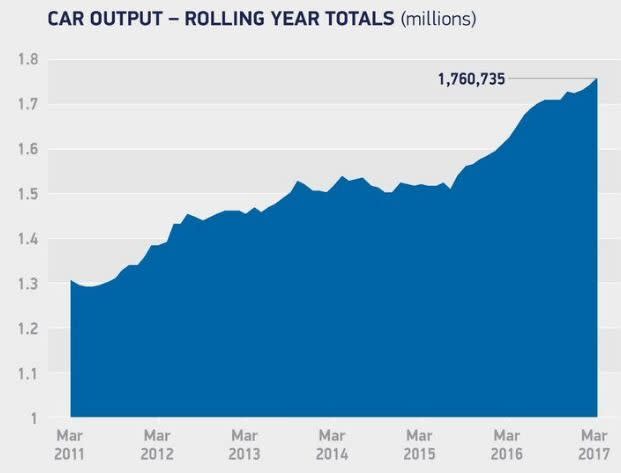

Britain's car plants hit 17-year production record

Britain’s car plants are running at the fastest speed in 17 years, with 170,691 new vehicles rolling off the production line in March.

Figures from the Society of Motor Manufacturers and Traders showed this was 7.3pc up on the same month last year, and takes first quarter production to 471,695, again the highest level since 2000 and up 7.6pc on the same period in 2016.

However, the data from the industry body also revealed a slowdown in domestic demand, with a 4.3pc drop in the quarter, possibly hinting that UK consumers could finally be hitting the brakes as concerns over the health of economy grow.

Export demand offset the UK dip, and in the quarter 77.9pc of cars built in Britain went for sale overseas, a 7.6pc rise on an annual basis. This is the equivalent of one car being exported every 20 seconds during the month.

The trade body used the export figures to reinforce its call for the car industry to be at the forefront of the Government’s thinking as it negotiates a Brexit deal. Car makers see tariff-free trade and easy access to Europe markets essential to continue the sector’s current renaissance.

“Much of our output goes to Europe and it’s vital we maintain free trade between the UK and EU or we risk destroying this success story,” said Mike Hawes, SMMT chief executive.

Car manufacturing is the largest exporter of goods out of Britain, accounting for 12pc of the national total. The industry has a UK turnover of £71.6bn and employs 169,000 people in manufacturing, and supports about 814,000 jobs in total.

Alongside its call for a Brexit deal that is favourable to the car makers, the SMMT also stepped up its campaign as what it sees as the “demonisation of diesel”.

In the wake of the “dieselgate” scandal where Volkswagen cheated emissions controls, there have have been calls for new taxes on cars powered by the fuel, scrappage schemes to incentivise buyers to trade in diesel vehicles and even demands that it be banned.

However, the SMMT has pointed out 96pc of commercial vehicles use the fuel, meaning a ban would increase costs of goods as companies were forced to replace their fleets of vehicles. Emergency services vehicles are almost entirely diesel-powered.

“A large proportion of UK-made cars are the latest low-emission diesels and it’s essential for future growth and employment that we encourage these newer, cleaner diesels onto UK roads,” said Mr Hawes, adding the authorities must “avoid penalising consumers who choose diesel for its fuel efficiency and lower CO2 emissions”.

The news came as Europe-wide figures from JATO Dynamics showed that the region overtook the US as the world’s second-largest car market in March, with 4.24m cars sold there in the first quarter, compared with 4.03m in the US, and beaten only by China at 5.08m.

This is first time this has happened since the second quarter of 2011, when the US economy was still being gripped by the aftershocks of the financial crisis, but Europe was relatively healthy economically. Back then 3.67m cars were sold in Europe, 3.27m in the US and 3.5m in China.

Europe also saw another event during the month, with the Volkswagen Golf losing the title of the region’s best-selling car for the first time in seven years.

Knocking it off the top spot was the Ford Fiesta, with monthly sales of 47,263, against the Golf’s 46,795.

Analyst Felipe Munoz put the achievement down to a combination of VW running down stocks ahead of an updated version of the Golf being launched, the wider slowdown in sales of diesels, which hit the Golf harder than the smaller Fiesta, and also Ford being more aggressive in its sales incentives.

“This change in position may only be temporary, as we expect the updated Golf model to reinvigorate sales once it becomes more readily available in the market,” said Mr Munoz.

Yahoo Finance

Yahoo Finance