British Pound Seesaws on Conflicting Brexit Polls

DailyFX.com -

Talking Points

Pound hits session high, then drops to lowest since weekly open

3 out of 4 “Brexit” opinion polls showed Remain camp leading

Pound pairs likely to see sharp volatility as referendum nears

Having trouble trading the British Pound? This may be why.

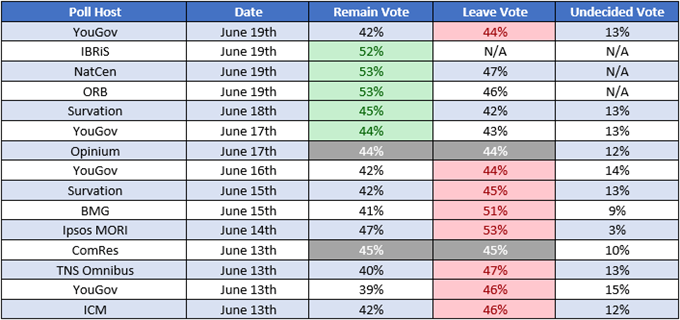

The British Pound continued to face sharp volatility as “Brexit” polls crossed the wires having gapping higher at the weekly trading open. An ORB survey showed that 53 percent of participants favored remaining in the European Union while 46 percent preferred leaving. This saw Sterling crosses spike higher in the immediate aftermath.

In addition, two more polls put the Remain campaign in the lead. A NatCen survey showed that 53 percent of respondents backed staying in the EU and an IBRIS poll saw 52 percent of those queried opting for the same.

The UK unit would see only short-lived gains however. A YouGov poll soon crossed the wires and argued that 44 percent of voters wanted to leave the EU while only 42 percent wanted to stay. GBP/USD responded accordingly, dropping to the lowest level since the weekly open.

Within a span of 30 minutes, the British Pound gained more than 0.3 percent against the US Dollar and fell more than 0.6 percent. Ultimately, the pair ended up more or less unchanged.

The UK EU membership referendum scheduled for June 23 could be one of the most potent sources of market volatility in 2016. In the lead-up to the vote, polling data has offered a small taste of the breakneck volatility on the horizon. More of the same looks likely as the fateful day approaches.

Data collected from Bloomberg and Wikipedia

Chart created by Currency Strategist Ilya Spivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance