BP Announces Arrival of a Semi-Submersible Platform in Texas

BP plc BP announced the arrival of Argos in the United States. The new floating production unit has reached the Kiewit Offshore Services fabrication yard in Ingleside, TX, from South Korea.

The new semi-submersible floating production unit is among the largest oil production platforms of the British energy giant and hence is the centerpiece of the integrated energy firm’s $9-billion Mad Dog 2 development. Notably, the project is to extract oil from the Mad Dog offshore field, which is the second phase of the field’s development. BP expects the Mad Dog 2 project to come online by the second quarter of 2022.

The company added that at its peak capacity, the facility will be capable of producing 140,000 barrels of oil equivalent per day which the energy major believes will scale up its production in the Gulf of Mexico by roughly 25%. Most importantly, Argos will not only strengthen upstream business in the Gulf of Mexico but will also support job creations. Investors should note that in the Gulf of Mexico, Argos is going to be the fifth operated platform of the company.

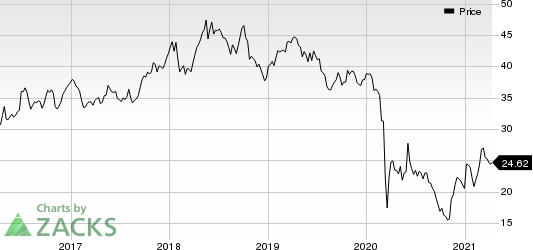

BP p.l.c. Price

BP p.l.c. price | BP p.l.c. Quote

Currently, BP carries a Zacks Rank #3 (Hold). Meanwhile, a few better-ranked players in the energy sector include Devon Energy Corporation DVN, Diamondback Energy, Inc. FANG and EOG Resources, Inc. EOG. All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Devon witnessed upward earnings estimate revisions for 2021.

Diamondback is likely to see earnings growth of 112.5% in 2021.

EOG Resources is expected to see earnings growth of 272.6% in 2021.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance