.

Semiconductor solutions and infrastructure software are anticipated to contribute $18 billion and $7 billion, respectively, to total revenues.

Moreover, management is banking on contribution from the acquisition of Symantec’s enterprise security business of approximately $1.8 billion.

Non-GAAP operating margin is anticipated to be flat on a year-over-year basis.

The company expects to pay down $4 billion of debt in fiscal 2020. Cash dividend pay outs are anticipated at a little more than $5 billion.

From first-quarter of fiscal 2020, the company will club reporting of revenues from Intellectual property licensing with Semiconductor solutions segment. This will result in two reporting segments: Semiconductor solutions and Infrastructure software.

Conclusion

Broadcom delivered stellar fiscal fourth quarter results. Moreover, fiscal 2019 revenues were up year over year and surpassed the Zacks Consensus Estimate.

Moreover, the company provided encouraging revenue guidance for fiscal 2020.

However, competition from Cisco CSCO on its recent entry in the silicon networking chip market with Silicon One Q100 is a concern. Further, slowdown in enterprise spending remains an overhang.

Zacks Rank & Stock to Consider

Currently, Broadcom carries a Zacks Rank #4 (Sell).

Some better-ranked stocks worth considering in the broader sector are Marchex, Inc. MCHX and Fortinet, Inc. FTNT. Both the stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Marchex and Fortinet is currently pegged at 15% and 14%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Marchex, Inc. (MCHX) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance