BP Brings Global Support to Its Teesside Low-Carbon Projects

BP plc BP is enhancing its partnership with the Abu Dhabi National Oil Company (“ADNOC”) and Masdar by developing clean hydrogen and technology hubs.

The move came as oil and gas producers aim to develop alternative fuels to help reduce carbon emissions in an effort to slow climate change.

In September 2021, BP, ADNOC and Masdar signed agreements with the intent to drive billions of dollars worth of investment into clean energy. With the latest move, BP is bringing global support to its proposed blue and green hydrogen projects in Teesside, northeast England.

ADNOC will acquire a 25% stake in the development stage of BP’s H2Teessideblue hydrogen project, marking its first investment in the U.K. BP and ADNOC will now advance the project to the pre-FEED stage, the next stage of design. Notably, the project is expected to commence operations in 2027.

Abu Dhabi-based energy company Masdar also signed a memorandum of understanding to acquire stakes in BP’s proposed green hydrogen project, HyGreen Teesside. The project is expected to deliver up to 500-megawatt electrical input (MWe) of hydrogen production by 2030. In the initial stage, the project aims to produce 60 MWe of green hydrogen by 2025.

The two projects could deliver 15% of the U.K.’s recently expanded ten-gigawatt target for hydrogen production by 2030. BP will also join ADNOC to analyze a new blue hydrogen project in Abu Dhabi. The companies will perform a feasibility study for a world-scale, low-carbon hydrogen project in the country.

BP, together with ADNOC and Masdar, is strengthening the crucial role that Teesside and the U.K. can play in developing new energy supplies. The strategic partnership between Masdar, ADNOC and BP will continue to accelerate innovation in clean energy for both the UAE and the U.K.

Company Profile & Price Performance

Headquartered in London, the U.K., BP is a fully integrated energy company, with a strong focus on renewable energy.

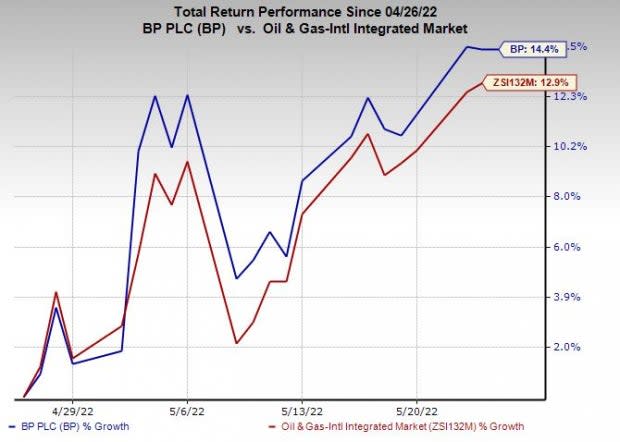

Shares of the company have outperformed the industry in the past month. The stock has gained 14.4% compared with the industry's 12.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

BP currently has a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Centennial Resource Development, Inc. CDEV is an independent oil and gas exploration and production company. Centennial recently signed an accord to merge with Colgate Energy Partners. The agreement, likely to close in the second half of this year, will create a $7-billion Permian Basin pure-play.

At the March-end quarter, cash and cash equivalents were $50.6 million, while long-term net debt outstanding amounted to $801.2 million. Centennial had a net debt to capitalization of 22.4%. Notably, CDEV’s debt-to-total capital ratio has persistently been lower than the industry from the last year, reflecting lower debt exposure. This can provide it with financial flexibility for growth projects.

EQT Corporation EQT is a pure-play Appalachian explorer, which is one of the largest natural gas producers in the United States. The upstream energy player has lower exposure to debt capital than composite stocks belonging to the industry. Hence, EQT can rely on its strong balance sheet to sail through the volatility in commodity prices.

For 2022, EQT expects total sales volumes of 1,950-2,050 Bcfe, indicating an improvement from the 2021-end level of 1,857.8 Bcfe. Also, it expects a free cash flow of $1.4-$1.75 billion, suggesting an increase from $934.7 million last year.

TotalEnergies SE TTE has one of the best production growth profiles among the oil super majors. TTE expects second-quarter 2022 hydrocarbon production to improve, driven by start-ups in Brazil, offset by sales of mature assets completed in 2021. It is also working to expand the LNG portfolio globally.

TotalEnergies is managing long-term debt quite efficiently and trying to keep the same at manageable levels. Its debt to capital has been declining over the past few years. Net debt to capital was 12.5% at the end of first-quarter 2022, down from 23.7% at the end of first-quarter 2021. As of Mar 31, 2022, cash and cash equivalents were $31,276 million. This was enough to address the current borrowings of $16,759 million as of Mar 31, 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

EQT Corporation (EQT) : Free Stock Analysis Report

Centennial Resource Development (CDEV) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance