Boeing's earnings set to reveal extent of 737 Max 8 woes

Boeing (BA) will report first quarter earnings before the opening bell tomorrow, the first key test of how two fatal crashes involving its flagship plane have impacted its brand — and the bottom line.

The aerospace giant has been battered in recent months, ever since a faulty software issue on its 737 Max 8 jet was attributed to crashes in Indonesia and Ethiopia, and led to the plane being grounded by regulators around the world. Meanwhile, Boeing has been hammered by allegations of shoddy workmanship on the 787 Dreamliner.

Wall Street expects Boeing’s adjusted Q1 earnings per share to drop to $3.25 — the steepest year-over-year decline since late 2017, compared to $3.64 a year ago.

Barclays analyst David Strauss also projected that the Max could represent a $10 billion drag on Boeing’s cash this year. Total revenues are expected to check in at $22.9 billion, down from $23.38 billion in the first quarter of 2018.

Since the Max 8’s grounding, the company has reported zero new orders for the beleaguered jet. It has also “temporarily” reduced production of the MAX from 52 airplanes a month to 42 — a move that’s spilled over into the airline sector and the broader economy.

‘Not a trivial part of the economy’

Overall, Boeing saw fewer deliveries at 149 — a steep decline of 19% year on year — driven primarily by weak demand for its 737 jets.

According to the company, the cut in production allows it to “prioritize additional resources to focus on software certification and returning the MAX to flight.”

However, the longer the crisis goes on, the bigger the impact could be on the economy, say analysts, who warn that a lack of resolution could reverberate across the stock market and the economy.

Boeing is a component of the Dow (^DJI), and bad news for the stock usually bleeds into the broader index.

Whenever BA nosedives, the entire Dow gets hammered, since it represents 10.9% of the index. Weightings for tech giants like Apple and Microsoft are less than 8% combined.

Additionally, the U.S. economy could start to feel some pain too.

“This is not a trivial part of the economy, the production of the 737,” J.P. Morgan Chief U.S. Economist Michael Feroli recently told Yahoo Finance’s On the Move.

If the production woes become an issue where they stop making the jets completely, he said, “that would mean in a quarter in which production stopped, you could see GDP growth rates decline by over half percent,” according to Feroli.

This week, Goldman Sachs also chimed in. The Max 8’s temporary grounding — and the sluggish attempts for the plane to be “recertified,” meant a “a net drag” on U.S. growth of around 4/10 of a percentage point.

While deliveries slipped this quarter, with companies like Indonesia’s Garuda Airlines cancelling orders of the Max 8, other airlines have taken a wait-and-see approach.

Southwest Airlines (LUV) — the carrier with the most number of Max 8’s on its fleet — has said that it had no plans to alter orders for more Boeing jets. CEO Gary Kelly added that “it’s a very good airplane … we’re obviously anxious to get the airplane back in service.”

However, a dark cloud still lingers over the company. It’s still under investigation by the Federal Aviation Administration (FAA) over concerns over its aircraft certification process.

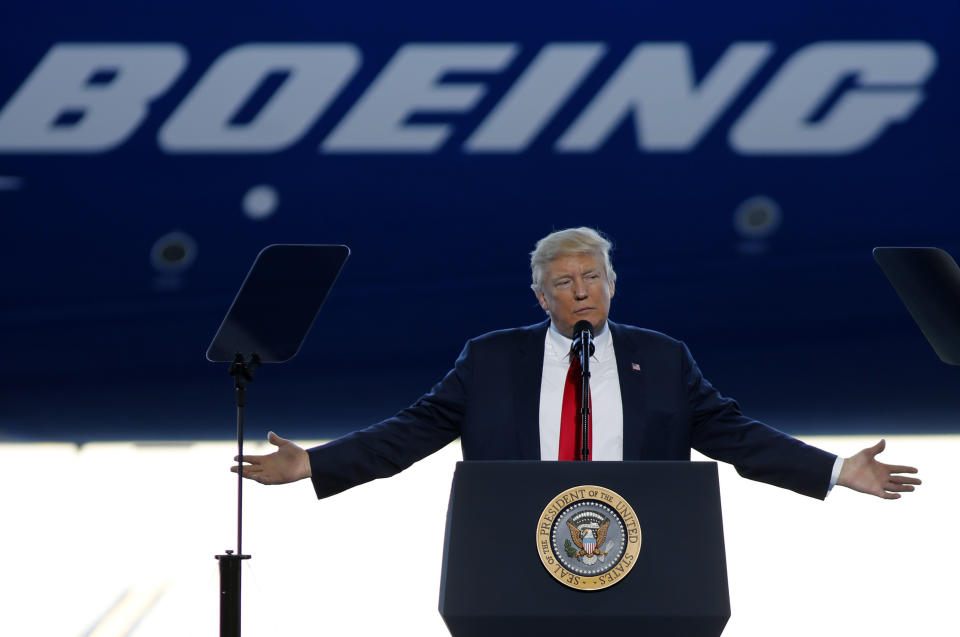

Separately, President Donald Trump also singled out the company last week, pressuring Boeing to rebrand.

What do I know about branding, maybe nothing (but I did become President!), but if I were Boeing, I would FIX the Boeing 737 MAX, add some additional great features, & REBRAND the plane with a new name.

No product has suffered like this one. But again, what the hell do I know?— Donald J. Trump (@realDonaldTrump) April 15, 2019

The President has also taken verbal shots at Airbus, alleging that European subsidies are unfairly benefitting the other aviation giant in the duopoly. He has threatened to impose U.S. tariffs on $11 billion worth of European Union products, ramping up tensions in a long-simmering debate.

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Boeing, amid crisis, is making a move that could hurt the economy

Short seller Carson Block calls out Boeing for 'negligent homicide' in 737's woes

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance