Boeing's 737 Max 8 woes is taking a $1B bite out of its bottom line

Boeing (BA) reported a steep drop in first quarter earnings on Wednesday, undermined by two fatal crashes involving its flagship 737 Max 8 that forced regulators around the world to ground the plane — which the company acknowledged is costing it at least $1 billion.

The company posted a quarterly profit of $3.16 per share on revenues of $22.9 billion, and temporarily suspended its forward looking guidance and halted share buybacks. It added that previous estimates did not factor in the impact of the “uncertainty” surrounding the Max 8.

Earlier this month, Boeing revealed weak first-quarter 2019 commercial delivery figures, partly reflecting the controversy with the Max 8. During that period, the company delivered 149 airplanes, a 19% year over year plunge.

“Boeing is making steady progress on the path to final certification for a software update for the 737 MAX, with over 135 test and production flights of the software update complete,” the aerospace giant said. The production costs associated with idling the Max 8 will cost Boeing around $1 billion, it said.

“The company continues to work closely with global regulators and our airline partners to comprehensively test the software and finalize a robust package of training and educational resources,” it added.

On average, Wall Street analysts surveyed by Bloomberg had expected Boeing’s adjusted Q1 earnings to drop to $3.25 — the steepest year-over-year decline since late 2017, compared to $3.64 a year ago.

Investors, however, appeared to breathe a sigh of relief that the company’s results weren’t worse. Boeing’s stock, the largest slice of the Dow Jones Industrial Average (DJI), rose modestly on Wednesday, settling at over $375.

“We’re confident in Boeing’s ability to weather the storm,” said Tom Kennedy, head trader and portfolio analyst at New England Investment and Retirement Group, which has $580 million in assets under management. Boeing is the one of the firm’s core holdings.

“They’ve done a good job of getting in front of the issue,” Kennedy said, adding that the Max 8’s troubles are likely to be prolonged.

From a financial standpoint, curtailing production has done a good job of reducing the cash impact and keep the balance sheet healthy,” he said.

‘Re-earning trust and confidence’

The aerospace giant has been battered in recent months, ever since a faulty software issue on its 737 Max 8 jet was attributed to crashes in Indonesia and Ethiopia, and led to the plane being grounded by regulators around the world. Meanwhile, Boeing has been hammered by allegations of shoddy workmanship on the its Dreamliner.

During the quarter, Boeing’s commercial airplane revenues were $11.8 billion, partly reflecting fewer 737 deliveries but offset by strength in its other lines.

Separately, revenues in the company’s closely-watched defense, space and security segment saw a 2% bump in Q1, bolstered by higher activity in Boeing’s satellites, weapons and surveillance aircraft business.

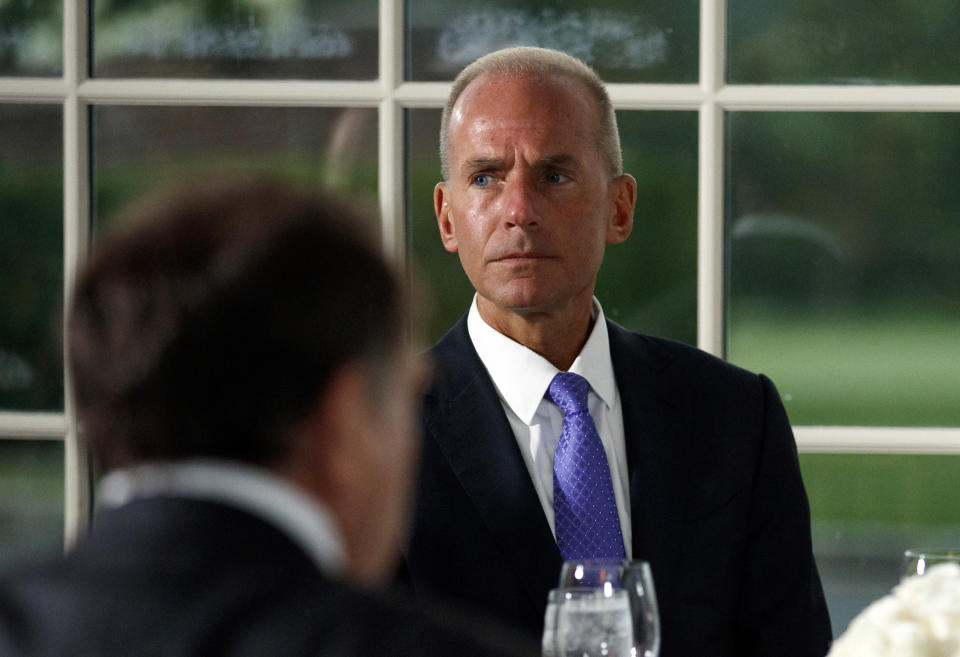

“Across the company, we are focused on safety, returning the 737 MAX to service, and earning and re-earning the trust and confidence of customers, regulators and the flying public," said Boeing chairman, president and CEO Dennis Muilenburg.

On a conference call with analysts, Muilenburg defended the company’s handling of the crisis, and insisted that fixing the Max 8’s software issues was a high priority for Boeing’s.

Read more:

Follow Javier on Twitter: @TeflonGeek

Yahoo Finance

Yahoo Finance