How British owners turned America's oldest sports publication upside down

Two years ago, Perform Group, a British media firm owned by Soviet-born billionaire Len Blavatnik, took full ownership of Sporting News, the oldest sports publication in America. The transaction was met with little fanfare, since Sporting News, these days, is smaller and lesser known than online peers like ESPN, Sports Illustrated, Bleacher Report and SB Nation.

But now Sporting News, already a shell of what the 131-year-old brand once was, is losing its identity.

Perform Group has cut journalists (it laid off eight Sporting News people in November, nearly a quarter of the editorial staff), ramped up aggregated content, and is using Sporting News as a marketing vehicle to promote DAZN, a subscription video service in foreign markets like Germany and Japan.

Sporting News is small—it sees fewer than 10 million unique views per month—but its current turmoil is a perfect example of the growing pains facing the entire digital media business. News sites are going all in on video (despite evidence that many readers don’t want to watch videos) to appease advertisers, and it’s killing differentiation.

Yahoo Finance spoke to eight current or former Perform Group or Sporting News employees (many on condition of anonymity because they are under non-disparagement agreements), as well as Perform Media CEO Juan Delgado, to examine the state of the oldest sports publication in America.

A change in corporate ownership

Many of the readers who land on SportingNews.com are likely unaware of its rich history. It began in 1886 as a weekly print newspaper, founded by the director of the St. Louis Browns baseball team. Sporting News was long known as “the Bible of baseball.” In 2008, it became a biweekly, then a monthly in 2011, and in 2013 the print product ceased.

Its ownership timeline is convoluted. In 2000, Sporting News sold to Paul Allen, Microsoft cofounder and billionaire owner of the Seattle Seahawks and Portland Trailblazers. In 2006, Allen sold it to Advance Publications, the private media group that owns Condé Nast and American City Business Journals, publisher of the localized Business Journal websites. Advance folded Sporting News into ACBJ. To this day, most of the Sporting News edit staff is in Charlotte, NC, where ACBJ is headquartered, even though ACBJ no longer has any ownership stake.

Perform came knocking in 2013. At the time, the London-based media group owned a number of sports websites in Europe, including Goal.com (the world’s largest soccer site) and Spox (Germany). It also owned a number of sports betting sites. But it had no American footprint.

Perform targeted Sporting News as its entryway into the US media market.

Juan Delgado, an executive who had been with Perform since 2007, was tapped in 2009 to kickstart its US business. “We realized,” he tells Yahoo Finance, “that if we wanted to build a direct-to-consumer proposition in the US, we were going to need a tentpole in which to talk to clients.” Perform needed a known US media brand it could tout when pitching advertisers.

He settled on Sporting News because it looked like an outlier in the Advance/ACBJ portfolio. Delgado also liked that Sporting News “had already made the move of going fully digital.” In other words: the lack of print baggage added to the appeal for Perform, which might contain a lesson today for struggling legacy media properties looking to slim down or attract a buyer.

So in 2013 Perform entered a joint venture with ACBJ, taking a 65% stake in Sporting News. Delgado became CEO of Sporting News, and spent most of 2013 trying to cut costs (read: layoffs).

Sporting News staffers remember the day in 2013 when Perform took majority control of the site. Delgado came to Charlotte and, as one former business-side staffer describes it, gave a speech “along the lines of ‘We’re in this together.’”

Days later, Perform laid off 12 Sporting News people. “The relationship between Sporting News and Perform never recovered from that moment,” the same former business exec says.

Perform was (and remains) extremely budget-conscious, employees say. Delgado owns that: “If you came out of a print world where everything was fluffy and people weren’t being measured on how much eyeballs you brought, and we implemented certain [cost-cutting] things,” he says, “it put people in the spotlight.” At one point, a prominent Sporting News journalist was laid off during an all-staff catered barbecue.

A shift in editorial strategy

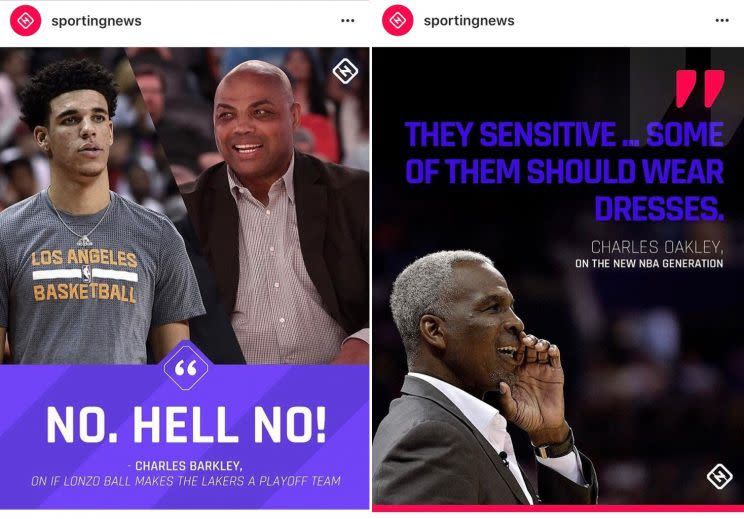

Perform sought to cut costs at Sporting News while also ramping up traffic, two efforts that may be at odds with each other. Management encouraged Sporting News journalists toward an editorial direction that four former staffers all separately described with the same word: “tabloidy.”

That thinking came from the success Perform was having with soccer site Goal.com. “In England, everyone knows and cares about one sport, soccer,” says a former Sporting News editor. “They wanted to turn us into The Mirror or The Sun for US sports. Like the sports content on Page Six of the New York Post.”

One former Sporting News business exec sees it all in less nefarious terms: “Perform wanted to make Sporting News a global brand the same way they made Goal a global soccer brand, so they thought Sporting News could become the generic catch-all for everything that’s not soccer.”

But the directives kept changing, staffers say.

“They’d talk about changing the way something was done, there would be a bunch of new initiatives, and then three to four weeks later everything would settle back to how it was before,” says former Sporting News writer Jesse Spector. For example, Perform wanted the site to deemphasize college sports, which raised hackles among the writers. But it never came to fruition anyway.

In addition to unclear messaging from management, there were obvious Perform power struggles. “There have been many pissing contests,” a current Sporting News journalist says, “and that wasn’t good for anybody.”

[MORE in sports media: Inside the ugly breakup of Sports Illustrated, The Cauldron, and Chat Sports]

In 2014, Blavatnik’s investment firm Access Industries, which previously owned a minority stake in Perform, took over Perform (by upping its stake to 77%) and delisted it from the London Stock Exchange. Taking Perform private meant that Perform does not have to publicly share its financial figures. Blavatnik (who reportedly made a bid for Time Inc. last year) declined to comment for this story.

The same year, Perform ended a traffic-sharing deal Sporting News had made with AOL FanHouse in 2011. Soon, Perform began pushing video above all other content. At first, it was focusing on a product called LiveSport.tv, a multichannel video platform, served up through Facebook, that Perform launched in 2012. The idea was for as many stories as possible to link out to LiveSport. “That was the sexy toy getting all of the attention,” says the former business exec. Still, “it didn’t really factor into the daily consciousness at Sporting News at first. I don’t think anybody had any idea that it was going to have the frustrating impact it had in 2015.”

LiveSport didn’t last long. Delgado now says it was “an experiment to use rights we held, but didn’t monetize.”

2015 was the year things went south, according to most of the people that spoke to Yahoo Finance. That was also the year that Perform bought out ACBJ’s remaining stake in Sporting News, making Perform the sole owner of Sporting News.

“There is zero doubt in my mind that for a one-year period, in 2014, everything hit right, the league deals we had were good, the editorial team was strong,” says the same former exec. “And then it came off the rails real quick. Everyone was running around trying to put their finger in a leak, and then we were running out of fingers and toes, and everyone got very sick of it.”

That year, Perform terminated Sporting News’s subscription to the AP, which most sports publications pull their news wire clips from, and instead pulled stories from Omnisport, a wire service Perform owns. In addition to text stories, Omnisport has the rights to short video-highlight clips. Today, more than a quarter of the posts on Sporting News are from Omnisport, plus game-highlight videos from Omnisport.

Perform also launched an Australian version of Sporting News; it’s now one of the top five sports sites there. Since then, it has also launched Sporting News in Canada. (These other portals are linked at the top of the US site: click Australia and the homepage changes to rugby stories; click Canada and it’s mostly NFL stories.)

After Perform went private, it created three separate internal divisions that feed off each other: Perform Media, Perform Content, and a division for its planned OTT video service.

Perform Content handles licensing deals, including a data service called Opta, and Omnisport, which licenses content to sites like MSN and Fox Sports in addition to Sporting News. Perform Media houses all the websites, including Sporting News, and Delgado is its CEO; he oversees editorial, product, sales, business development, legal, and HR for all the sites. (Perform Group’s CEO is Simon Denyer; Sporting News has an editor in chief, but he declined to interview for this story.)

Sporting News is only Perform’s No. 2 site by traffic, so it’s understandable that it isn’t Delgado’s top priority. Goal.com is the top site by traffic (60 million uniques per month); Delgado calls it “our kingpin property.”

As Delgado acknowledges, “My priorities changed a little bit in 2015. You’re now looking after not just this media business in the US, but this expanded reach, across Europe and Southeast Asia. I’m trying to balance all those things together. Having said that, Sporting News still forms a very strategic part of the media business and the overall group, because it’s sort of the only multi-sport brand that you can carry over and it still resonates. Our success in Australia has shown us that.”

Perform’s subscription OTT video platform is called DAZN (pronounced “Da Zone”) and it debuted in August 2016 in Germany, Japan, Austria and Switzerland. Last month, it launched in Canada (NFL games only).

Delgado calls DAZN “our bet into the future.”

He showed Yahoo Finance a demo. It’s a relatively straightforward streaming sports platform: paying subscribers can click through and watch, live or recorded, certain games that Perform has bought the rights to show in certain markets. Perform is betting that video subscriptions will be more profitable and scalable than selling ads against written articles.

All of the Perform-owned sports sites now heavily promote DAZN. Delgado pulls up the homepage of German site Spox as an example: “Everything is geared toward getting you to subscribe to DAZN,” he says.

Delgado adds, after a pause: “I guess for lack of a better word, we mortgaged the house on the two existing businesses to launch this OTT business.”

Some current Sporting News journalists, hearing that comment read back to them, expressed mild shock. One former business exec says, “For the last few months I was there, that was all I wanted Juan to say. I just wanted him to admit that.”

Based on Delgado’s own explanation, then, a clearer picture emerges of Perform’s vision for Sporting News: a marketing vehicle to promote DAZN in other countries. Bring readers in through the news content, then sell them a DAZN subscription.

Delgado says the aim is to make DAZN the “Netflix for sports.” But as one recently departed employee asks, “How is the Sporting News staff in the US supposed to get fired up about something that isn’t even going to exist here?”

‘Mortgaging the house’ on video

Perform has determined that the best way to market DAZN is to Sporting News readers. “We’re rolling out Sporting News in markets that we’re already present in with DAZN, as well as in new markets we might go into with DAZN in the future,” Delgado says. “So Sporting News is very important because it allows us to create a funnel in which you can get all the NBA fans that exist in, say, Japan, and then if you convert 10% of them, that’s good.”

Delgado declines to share if DAZN is profitable yet, but he says it’s a “very long-term bet.” The broadcast rights, in many markets, are expensive (ESPN will spend $8 billion in live broadcast rights fees this year alone), and the platform, for now, is ad-free. “This is, in our view, the future of how you consume sports.”

The rest of the digital media industry appears to agree. Online news organizations, en masse, are shifting toward video and away from the written word. This summer, Fox Sports, Vice, and MTV.com all had major layoffs of writers, with the stated goal of pivoting toward video.

Sporting News is clearly doing the same. Its full-time editorial staff is down to about 20 people, though it’s more than 40 if you include Omnisport staffers.

So, where does the DAZN push leave Sporting News as a journalism brand?

Perhaps everyone in news laying off editorial to focus on video ought to read the 2017 @risj_oxford report. https://t.co/ye5Yw0awDK pic.twitter.com/VaZqDQG0Gw

— Chanders (@Chanders) June 26, 2017

Sporting News still has a healthy 1.5 million fans on Facebook, 200,000 on Twitter, and 54,000 on Instagram. For comparison, Bleacher Report, the site that Delgado cites as his model for Sporting News, has 7.3 million Facebook fans, 4.6 million Twitter followers, and 5 million on Instagram. (But that site has the benefit of certain digital assets thanks to being owned by Turner.) “Everybody has sort of hit a little bit of a ceiling now where on-platform audience growth is quite hard to obtain, but off-platform growth—Facebook, Twitter, et cetera—is still growing quite fast,” he says. “And what I’ve seen Bleacher do well is that off-platform growth. Sporting News, maybe because of its heritage or maybe because we weren’t as far ahead of the curve as we should be, we’re not innovating as much on social.”

Troy Machir was a social media editor at Sporting News for three years. “Every day I’d see a tweet or comment from someone saying, ‘I didn’t know Sporting News still exists.’ That was just so disheartening,” he says. “I think because of all the changes there, they’ve fallen back on the two major places where you can really build a base in sports media: SEO and viral blog content. But if you don’t do anything more than these two things, you don’t stand out at all.”

Ramzy Nasrallah, executive editor of the Ohio State football site Eleven Warriors, puts it this way: “I hold Sporting News to a higher standard, traditionally. But when you start to see prestigious older sports outlets circle the drain, it’s a function of identity. Sporting News never figured out what they’re going to be in the Internet age.”

[MORE in sports media: Inside ESPN’s plan to reinvent SportsCenter]

Sporting News still gets occasional news scoops, and the median age of its readers has gone down in the past few years from 45 to the mid-30s. (“So we’re a little bit older than Bleacher, but not that much older,” says Delgado.) Asked what he believes the Sporting News brand is known for, Delgado says, “It’s a respectable, reputable brand; been around forever; sometimes associated with print, which isn’t good when you’re talking about brand, but it does give you that heritage when you’re talking to someone who wants to be around respectable, reputable, safe content.”

As an example of the strong original content the site still produces, Delgado points to a June 2017 feature on Mark Merchant, the little-known baseball player drafted right after Ken Griffey Jr. in 1987. It’s an in-depth profile, written by a freelancer. “That’s what Sporting News has been known for its whole life, and it’s what some of its audience still engages with,” he says. “We’re trying to play it so that we don’t lose the heritage, because ultimately it does benefit us. But we also need to go after that young consumer who’s on Instagram. And we’re pumping as much content as we can to service that audience.”

That logic sounds reasonable: pump out more social content than ever before, while also trying to keep doing original reporting. And from a business standpoint, Perform might be pleased with its media business: Sporting News traffic is up 20% in the last year, and Delgado says Sporting News “makes money,” though he declines to share revenue figures.

But when ownership is laser-focused on promoting an overseas video platform, it’s hard to imagine Sporting News can still be a top destination for original reporting.

The round of cuts in November, in the eyes of one former staffer, “got rid of basically anyone who will ask, ‘Hey… what about Sporting News and its 130-year history?'”

—

Daniel Roberts is the sports business writer at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

Exclusive: Inside the ugly breakup of Sports Illustrated, The Cauldron, and Chat Sports

Exclusive: Jeff Bezos ‘kicked the tires’ of buying Time Inc

Yahoo Finance

Yahoo Finance